Trove: Collectibles meets Perpetuals

Over the past few months, several topics have taken center stage in the crypto world. One of them is perp DEXs. In recent weeks, multiple decentralized exchanges have launched, collectively generating a trading volume of $1.364t over the past 30 days.

Another topic that has attracted a lot of attention is collectibles. Collectibles are becoming increasingly visible both within and outside of crypto. Nostalgic products like Pokémon cards are more popular than ever, escaping forgotten binders in dusty places and making their way to major mainstream marketplaces.

The downside of the collectibles market is that it remains illiquid and slow-moving. Even though the global collectibles market exceeds $400b, relatively few transactions take place on a day-to-day basis. New platforms such as Collector Crypt, Courtyard, and Phygitals are changing that. They enable users to trade TCGs on-chain, tapping into a much broader market.

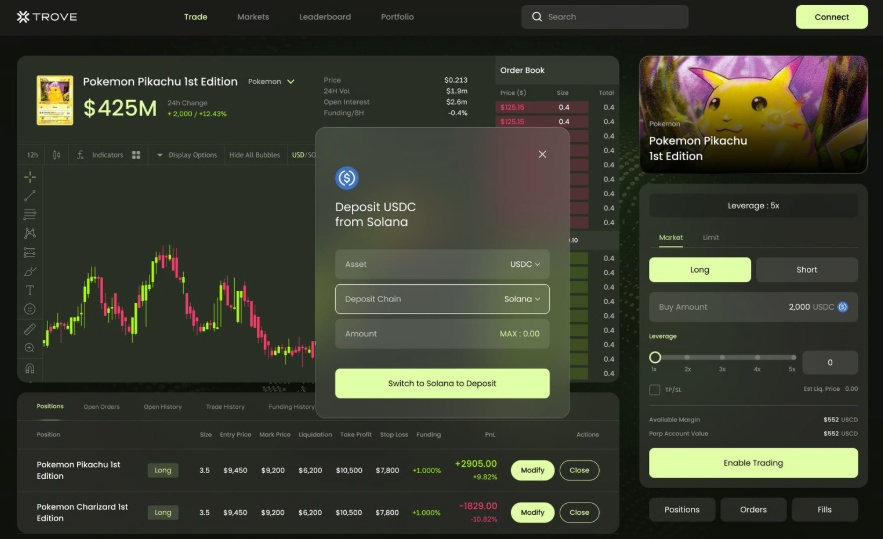

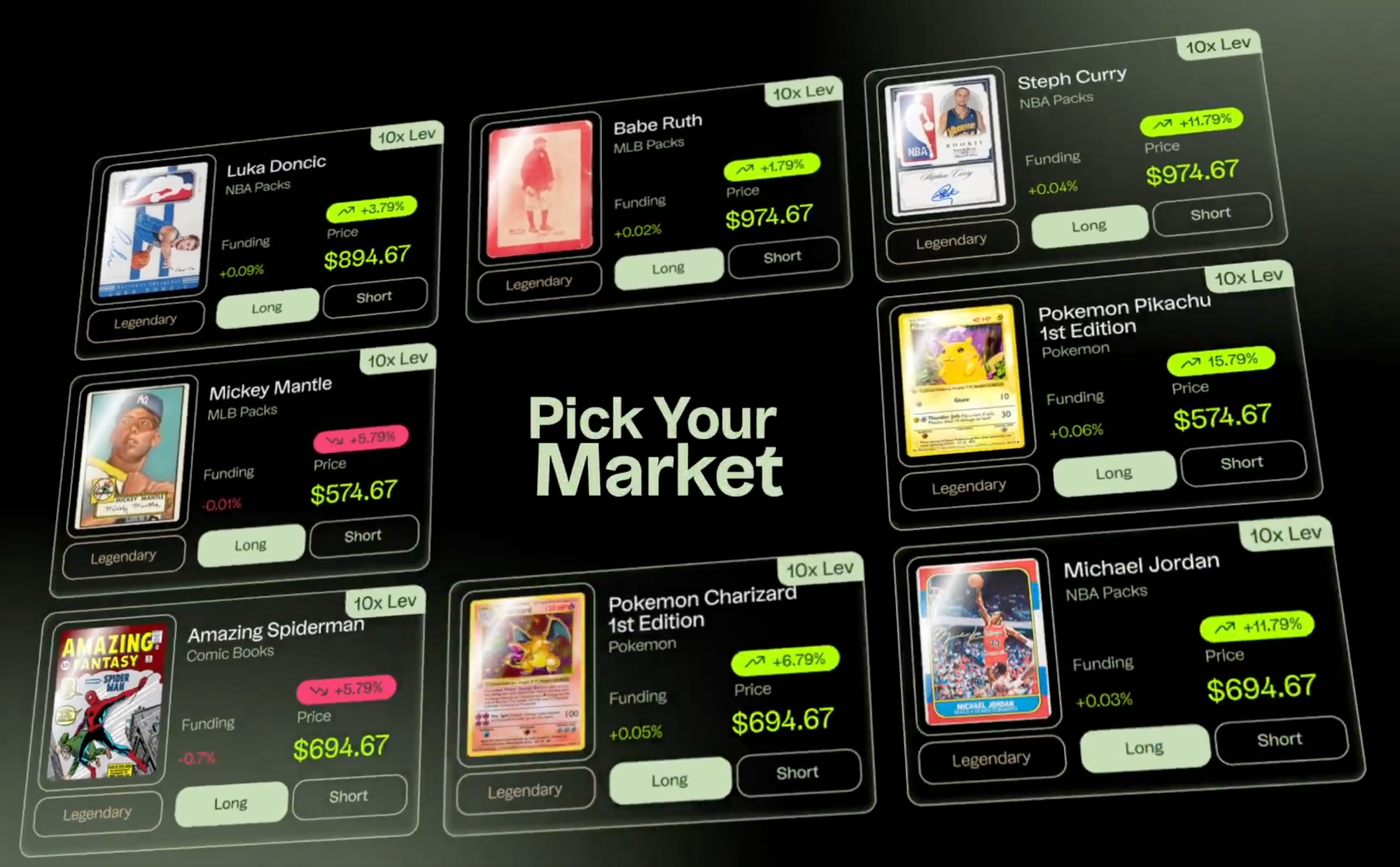

This is precisely the opportunity that Trove is seizing with both hands: a perpetuals market for collectibles, connecting the demand for collectibles and the popularity of trading perps.

In this article, we will first take a closer look at a recent example of a situation where Trove’s solution would have been particularly useful. After that, we’ll explore how perpetuals function in detail, how Trove works, and we'll take a look at the product–market fit and market data.

CS2 Crash

According to Price Empire, the value of the CS2 skin market reached it's peak of over $6b, with players spending roughly $1 billion annually on case openings. Skins are then tradable across various marketplaces, from user to user. The prices of some of these skins can rise significantly, with rare ones reportedly being traded for around $2 million.

The recent events on the CS2 skin market have demonstrated why what Trove offers is a valuable addition to the collectibles market. Due to an update from Valve, the developer of Counter-Strike, a crash occurred in the market, which directly illustrates why the ability to trade perpetual futures on collectibles can be important. The value of a certain category of skins dropped by about 50%, causing many people to see their portfolios decline significantly. After the update, the market fell to $3,08b, meaning the update erased over $3b of money.

In the collectibles market, this kind of risk cannot be hedged, as these are products for which no perpetual futures exist. If it had been possible, for example, to short these products, people could have profited from the drop in value of these skins. Instead, collectors could only watch as their assets decreased in value, while traders remained sidelined due to the absence of perps.

Collectibles and Perps

@unwise is part of the Trove team. He has written a short article* explaining what they are building at Trove and which problem they are solving. They argue that everything that holds value can be traded, and everything that can be traded can be traded as a perpetual future. This is exactly what Trove aims to offer for collectibles. They want to make it possible to trade collectibles with 5x leverage, starting with Pokémon cards and CS2 Skins.

To offer perps for a specific product, several things are required. One of the most important aspects is price determination. Without a stable and reliable way to determine prices, it’s impossible to offer perps. This price must not only be reliable but also real-time. Once prices are no longer real-time, unjustified liquidations can occur and the market becomes vulnerable to manipulation due to delayed updates. As a result, trust in the market can disappear.

Funding rates are also an important part of the mechanism. Without these funding rates, the perp and spot prices can move apart. The spot price is based on supply and demand, while the perp price is driven by trader sentiment, liquidity, and expectations. When there is high demand for long perps, the perp price increases, while high demand for short perps pushes the perp price down. Because this doesn’t happen on the “real” market, the perp moves differently from the spot price. Funding rates ensure that these two prices stay close to each other. When the perp price is higher than the spot price, traders with long positions must pay a fee to those with short positions. When the perp price is lower than the spot price, it’s the other way around: shorts pay longs a fee. This fee makes it more attractive to take a less popular position, since you can then receive funding. As a result, the spot price and perp price move back toward each other. Funding rates are calculated periodically, for example every eight hours. After those eight hours, the funding rate is recalculated to determine who has to pay whom.

There are many other important aspects involved in creating perps, but I want to highlight one that cannot be overlooked, and that is liquidity. If there is no liquidity, a perp market will fail because not only the price, but the entire system becomes far too volatile. When an order is placed on an illiquid product, the price can move so sharply that it may rise or fall by tens of percent. This also causes the funding rates to fluctuate heavily, forcing traders to pay so much in fees that trading becomes unattractive.

If a product is not liquid, it also means that there is insufficient trading activity. This means that, in addition to the price being too volatile, orders cannot be filled. There is no one on the other side of the order book to match the placed orders.

This is what makes it difficult to make perps for collectibles possible. The collectibles market is inherently illiquid. At the beginning of this article, the problem was already outlined. Collectibles are usually sold from person to person through slow auctions. As a result, it is nearly impossible to establish a real-time price for certain items. This shows that all the points we identified above as important are difficult to apply to collectibles. Trove solves the problem of illiquidity and the lack of continuous trading in collectibles. By doing so, they turn collectibles into liquid assets, making it possible to hedge positions or even take short positions on a 24/7 marketplace.

Price Determination

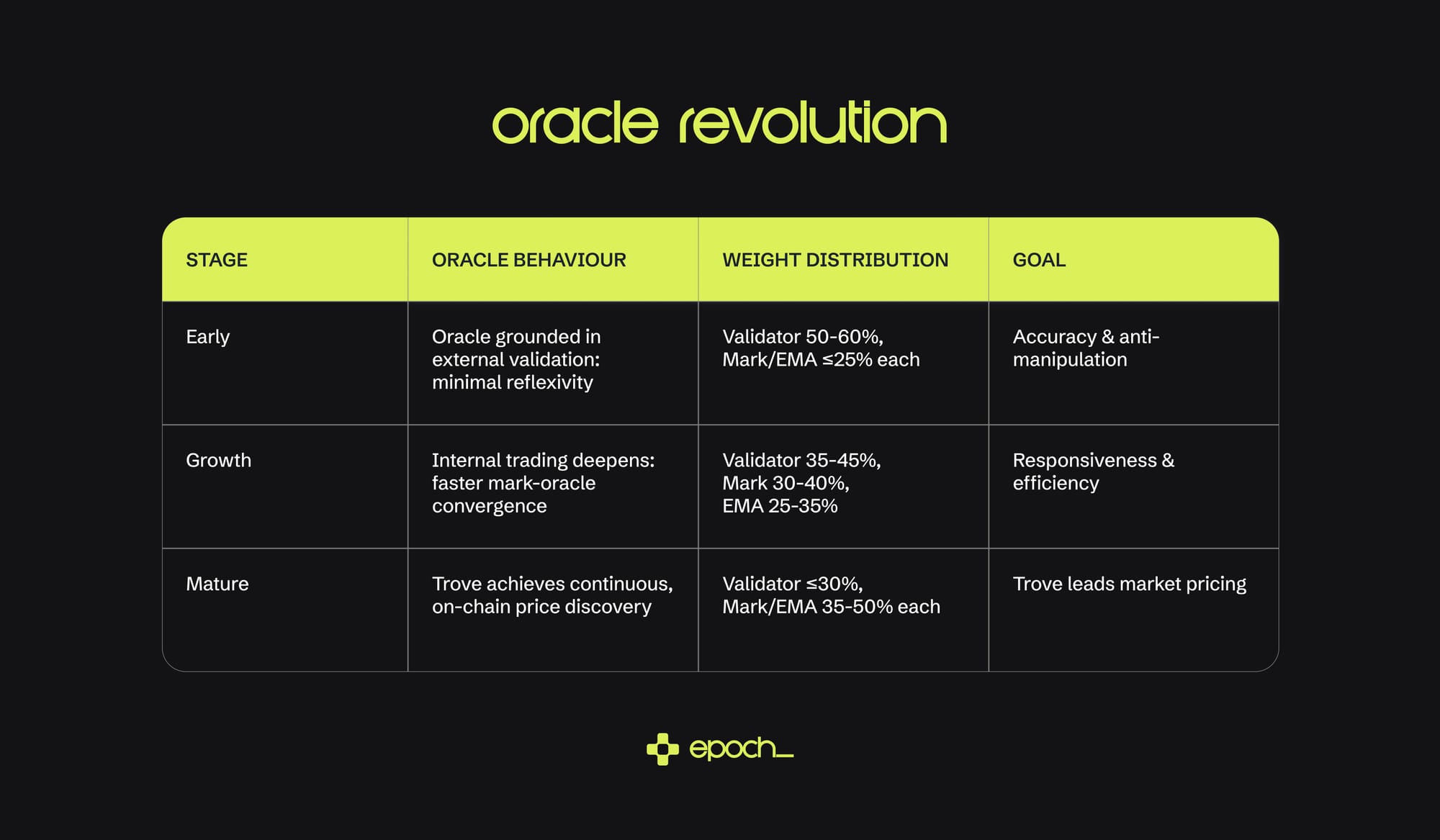

We start by determining the correct prices for the items. Trove uses three components for this, each with its own weighting. The oracle price is determined based on three components: the mark price, validator, and EMA (exponential moving average), each with a starting weight of 33%. This weighting is dynamic and shifts over time.

The mark price is an internal price based on executed trades, order book depth, and open interest. For the validator price, 25 sources are used to get the most accurate price from external markets, including sources such as Collector_Crypt, Courtyard, and Phygitals. Finally, the EMA is used to smooth out volatility.

The Beta is announced and according to Trove will go live very soon. Their website shows that more than 42,000 people have signed up for the Private Beta. During this Beta, the weighting of the different components of the oracle is being tested and fine-tuned based on market depth. This will continue to evolve as the market matures. Below you can see a table showing the progression of the weighting:

Funding Rates

The part about the funding rate is pretty self-explanatory. If the mark price is higher than the oracle price, longs pay shorts. If the mark price is lower than the oracle price, it’s the other way around. The payments occur periodically and are calculated using the volume-weighted TWAP of the mark-oracle difference. This avoids manipulation right before the recalculation of the rate because it looks at the average price difference over an eight-hour period, for example. Periods with higher trading volume carry more weight than periods with lower volume, making it a fairer calculation.

LP

It will be possible for users to provide liquidity to the Trove vault. The vault is not live yet, but will be soon. The vault will be used to provide liquidity for market pairs to maintain efficient trading. Users can provide SOL, USDT and USDC at first, with more alternatives to come. In return, yield in the form of $TROVE is issued to all stakers. How much yield stakers earn is TVL-weighted and depends on which asset is staked. This means LPs who contribute to a higher percentage of TVL receive more yield. Trove doesn't take SOL price exposure in their vault, therefore SOL offers the lowest yield. They do deploy USDT/USDC actively, making this more lucrative to stake.

The deposits in the vault are used to provide liquidity to market pairs, automatically posting quotes on both sides of the market. When the flow is one-sided, the vault temporarily takes the other side of the trade. In other words, for example, when there are more buyers than sellers, the vault will act as a seller to balance the books.

It is important to note that all LP participation and rewards are cash-settled in stablecoins, with no exposure to physical collectibles.

Trove x Hyperliquid

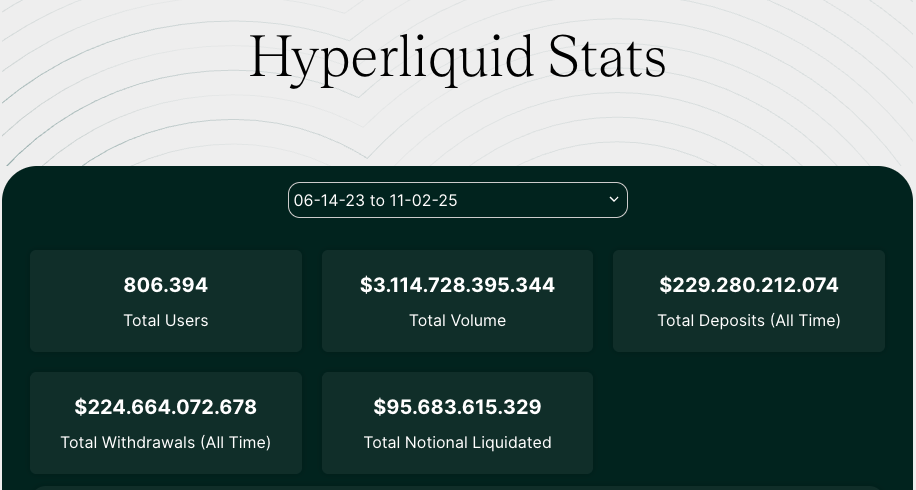

On October 30, Trove announced that it would launch its markets through HIP-3 on Hyperliquid. HIP-3 is a protocol within the Hyperliquid ecosystem that allows external projects to run their own perpetual markets on the platform’s existing infrastructure. This enables Trove to benefit from Hyperliquid’s trading engine, funding mechanisms, cross-margin system, and high level of transparency.

An important advantage is that Trove’s markets will be directly available in Hyperliquid’s dApp. This means that the more than 800,000 users of the platform, according to its own data, will have direct access to Trove’s markets. If even a portion of these users start trading on Trove, it could significantly increase liquidity and trading volume. The total trading volume on Hyperliquid currently stands at $3.11t, showing the scale of the ecosystem Trove is entering.

The HIP-3 markets will also serve as one of more than 25 external data sources for Trove’s oracle. Increased trading activity will therefore not only drive higher volume but also improve the accuracy of price discovery and oracle data.

Trove x Kalshi

Trove recently announced a partnership with Kalshi. Kalshi is one of the largest platforms in the field of prediction markets and is the biggest competitor to Polymarket. Kalshi currently has around 2 million users. It is the first and, for now, the only prediction-market exchange approved by the U.S. Commodity Futures Trading Commission (CFTC), which means it is legally allowed to offer derivatives contracts on events within the United States.

This is a first step towards trading perps on prediction markets, but further details of the collaboration have not yet been announced. The fact that Trove is partnering with a major player like Kalshi shows that established parties have confidence in the product.

Product-market fit

At the moment, Trove has three different live markets: the Charizard Index, the Pokémon Index, and the CS2 Skin Index. The Charizard Index focuses on the card of the Pokémon with the same name and tracks the price development and market exposure of this specific card. The Pokémon Index represents a basket of various cards, offering exposure to the broader Pokémon trading card market instead of to a single card, as with the Charizard Index. Finally, the CS2 Skin Index tracks the price movements of the most actively traded skins, offering insights into trading activity and market demand within the collector community.

Although this currently represents only a small fraction of the total collectibles market, it forms an important starting point within a fast growing industry. While additional markets are in development (including the Yu-Gi-Oh! Index, Magic: The Gathering Index, One Piece TCG Index, and Sports Card Index), there is still a long way to go before the entire market can be captured. This shows the growth potential of the concept that Trove offers.

The collectibles market has grown enormously in popularity in recent years. In 2025, it reached an estimated value of $496b and is expected to continue expanding. Between 2018 and 2025, the global market had an average annual growth rate (CAGR) of 6.2%. If this trend continues, it could reach approximately $628b by 2031. In practice, that figure may turn out even higher, driven by developments in online trading for collectibles such as TCGs. Projects like Collector Crypt, Courtyard, and Phygitals contribute to this evolution by enabling on-chain trading.

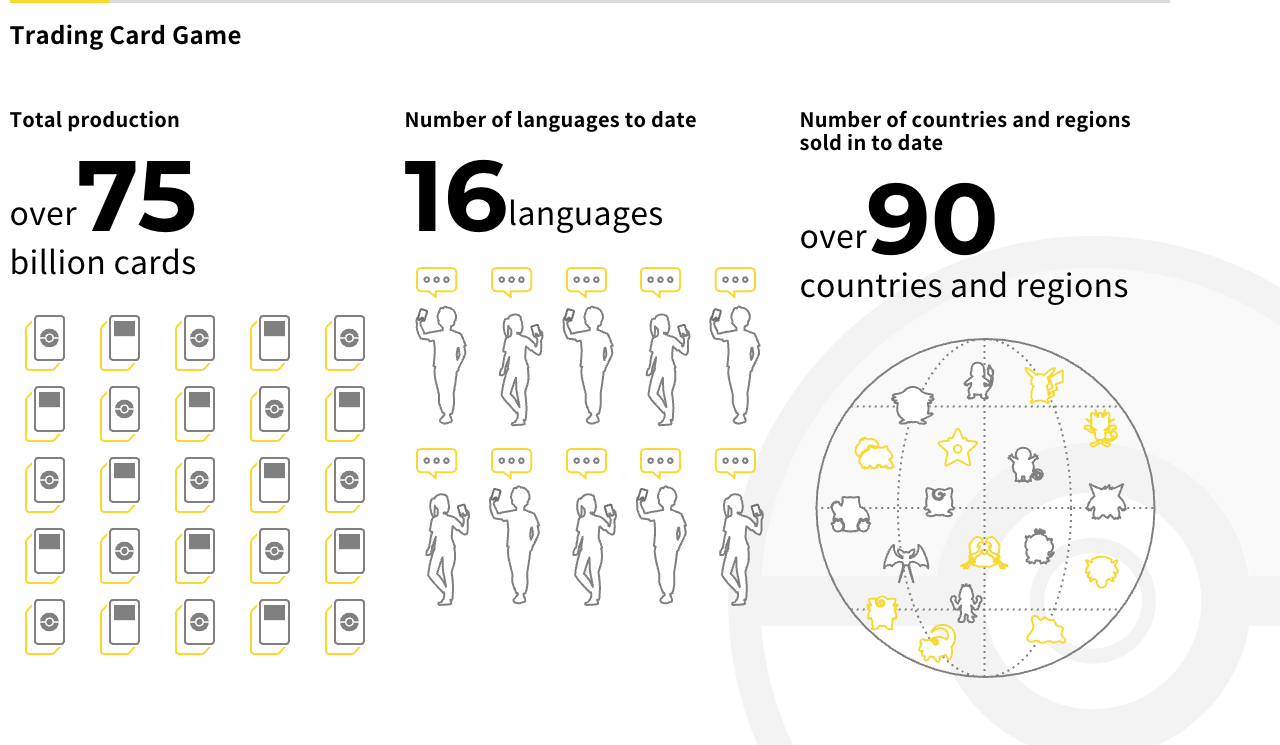

Looking at the numbers, it is not surprising that Trove initially focuses on Pokémon cards and CS2 skins. Pokémon is one of the most recognizable brands in the world when it comes to trading cards. Last year alone, more than 10 billion cards were produced, accounting for 13.59% of total lifetime production. This demonstrates the huge popularity and sustained demand for these cards.

Conclusion

Trove offers a solution to a problem that has not yet been solved in the current market. It makes the naturally illiquid collectibles market liquid. In addition, it provides the possibility to trade these items with 5x leverage. This allows collectors to hedge against potential crashes, such as the one that occurred in the CS2 market last week, but it also brings a new group of participants into the market: traders. In recent times, both Perp DEXs and collectibles have grown in popularity, and Trove brings these two worlds together on a single platform.

It's a unique product in a new niche. If the product works (private beta right now), it will be a gamechanger for the ones wanting to participate in the collectible market without having to deal with physical products and additional costs (shipping/auction+marketplace fees). This will have to be proven but only time will tell.