The attention economy: PumpFun

In Black Mirror episode ''Common People'', the producers created an episode that fictionally explains how we as a society are willing to go far for creating clout chasing content. In the Episode, Dum Dummies is a website of which people can perform extreme (humiliating) content in order to get paid by viewers. A viewer could offer 100 dollars in order for the streamer to drink rotten milk for example. The protagonist of the episode decided to start creating content on Dum Dummies after he realised that he can't pay the bills for his wife's illness.

A choice made out of desperation.

Black mirror is obviously a fictional: none of the stories are based on a true story. Though the reason why Black Mirror is a popular blockbuster: it's shining a light on whats likely heading for us.

Degeneracy/loneliness/soulless etc. are all topics that are being highlighted in different episodes as a warning for what's coming to us as a society because of the increase of technology (social media/AI/universal basic income).

We are in a timeline of which human beings are feeling lost: religion is declining, individualism is increasing and our God is money. A trend that already started decades ago but is rapidly increasing because of social media.

Attention and fame (basically the same thing) always was the currency of degeneracy. It's the throne of Game of Thones. Everybody is willing to fight for it and even die for it. But in the end, it's just an illusion: the throne is just temporary.

Just like how music artists reach the top for a short period of time, they will fall into a black hole of irrelevance afterwards. The short window of attention is where you are able to squeeze the monetisation part.

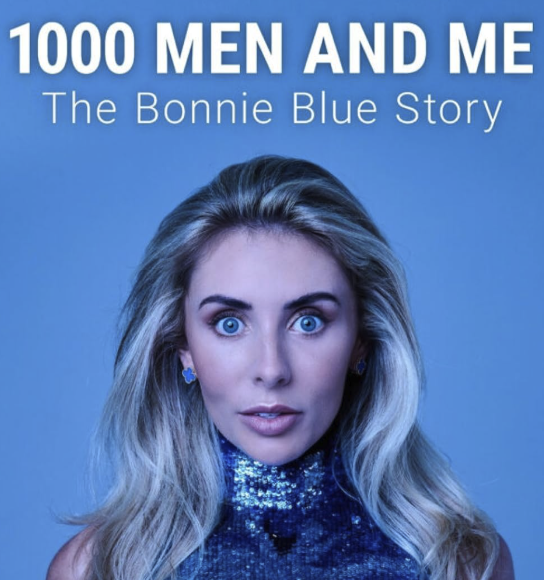

Music artists was just a beta test. But for the first time since the birth of social media, the average nobody can suddenly become an overnight star. This is where floodgate opened. After Covid, the amount of degenerate content online increased. We are in a society where it pays off to take risks that go too far in content creation: every 2/3 months a new Adam22 is born (yes, the guy you forgot about). Or a Bonnie Blue.

See, what Bonnie Blue realised is that attention is money. The more extreme her content became, the more attention she received and most importantly: the more money she made. She was already in the top 0.01% on OnlyFans (another web2 content creation platform). There is no way she would have exploded in attention if she wasn't willing to go extreme mode in content creation. The platforms (podcast, media) are incentivised to push her as it generates more clicks.

You want to be famous in an easy way?

Make extreme content

There are no moral codes anymore, no sense of shame and most importantly: an economic despair. Inflation is increasing and assets are outpriced. As we worship money as a society, which is tied to your status as an individual, the amount of peopling willing to sell themselves increases.

This trend is going to accelerate, just like how Black Mirror described it.

Content Creator economy in crypto

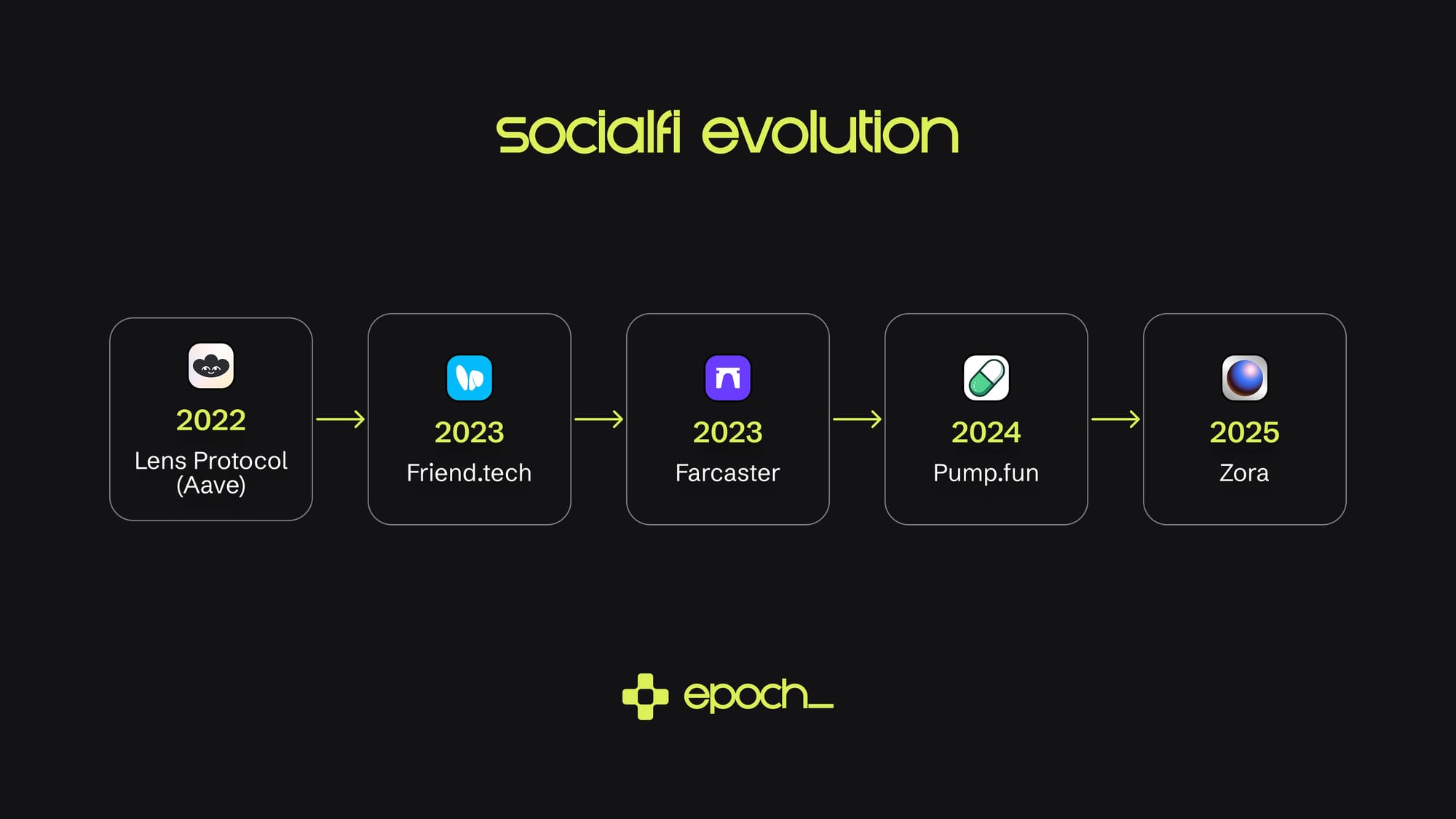

Content Creator coins have been rising within the crypto space. There seems to be a reason why Base as a chain has been focussing a lot on content. Initially it started with the Friend.Tech meta and later Zora and Forecaster. Obviously Pumpfun is the major content creator coin of Solana.

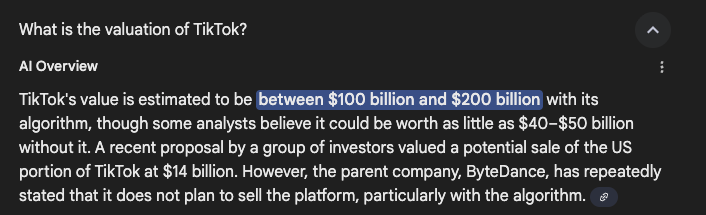

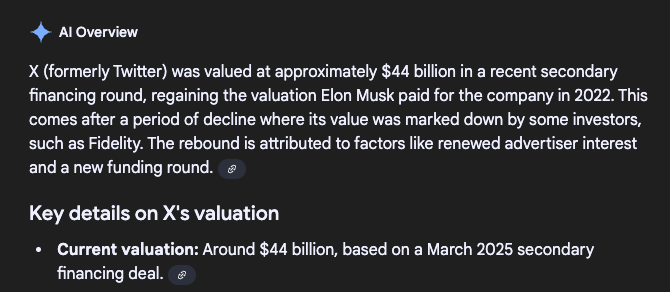

It's clear that we are trying to bring the creator economy to crypto as it's a major business in web2 (see the context before this paragraph). Content creators generate simply a lot of revenue for companies outside of crypto. It's for this reason a lot of web2 social media companies are having massive valuations, even though they are not tradeable on public markets.

The 'social' business is an untapped world within crypto which many apps try to monetize. In the crypto landscape, none of the current social apps have a valuation above 1 billion.

Why isn't socials booming in crypto?

I've been in crypto long enough to see that there is a hidden pattern most don't notice: just like with dexs, initially we had Etherdelta and Idex (pre 2020). These were orderbooks based dexs that were slow and painful to use. It wasn't until Uniswap came and took over the dex space with their AMM model. Same goes for perp dexs: people believed it would never work out as it can't scale and reach same speed as a cex. It wasn't until Hyperliquid changed the game a few years later.

I believe we will have the same thing for Social Apps as well.

Lens initially kickstarted it with Friend tech but despite first moving advantage, they clearly couldn't attract the attention of crypto retail long enough. There will be one or two social apps that will dominate and the best papers right now Pumpfun.

PumpFun: the Dum Dummies of reality

PumpFun will play a keyrole in society. Yes, you heard that right: I believe PumpFun will go mainstream. And potentially become the fictional platform described in the intro.

The issue is that we are not aware of the potential. We only know PumpFun as a memecoin launchpad mostly. PumpFun clearly stated to focus and double down on content creation via their streaming platform.

It has a 1-2b warchest, has been acquiring projects that could be useful for PF (see recent Padre acquirement): the same way Coinbase has been buying profitable businesses like Echo. This kind of behaviour kind of reveals the intention of PumpFun founders: they are here to conquer the space. I was initially skeptical for their hungriness to deliver after pocketing 2b but it's clear they are here to dominate with these kind of moves.

PumpFun vs Hyperliquid

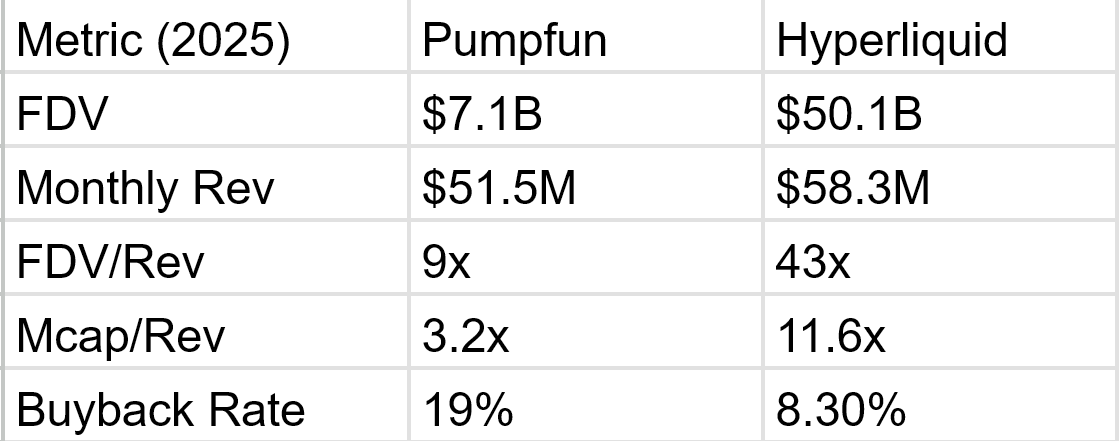

Pumpfun and Hyperliquid clearly are the only coins with buybacks with revenue. As I think Hyperliquid will go higher and compete with CEXs as the Decentralised Nasdaq, I think PumpFun is a premium play outside of the points above.

I found an interesting tweet from @DeFiMinty (Delphi Digital) pointing out that it's trading at 1/7th of Hyperliquids valuation and generates over half it's revenue. This premium is clearly mispriced. You can obviously speculate if the revenue of PumpFun is organic vs Hyperliquid, but in either scenario, it's clear that PumpFun will generate revenue regardless. Onchain is heating up right now as we speak and after the 10/10 blackswan, it's still the only place for the 'little guy' to trade multiples which are extremely hard to get this cycle on a CEX. Trust is broken in CEXs and both PumpFun/Hyperliquid will profit from that.

Conclusion

Higher.