Plasma: up or down?

This is going to be a short one. On Epoch, we focus on research about new projects, but I've also decided to share some thoughts I have that I don't like to post on crypto Twitter (for obvious reasons). These thoughts, like the articles, are not financial advice. Nonetheless, they could serve as inspiration for you: whether you decide to ape into something or not. Simple as that.

With the successful launch of Plasma, seed round folks and airdrop farmers have been bathing in dopamine rushes. The Echo round is sitting over 200x (I saw screenshots of people turning $1k into $200k), and airdrop farmers in total made hundreds of millions on Plasma. I farmed a small amount myself, so I can’t complain.

My whole timeline is talking about Plasma going higher, and I’m still debating and hesitating about the outcome. After eight years of being in crypto full-time, you start to learn that you can’t ever be 100% sure of an outcome. Instead, you decide based on probabilistic thinking: “I think there’s a 70% chance it goes down because XYZ.” There are too many variables and shenanigans to be completely certain: we just can’t process it all as simple human beings.

After seeing the victory laps of seed round people being up over 200x (congrats, by the way), my brain immediately made the connection with the launch of Ethena. Private sale investors were up over 100x, and it was basically one of the best seed round investments of the last five years in crypto. Especially in the post-ICO era (2017), when it was a unique situation where everybody and their mums were printing 100x on a weekly basis.

Long story short, and funny enough, looking at the chart on CoinGecko: Ethena launched at $0.78. It proceeded to pump to $1.46, then dumped all the way back to below $0.20 before starting its surge.

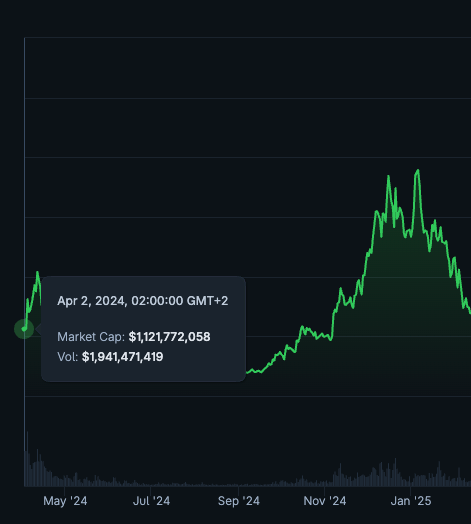

Market cap-wise, it looks like this:

Now, looking at Plasma, the circulating market cap is almost similar: $1.3B was the bottom, and it touched $2.6B (both within the last 24 hours). There’s a case to be made for comparing both price actions across different timeframes: Ethena’s bottom and top were roughly one week apart, while the same movement for Plasma happened within just 24 hours.

Another point of discussion is that both were, and are, trading in very different market environments. Ethena launched in May 2024, when the markets were frothy. Plasma, on the other hand, is likely launching at the tail end of the cycle, with bullish momentum driven by the perp DEX narrative (Aster, Avantis, etc.).

Comparing both price actions at launch and trying to predict the future from that is a bold move, but it’s a possibility that crossed my mind this morning. I figured I’d share it here on Epoch, as it might be the kind of content you guys enjoy reading.

I personally think the likelihood of the above playing out is around 70%. I could be wrong, these types of comparisons are never 100% accurate. I wouldn’t base financial decisions solely on this, but it might serve as one argument in your broader analysis.

I’ll try to post more of these in the future if it’s something you guys find interesting.