Yield Basis: Solving Impermanent Loss

Almost everyone who has ever traded crypto has come across an Automated Market Maker (AMM). On traditional exchanges such as Binance and Coinbase, trading happens through an order book. One trader places a buy order, another places a sell order, and the two are matched.

An AMM works differently. Instead of using an order book, it relies on a smart contract that uses a mathematical formula to keep a liquidity pool in balance. This pool is funded by liquidity providers (LPs).

When the price of a token increases, the pool automatically sells part of it to maintain the ratio with the other token. When the price decreases, the pool buys more to restore balance.

This mechanism creates a potential risk for LPs known as impermanent loss (IL).

Although LPs share in the trading fees, price fluctuations can cause their position to underperform compared to simply holding their tokens.

Yield Basis offers a solution to this problem.

Impermanent Loss

So, what is impermanent loss? As described above, impermanent loss (IL) is the loss in value that a liquidity provider can experience compared to simply holding their tokens. In other words, the tokens would have been worth more if they had not been added to the liquidity pool.

To illustrate this numerically, here’s a simplified example of how liquidity changes over time.

Starting point of the liquidity pool:

1 BTC (worth $100,000)

$100,000 USDT

= total $200,000

Now, suppose BTC increases to $150,000.

The smart contract automatically rebalances the pool using the standard mathematical formula so that the value of BTC and USDT in the pool remains roughly equal.

This means that part of the BTC is sold to maintain the balance.

New balance in the pool:

0.8165 BTC (worth $122,475)

$122,475 USDT

= total $244,950

If the tokens had not been added to the pool (and were simply held), the person would now have:

1 BTC worth $150,000

$100,000 USDT

= total $250,000

The difference between $250,000 and $244,950 represents the impermanent loss.

In this example, that equals approximately $5,050, or about 2% less compared to just holding.

The Solution

There have been many projects that have tried to solve the problem of impermanent loss (IL), but so far no protocol has come as close as Yield Basis (YB).

In addition, the yield that YB can offer on BTC could be more attractive than that of most other platforms.

But what exactly is YB, and how does it work?

Yield Basis is a DeFi protocol developed by Michael Egorov, the founder of Curve Finance. Curve is a liquidity protocol used by leading projects such as Aave, Yearn Finance, and Lido for stable swaps, yield generation, and liquidity sourcing. In short, Curve provides deep, stable liquidity that forms the foundation of many DeFi systems.

Yield Basis allows users to provide BTC as liquidity without the traditional risk of impermanent loss, while still earning trading fees.

Within the protocol, the crvUSD stablecoin is used as the balancing and leverage mechanism.

Without diving too deep into the math behind it: YB mitigates IL by creating a 2× leveraged position on the liquidity provided by the user.

Thanks to this leverage and automatic balance adjustments, the value of a position moves almost one-to-one with the BTC price.

For now the pools on YB only support BTC. However, it's possible that in the future, other assets such as ETH, SOL, and BNB will be added.

Numbers so far

On October 2, 2025, the first three Yield Basis pools were launched. Within minutes, all three were fully filled, each reaching a TVL of $10m. Not long after a governance vote decided to increase the maximum TVL to $50m per pool, a limit that was reached again within twenty minutes.

On October 13, the Pre-TGE Sale of $YB took place through Binance Wallet, where 2.5% of the total token supply was allocated to users who were eligible to participate. More than 212,000 people took part in this sale. The tokens were airdropped on October 15 to the participating wallets, which was also the date of TGE, at 11:00 UTC. The token price during the sale was $0.10.

In addition to Binance, Legion, in collaboration with Kraken, also held a separate sale of YB. This was the largest sale ever organized by Legion, with over 60,000 participants, representing a 98x oversubscription.

Tokenomics

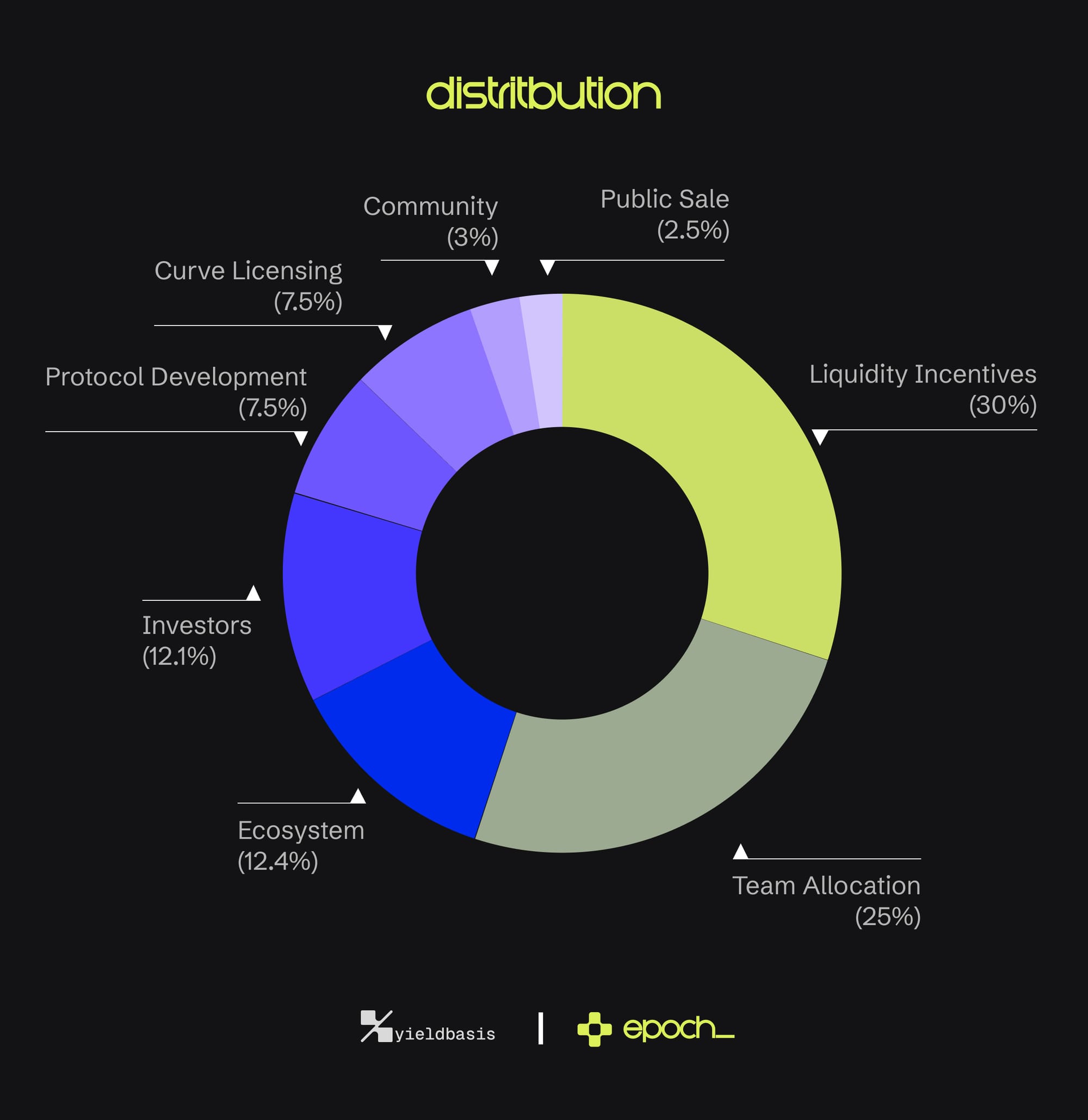

The $YB token launched on October 15. The total supply is 1b $YB and below you can find the token distribution as well as the vesting schedule.

Conclusion

There have been many projects that have tried, unsuccessfully, to solve the phenomenon of impermanent loss. Among them was Bancor, which offered impermanent loss protection but ended this feature in 2022 due to ‘hostile market conditions’. If Yield Basis can live up to expectations, it might have solved one of the biggest pain points in crypto, especially if it expands to other assets such as Ethereum and Solana.

The price action following the launch on October 15 was not ideal, as there has been considerable selling pressure. However, a large portion of the selling wallets were those that received the token without purchasing it, e.g., wallets that were part of the airdrop.

With the majority of holders having spent actual money to buy the token and most of the free recipients probably already out, $YB could have a bright future ahead.