PrimeLayer: Optimizing Bitcoin

Bitcoin. The first truly well-known cryptocurrency that started the digital gold rush. Almost everyone you meet these days has heard of Bitcoin. Stories about people who “could have bought Bitcoin for $0.01, but didn’t” seem to come up at every birthday party. With a market cap of $2.08 trillion, it is also the largest coin in existence.

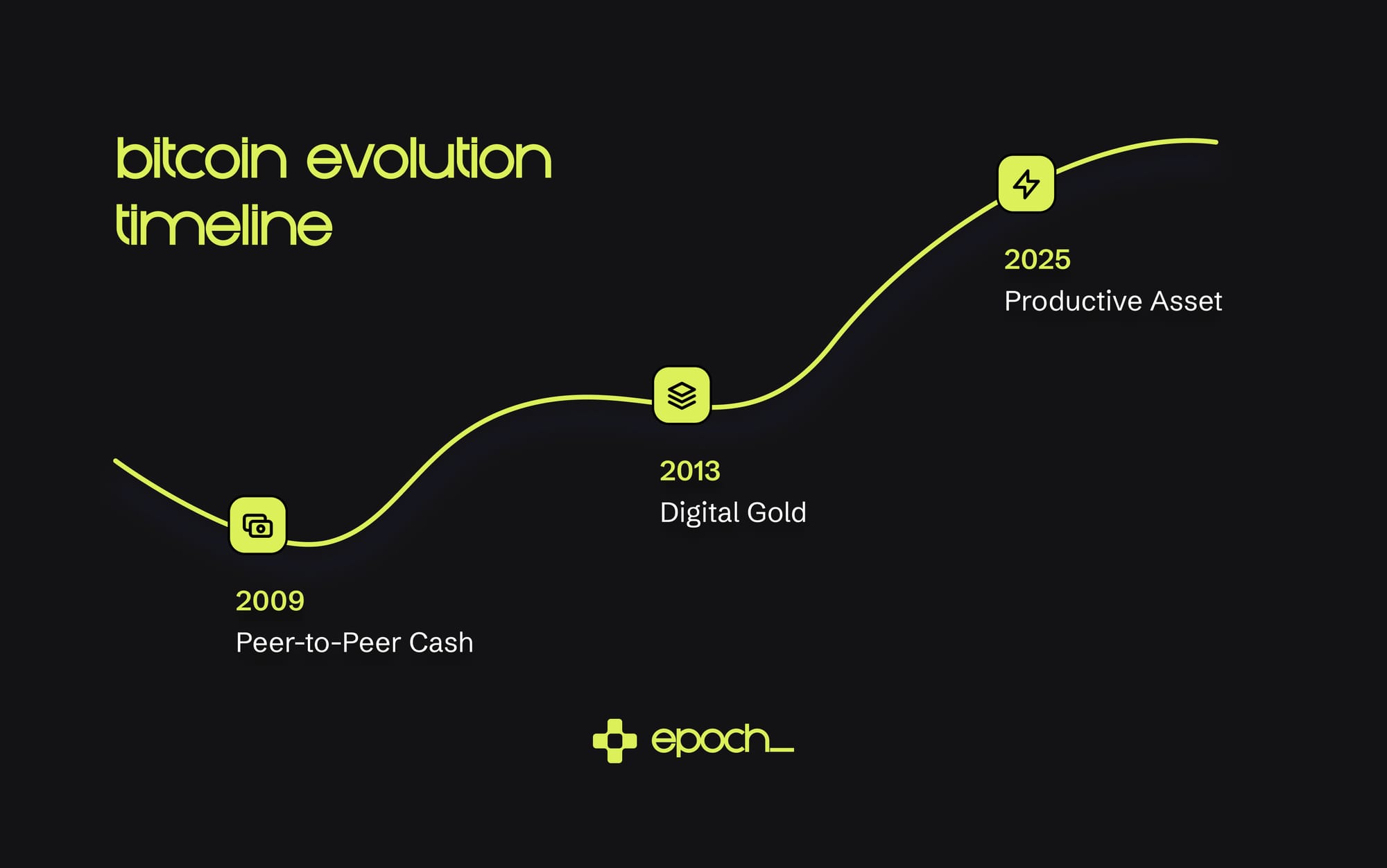

That BTC is immensely popular is something no one can deny. The downside, however, is that since Bitcoin’s creation, the rest of the crypto world has continued to evolve. Bitcoin itself has (deliberately) been slow to innovate. BTC was designed as a digital, decentralized currency that eliminates the need for intermediaries. Today, it is mainly used as a store of value and is often referred to as digital gold. Use cases beyond that, which other coins do have, are difficult to achieve because of Bitcoin’s design. Although Bitcoin has progressed slowly, other projects have advanced much faster, leading to what we now know as Decentralized Finance (DeFi).

With the rise of DeFi, the ways to earn money with crypto have become far more diverse than simply buying a coin and hoping to sell it later at a higher price. Some of these methods include staking, liquidity providing, lending and borrowing, yield farming, and several others.

However, to earn money with your Bitcoin through these methods, you need to take several intermediate steps. And those steps require trusting third parties, something Bitcoin was originally designed to avoid. The BTC blockchain was built as a decentralized, secure, and transparent way to record and transfer ownership of money without intermediaries. In other words, it was created purely for transactions and value storage.

To make use of DeFi with Bitcoin, alternative solutions are needed that allow BTC to be used on another blockchain. This requires bridging BTC through a custodian to a different chain. In practice, this means your BTC is parked with a third party while you receive a wrapped version in return, for example wBTC. This wrapped token can then be used for DeFi purposes. The downside is that you lose control over your parked BTC, as the custodian holds the actual assets.

BTC & DeFi

If you want to earn money with Bitcoin, you can either sell it for a profit or exchange it with a custodian for wBTC to use in DeFi applications. When you sell, you lose your asset and must settle for the proceeds of the sale. If you choose to work with a custodian, you have to trust that they handle your BTC responsibly and are not compromised, for example, by a hack.

Earlier, we mentioned that several projects have already made Bitcoin easier to use, both for payments and within DeFi. The first true Bitcoin Layer 2 is the Lightning Network (LN). This solution makes BTC transactions faster and more convenient by taking them off the Bitcoin blockchain and executing them off-chain. In the end, only the essential details of these transactions are recorded on the Bitcoin blockchain as proof.

LN cannot truly be considered DeFi, as it does not involve smart contracts or financial protocols, but the launch of the project has made Bitcoin more efficient and better suited for everyday payments.

The Liquid Network can also be seen as one of the first Bitcoin Layer 2s. The network is the issuer of lBTC, one of the earliest variants of wrapped Bitcoin, which reduces transaction times from ten minutes to around one minute. Liquid is primarily used by institutional players, but it serves as a strong example of bridging BTC to create and use a wrapped version of it.

Then came Rootstock (RSK). RSK launched in 2018 and was the first project to enable EVM compatibility secured by Bitcoin. You could say it was a true game changer at the time. RSK opened the doors for Bitcoin to participate in DeFi through its own variant of BTC, rBTC. This made it possible to engage in lending and borrowing, trading on DEXs, staking, and even the first Bitcoin-collateralized stablecoin in the form of Dollar on Chain (DOC).

Although RSK was revolutionary in 2018, its usage numbers in 2025 are disappointing. It was the pioneer of Bitcoin-based DeFi, but growing competition has pushed RSK into the background. Networks like Stacks (STX) are much more comprehensive than RSK and therefore more popular. STX is a Bitcoin Layer 2 where users earn BTC rewards in exchange for staking. The network has a strong community and a broad ecosystem and is currently one of the largest projects in the Bitcoin ecosystem. It is used for lending and borrowing, staking, dApps, launchpads, and NFTs.

While STX offers many ways to make BTC productive, it is not a true Bitcoin Layer 2 but rather a sidechain that uses the Bitcoin blockchain to finalize transactions. The transactions are executed and validated on the Stacks chain and, in practice, operate independently from Bitcoin. In addition, Stacks uses its own smart contract language instead of the EVM, which can slow down mass adoption.

Bitcoin has gone through many stages of development since its creation, but what it still lacks is a truly trustless Bitcoin Layer 2. This is where PrimeLayer aims to make a difference.

PrimeLayer

PrimeLayer is a Bitcoin-anchored Layer 2 (L2). This means it does not run directly on Bitcoin but relies on the same security and settlement layer. PrimeLayer is structured as a zk-rollup with zkEVM, making the system fully programmable like an Ethereum Virtual Machine (EVM). This makes PrimeLayer unique, as zkEVMs have not existed on Bitcoin until now. The advantage of this approach is that PrimeLayer combines Bitcoin’s security with the speed and programmability of Ethereum. In addition, existing dApps can easily be migrated to PrimeLayer. The fact that existing dApps can be easily used on PrimeLayer is important for adoption and is a major distinction from the competition. Additionally, it opens the door for developers who are already familiar with building dApps on EVM, without having to pivot to a different programming language.

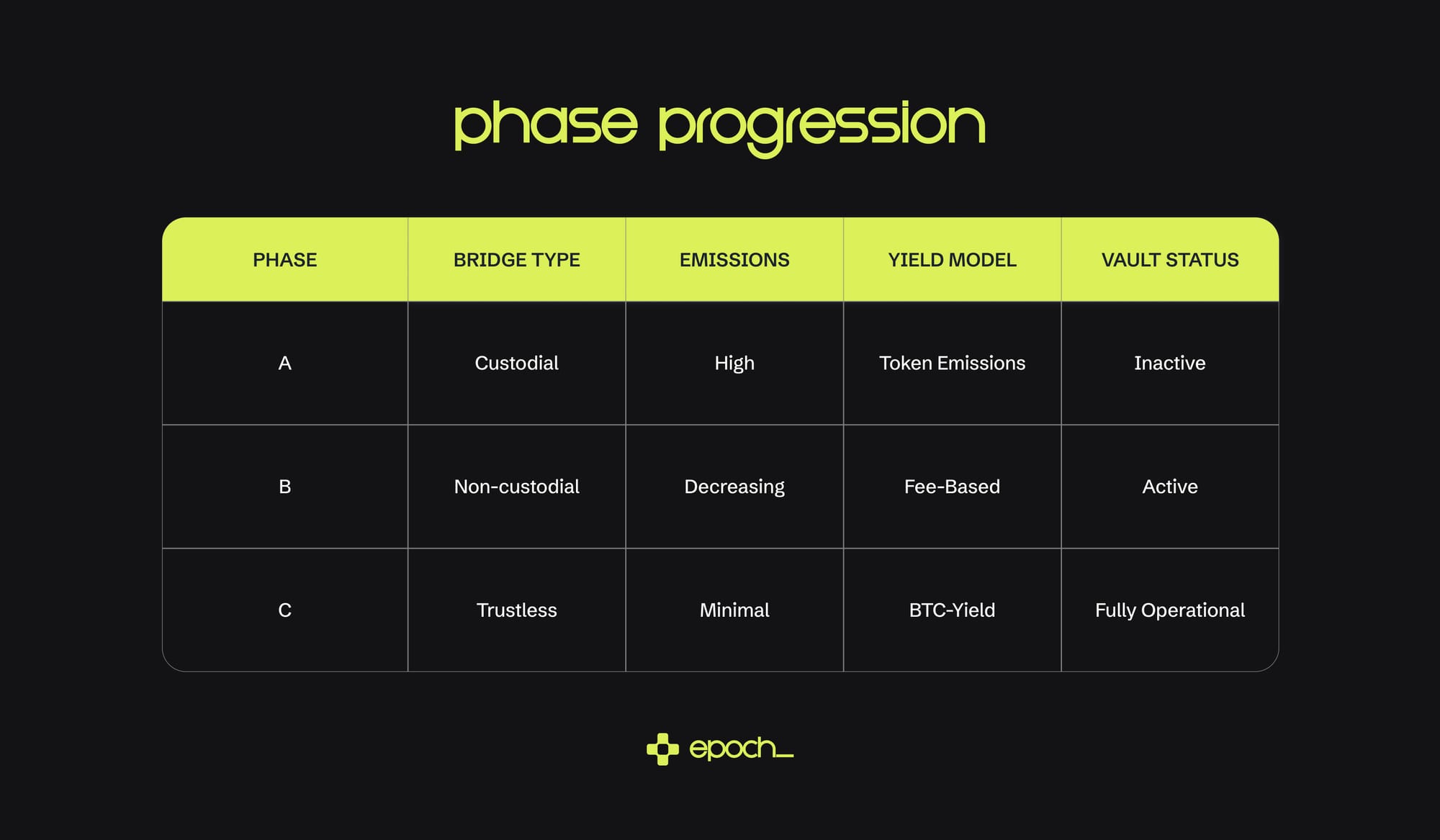

In the initial phase, PrimeLayer will still rely on an external bridge to convert BTC into PBTC, PrimeLayer’s version of BTC. However, the goal is to gradually reduce its dependence on external infrastructure over several phases and work more closely with Bitcoin itself. For custody and the anchoring of transactions, PrimeLayer makes use of Syscoin. Syscoin is an interoperability layer for blockchains that connects to the Bitcoin network through merge-mining. Syscoin has been doing this since 2014, making it an established and battle-tested network.

Once PrimeLayer reaches their final phase, they will be the only fully trustless BTC native bridge in existence.

Economy

There are several ways to earn money with PrimeLayer. These will continue to evolve as the project grows and becomes more decentralized. In Phase A, yield still comes from the issuance of PRML, PrimeLayer’s native token. During this stage, the main focus is on growing the ecosystem, with emissions designed to attract users and builders.

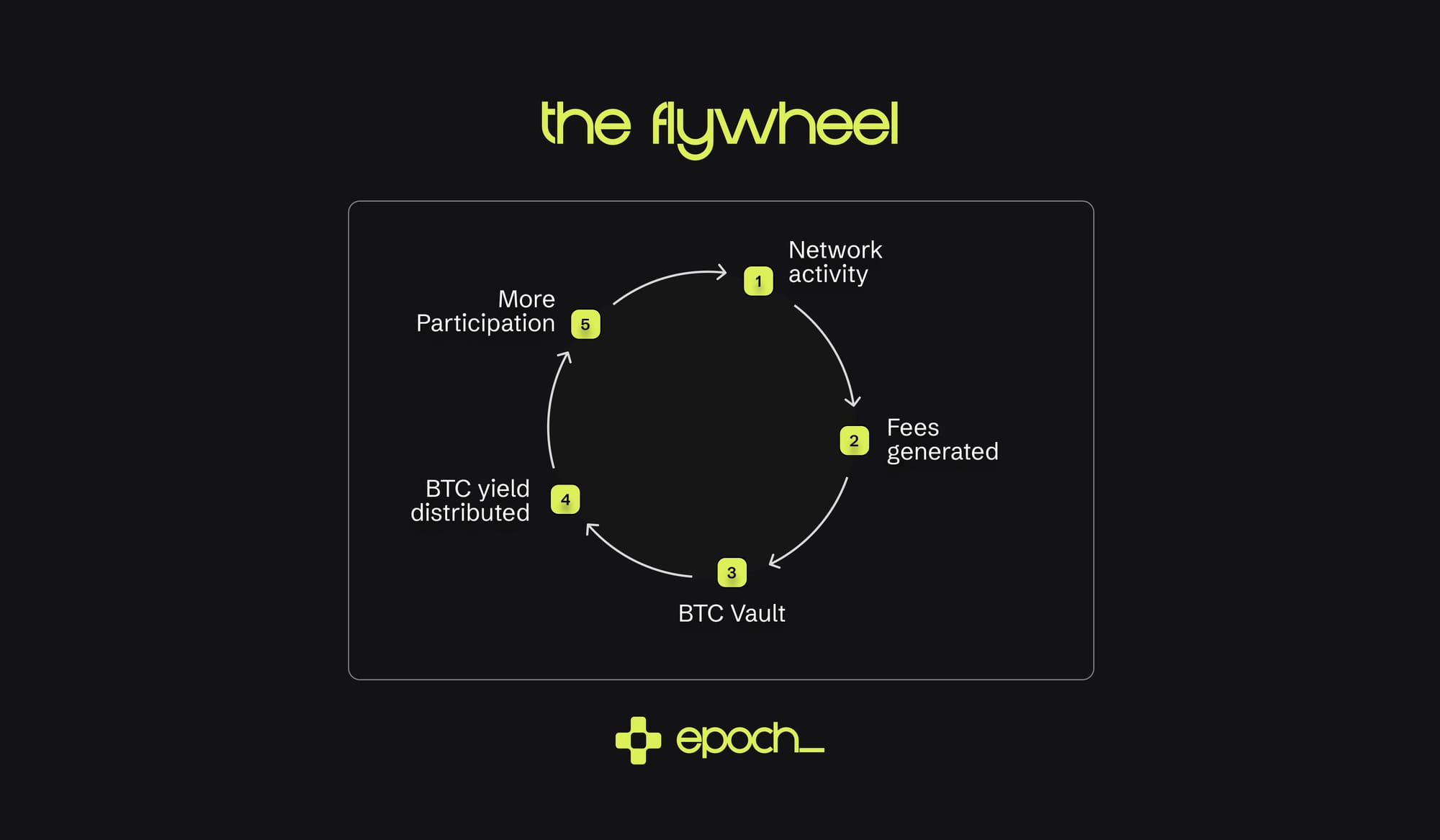

Activities on the network generate fees, for example when PBTC is used to mint pUSD. pUSD is an over-collateralized stablecoin backed by BTC that can be used for trading on PrimeLayer’s DEX, lending and borrowing, staking, payments, and on-chain settlements.

Once the revenue from fees allows it, real yield from protocol revenue will be distributed among the network’s participants.

That is what Phase B will revolve around. The goal is to gradually phase out emissions and replace them with fee-sharing and buybacks. The buybacks are important because they are used for burns, creating scarcity. Many projects continue to print their native tokens, resulting in artificial yields. PRML is used for governance, allowing users to decide how the yield is distributed across the pools. As the PrimeLayer economy gains momentum, holding PRML will be equivalent to having influence, while the buybacks and burns create increasing scarcity. Demand for the token will rise as supply decreases, creating a flywheel effect.

Another important part of Phase B is the BTC Vault. This is an on-chain treasury that launches in this phase and collects PrimeLayer’s revenue. The protocol-generated revenue that flows into the vault are converted into BTC and periodically distributed to network participants as Bitcoin yield. With the introduction of the vault, the revenue model shifts from an inflationary system to one that generates real, income-backed yield. Once PrimeLayer has fully matured, the Vault should become the primary source of yield.

That brings us to Phase C. This is the final stage of PrimeLayer, where the project reaches full maturity and operates without dependence on external parties. The PRML emissions will have been almost entirely phased out, and the economy should primarily run on real yield. This real yield is generated from fees collected through the bridge, the DEX, stablecoin minting, and liquidations. The Vault will be in full operation, and the native token becomes minimally deflationary.

Conclusion

If PrimeLayer can deliver on its promise, it is a project that innovatively makes Bitcoin productive. At the moment, Bitcoin mainly serves as a store of value, a form of digital gold that offers little opportunity for profit beyond selling. Although there are providers that make this possible, these solutions still require trust in third parties. In its final phase, PrimeLayer ensures that it operates without such dependencies, allowing those who want to put their Bitcoin to work to do so without giving up control of their BTC.

The market that can be reached with the introduction of PrimeLayer is enormous. BTC maxis are known for being risk averse, and concepts like DeFi often do not appeal to them. The appreciation of Bitcoin itself is enough for many. And understandably so, entrusting large sums of money to strangers in a space that is often associated with scams is difficult. For these people, PrimeLayer could be the answer, as everything here operates in a trustless way. It bridges the gap between Bitcoin and DeFi in a way that has never been done before.

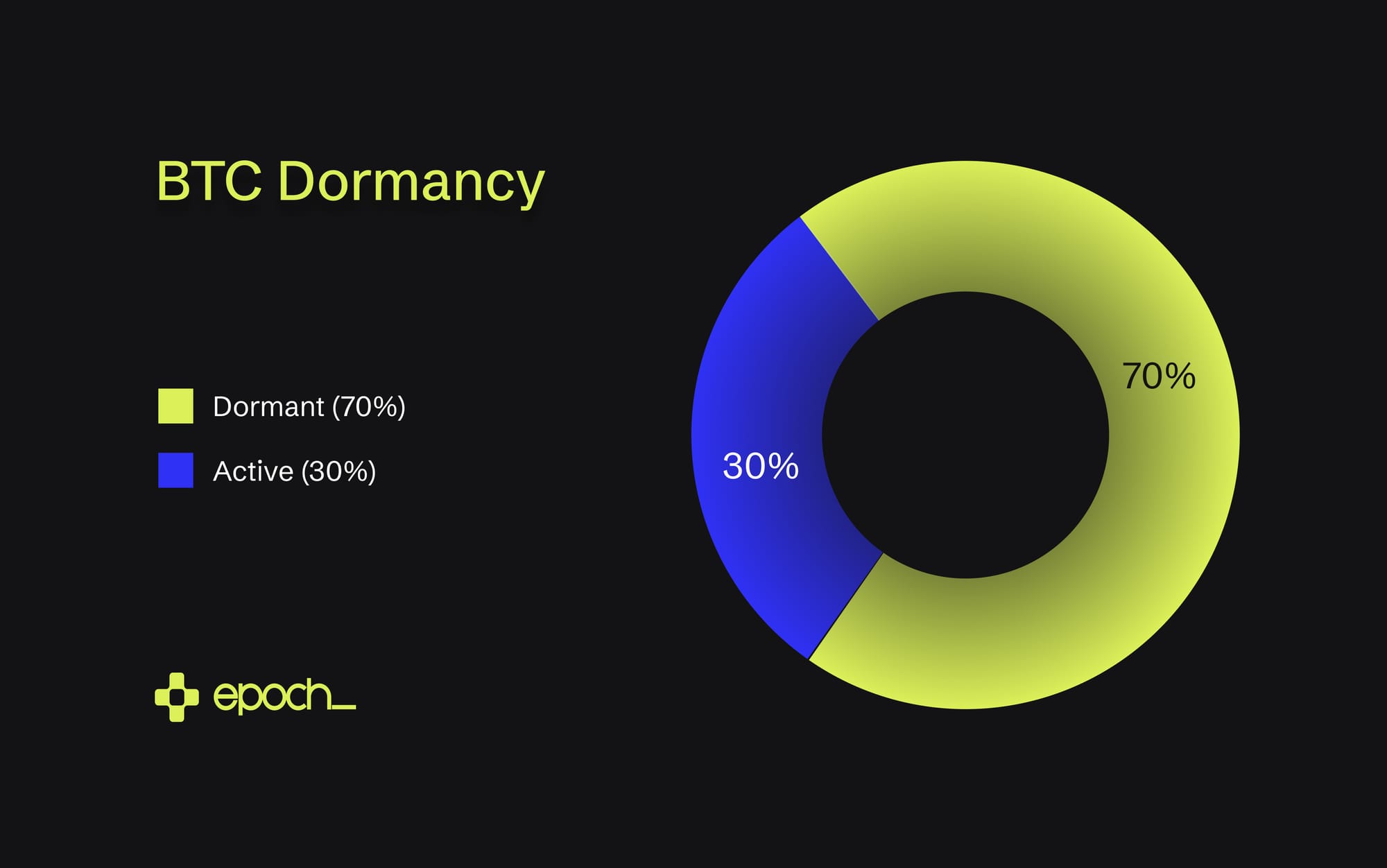

At the moment, around 70% of all Bitcoin is dormant, meaning it is simply being held in anticipation of price appreciation. If only a fraction of this amount were to be deployed to participate in DeFi through PrimeLayer, it could generate yield not only for those putting their BTC to work, but also for the platform’s users through fees.

These fees, unlike those in many other DeFi projects, would also be distributed in BTC. It is common for users of similar platforms to receive their rewards in the platform’s native token, which leads to inflation and artificial yield. At PrimeLayer, rewards are paid out in BTC, stablecoins or tokens that are available on the PrimeLayer DEX. This provides real yield without putting pressure on the value of the native token.