Tari Protocol - The Next-Gen Private L1

Since 2023, I have been closely monitoring the development of Tari, a blockchain project that has largely flown under the radar but holds significant potential. My initial interest was sparked by the impressive credentials of the core team, an aspect I will explore in greater depth later in this report. After engaging in preliminary discussions with the team last year, I developed a strong conviction that Tari had the technical foundation and strategic positioning to become a compelling player in the broader cryptocurrency ecosystem (specifically privacy).

With the recent launch of its mainnet, Tari has entered a critical new phase. This milestone has prompted the publication of this in-depth research report, which aims to assess the project's technological architecture, strategic vision, and potential market impact.

Tari represents a novel Layer 1 blockchain protocol that employs a Proof-of-Work (PoW) consensus mechanism. What sets it apart is its distinctive focus on privacy, a characteristic that makes it the first privacy-centric Layer 1 blockchain built on PoW principles.

The strength of Tari's privacy claims is bolstered by the involvement of Riccardo Spagni, widely known as “fluffypony,” who is best known for his role as a lead maintainer and formerly partner of MoneroCore (better known as XMR), the most prominent privacy coin in the cryptocurrency space with a market capitalization of approximately $6 billion. Spagni is now a core contributor to Tari, which many consider to be a natural evolution or extension of his work with Monero, bringing the ethos of privacy into a native Layer 1 environment.

Mining

While Tari’s emphasis on privacy as a Layer 1 protocol is notable in itself, its integration of a Proof-of-Work (PoW) consensus mechanism is particularly compelling from both a strategic and sociotechnical standpoint. Over the past several years, PoW-based blockchains that offer a novel narrative or design element have consistently demonstrated the ability to attract significant grassroots participation, particularly from retail investors and general cryptocurrency enthusiasts. This pattern suggests that PoW chains, when introduced with a unique positioning, tend to capture the imagination of broader, often non-technical audiences.

Empirical examples such as Kaspa and TAO illustrate this trend well; both projects have gained substantial traction by leveraging the familiarity and ethos of mining. Even controversial or low-utility projects such as Pi Network have managed to achieve multi-billion-dollar valuations, largely driven by the widespread appeal of mining as a concept. The psychological association between mining and Bitcoin, the original and most recognized cryptocurrency, has effectively hardwired mining into the collective consciousness of mainstream users. In contrast, staking, though technically accessible, remains poorly understood by the average participant, often requiring more nuanced knowledge of validator networks and delegation mechanisms.

What’s particularly interesting about Tari’s approach is how easy it is for anyone to start mining. The process is simple: users just download the official Tari mining software and can begin mining using a regular home computer. Unlike many other PoW blockchains that require expensive, specialized hardware and technical know-how, Tari makes it possible for everyday users to participate without major upfront costs or complexity. This lowers the entry barrier significantly and makes the network more inclusive and decentralized from the start.

Moreover, the types of communities that form around accessible mining projects like Tari tend to be very different from typical crypto communities. They are often more passionate, loyal, and deeply invested in the long-term success of the project, sometimes even resembling tight-knit subcultures. This kind of strong, grassroots support can play a crucial role in helping the network grow and stay resilient over time.

Privacy Stablecoin: A Major Product-Market Fit for Tari

Tari distinguishes itself as a Layer 1 blockchain where all transactions are confidential by default. This level of built-in privacy is rare in the current blockchain landscape and opens the door to entirely new types of applications. Among the most promising use cases is the concept of native private stablecoins, a potential product-market fit that could position Tari at the center of a significant market shift.

Stablecoins remain one of the most widely adopted and impactful products in crypto to date. They serve as the foundational layer for many decentralized financial applications and trading ecosystems. Increasingly, we are seeing major stablecoin issuers either launch their own blockchains (e.g., Ethena) or invest heavily in Layer 1 networks designed specifically for stablecoin use cases (e.g., Plasma). These networks often achieve multi-billion-dollar valuations based on the assumption that stablecoin utility will continue to grow.

Now, with the recent passage of the Stablecoin Act and growing regulatory clarity around fiat-backed digital assets, the focus on stablecoins is only intensifying. In this environment, the demand for a privacy-preserving stablecoin could become a major opportunity. While privacy is not currently at the forefront of industry trends, I believe it will become increasingly important, especially as crypto continues to move into more practical, everyday use cases.

For example, consider the scenario of paying a remote employee on-chain. Without privacy, the salary amount would be publicly visible on the blockchain, raising obvious concerns about personal and financial confidentiality. Privacy in this context is not about obscuring illicit activity, it’s about protecting users in legitimate, real-world use cases. This mirrors how Bitcoin was initially misunderstood as a tool for crime before it gained broader acceptance as a store of value.

Monero has long been regarded as the leading privacy coin in the crypto space, but its limitations are clear: it is a PoW chain without smart contract capabilities, meaning private transactions cannot interact with programmable logic. This makes it unsuitable for building complex decentralized applications or financial products like private stablecoins.

Tari solves this problem. By combining confidential transactions with smart contract functionality in a PoW-based Layer 1, it creates the conditions for the first truly private, programmable stablecoin platform. This innovation has the potential to reshape how stablecoins are used and perceived, making privacy a core feature rather than an afterthought. It’s likely no coincidence that Riccardo Spagni (fluffypony), the creator of Monero, has chosen to focus his efforts on Tari. The project builds directly on Monero’s privacy principles while addressing its technical limitations.

Tari architecture

Tari is designed with a dual-layer architecture to balance strong privacy, decentralized security, and scalable performance.

The base layer (L1) uses Proof-of-Work (PoW) and features a hybrid mining model:

- 33% RandomX solo mine Tari

- 33% RandomX merge mine with Monero

- 33% SHA3

It incorporates the Mimblewimble protocol for lightweight, confidential transactions and supports TariScript, a simple smart contract language that enables privacy features like stealth addresses.

It will be changing in the near future to:

- 25% RandomX solo mine Tari

- 25% RandomX merge mine with Monero

- 25% Cucakroo29

- 25% SHA3

The goal here is to create distinct lanes for different types of miners without over complicating the user experience. In Tari Universe, the default (and best lane) is chosen for you, while the other lanes help massively increase the overall security model for the network (eg. merge mine with Monero lane).

Above this sits Ootle, Tari’s Layer 2, which handles more complex smart contracts and high-speed asset interactions. Ootle runs on a separate consensus mechanism, Cerberus/Hotstuff, enabling fast and scalable decentralized applications without compromising the base layer’s privacy and security.

This separation allows Tari to combine the privacy and robustness of a Monero-backed L1 with the throughput and programmability of an Ethereum-style L2, a strong foundation for building private financial products.

According to Hack VC’s investment thesis, Tari Labs has already made significant progress toward launching a confidential, compliant stablecoin. A stablecoin issuer has reportedly committed to deploying the first default-private stablecoin on Tari once Ootle is live.

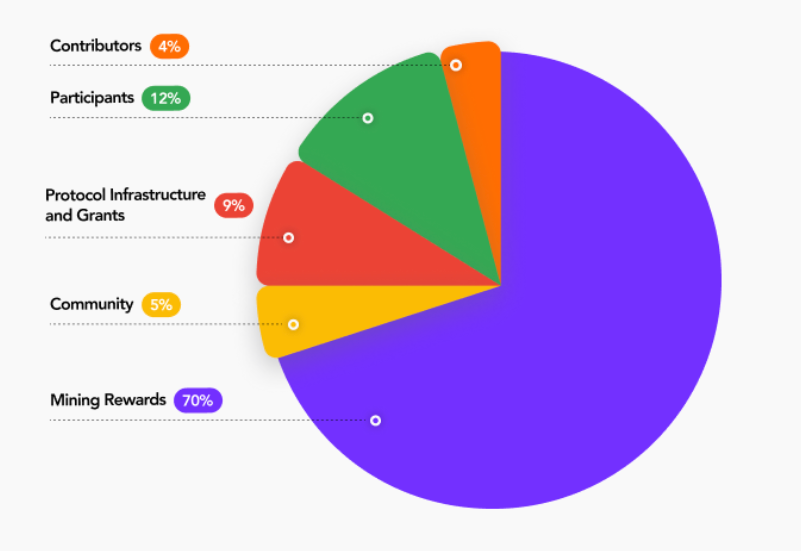

Tokenomics

- Total Supply (XTM): 21,000,000,000 (21 billion)

- Emission Timeline: ~27.8 years to full emission

- Current Circulating Supply: ~1.01 billion XTM

- Circulating Supply at Year 3: ~50% of total supply expected to be in circulation

- Premined Allocation: 6.3 billion XTM

- Used for: infrastructure support, ecosystem grants, community incentives

- Halving Cycle: Every 3 years (vs. Bitcoin’s 4 years)

- Block Reward Decay: Declines on a block-by-block basis

- Tail Emission (post-Year 12): 1% annual inflation to sustain miner incentives

- Miner Incentives:

- 100% of L1 block rewards

- 100% of L1 transaction fees

It’s easy to be fudded out of the low circulating/high fdv impression we are seeing here. Despite inflation being high right now, we have to consider that Pow chains all start like this (including bitcoin). Tari has an halving every 3 years. Block rewards decline on a block-by-block basis. After 12 years, the protocol rewards miners via a tail emission to ensure they receive compensation forever for securing the network. The tail emission increases the XTM emitted by 1% a year. Tari miners receive 100% of block rewards and L1 fees.

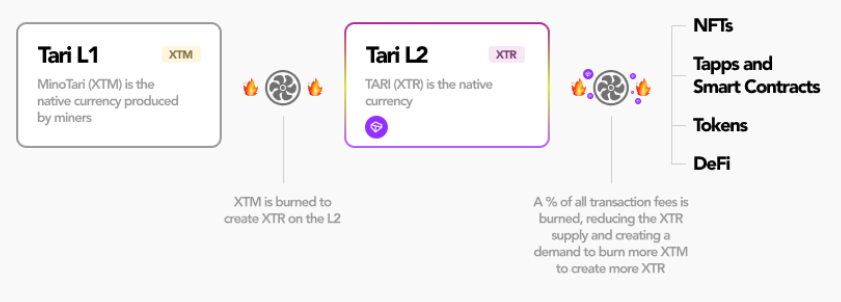

All dapp activity will occur on the Tari Layer 2 (aka the Ootle), including DeFi, NFTs, SocialFi, GameFi, stablecoins, streaming payments, and more. Tari contributors have designed an elegant relationship between the Layer 1 tokens (XTM) and the Layer 2 tokens (XTR) to offset supply inflation and maintain a soft peg between them. Tari contributors achieve the interplay between the two tokens through a token model called the Turbine Model.

In the Tari Turbine model, the sole method for creating XTR tokens is by burning XTM tokens on Layer 1, which are then redeemed at a 1:1 ratio on the Ootle network. This establishes a one-way relationship between the two tokens. On the Ootle network, a portion of each transaction fee is distributed to validators, while another portion is permanently burned. This token-burning mechanism supports a robust economic framework in which Tari miners can sustainably and confidently secure the network indefinitely. At scale, this design helps the Tari token economy reach a balanced and sustainable circulating supply.

Tokenomics can be challenging to evaluate, as they are often complex—particularly when deciding whether or not to invest early. We're generally accustomed to projects with clearly defined vesting schedules, but proof-of-work (PoW) chains tend to be more nuanced in this regard. As such, I typically assess token value based on the projected circulating market capitalization two to three years into the future: would the current price still be attractive at that point?

At the current price of $0.014, if 50% of the total supply were in circulation after three years, the implied market capitalization would be approximately $151 million. This seems relatively low, especially considering that early backers are under lock-up agreements, while only a small portion of the supply is currently liquid.

Although the price could decline further, such movement would likely reflect a transfer of tokens from short-term speculators (mercenary miners) to long-term holders (diamond hands). This transition is a natural phase for nearly all PoW projects, including Bitcoin.

As for my personal approach: I'm gradually building a long-term position through dollar-cost averaging (DCA), and I’m also mining as a side activity—for fun, primarily, rather than with the expectation of earning life-changing returns.

Conclusion: counter arguments

‘’Another L1?’’

We can already anticipate the reaction: “Not another Layer 1 project”. This skepticism is understandable, especially in the current market cycle. However, it's important to recognize a common cognitive bias, many of us judge new L1s based on the underwhelming performance of heavily VC- and CEX-backed Layer 1 coins over the past two years. I’ve personally experienced losses from such investments as well.

That said, a clear distinction emerges when we categorize L1 projects into two groups: CEX + VC-backed versus DEX + community-driven. The latter consistently outperforms in both community participation and price appreciation. Projects like Keeta, Kaspa, and even TAO launched directly on-chain and provided meaningful opportunities for retail participants to get involved early and benefit from price growth.

This dynamic creates a powerful flywheel: as early supporters see gains, they become more loyal and committed to the project, resulting in a strong, almost “cult-like” community. Such grassroots enthusiasm is exactly what a Layer 1 project needs to thrive in today’s competitive environment.

Tari fits into this second category. It launched on-chain, without major centralized exchange listings. If you want exposure, you must either purchase the wrapped version on-chain or mine it yourself, much like Kaspa and TAO in their early stages.

It’s a completely fair and transparent model.

There is a good possibility that Tari could be the next Kaspa next cycle in terms of PA. Kaspa had high inflation initially with very low daily volume. It took atleast 6-12 months until it started to move and explode. There was a lot of sell pressure from miners until it bottomed and reached an accumulation zone.

With big names like Multicoin who have invested in Tari since the early days + the start of CEX mining (another article will be published about this): the future looks bright. As a new under the radar low cap, it's one of Epoch's high conviction fundamental picks. This is a multi year long term bet: not a quick trade. The sell pressure from mining is still high but at some point the price gets too low for miners to sell. This is where the accumulation starts.