Orderly: The Invisible Engine Powering Tomorrow's DEXs

Open your favorite crypto wallet, tap "Trade," and watch as an orderbook springs to life. Quotes tighten, orders execute instantly, your PnL updates in real time. It feels exactly like trading on Binance, except you're still holding your own keys. There's no "Orderly app" to download, no new exchange to sign up for. That's because Orderly isn't trying to be another DEX. It's building the infrastructure that powers all of them.

The Problem: Why Every DEX Feels Like an Island

Picture the current DeFi landscape: hundreds of DEXs scattered across dozens of chains, each with its own shallow liquidity pool. Want to trade on Arbitrum? That's one orderbook. Need to move to Solana? That's a completely different market. It's like having a different stock exchange in every city, none of them talking to each other.

The result is terrible prices, massive slippage, and the constant headache of bridging assets between chains while praying nothing goes wrong in transit. Meanwhile, centralized exchanges like Binance offer deep liquidity and instant execution, but require you to hand over your assets entirely.

Orderly's Solution: One Engine, Infinite Exchanges

Orderly flips the entire model. Instead of building another competing DEX, they've created a shared trading engine that anyone can plug into.

Here's how it works: Orderly maintains a single, unified orderbook for perpetual futures. Any wallet, app, or exchange can connect to this orderbook through Orderly's APIs and SDKs. When you trade through your favorite wallet's built in exchange, you're actually trading against the same liquidity pool as someone using a completely different app on a different blockchain.

The Trading Experience: CEX Speed, DEX Security

For traders, Orderly feels refreshingly familiar. After a one time setup of a "trading key" (think of it as a limited permission key that can only place orders, not withdraw funds), every action becomes instant. No more MetaMask pop ups for every trade.

No more waiting for blockchain confirmations. Just click, trade, done. But unlike Binance, your funds never leave your control. You can withdraw instantly to any supported chain. No permission needed. No frozen accounts. No maintenance that locks your money.

The Builder's Paradise: Launch a DEX in Days, Not Years

Here's where Orderly gets really interesting. They're not competing with DEXs; they're empowering them.

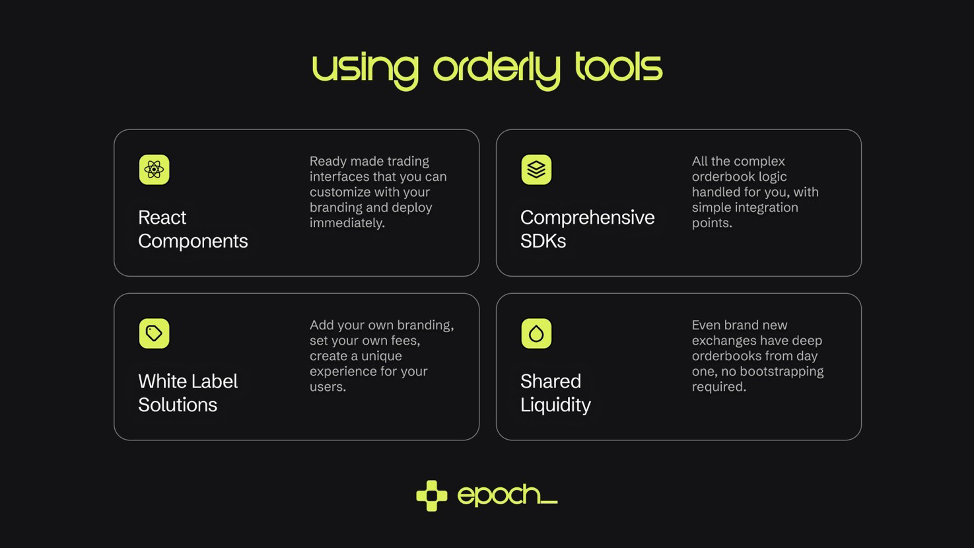

Any project can now launch a fully functional perpetuals exchange in days using Orderly's tools:

Imagine trying to start a new stock exchange from scratch. You'd need market makers, liquidity providers, matching engines, settlement systems. With Orderly, you just plug in and go. Set your own fees on top, keep the profits, and let Orderly handle the plumbing.

OmniVault: Where Passive Meets Profitable

To deepen liquidity even further, Orderly launched OmniVault, a strategy vault that lets everyday users earn like market makers.

Here's the concept: You deposit USDC from any chain into the vault. Professional trading firms (starting with Kronos Research) use this capital for market making strategies, placing buy and sell orders to capture spreads and funding rates. Profits get distributed back to depositors proportionally.

The system uses three hour "vault periods" to batch deposits and withdrawals, ensuring everyone gets fair pricing and preventing timing games. It's like a DeFi index fund, but for trading strategies rather than tokens.

Current yields have ranged from 20 to 40% APY, significantly outpacing traditional DeFi yields, though naturally with corresponding risks from active trading strategies.

The Token Economics: Value Flows to ORDER Holders

Orderly's token system connects platform success directly to token holder value:

$ORDER serves as the primary token, working seamlessly across chains via LayerZero's OFT standard. Stake it to earn VALOR points, which are periodically redeemable for USDC from the protocol treasury. This represents real yield from real trading activity.

esORDER adds an interesting twist: rewards are distributed in escrowed form, vesting over 15 to 90 days. The longer you wait, the more you receive. Vest immediately and get 50%; wait the full period and get 100%. This reduces sell pressure while rewarding patient participants.

The community has currently passed a proposal to redirect up to 60% of protocol fees toward ORDER buybacks, potentially making the token deflationary as volume grows.

The Architecture: Pragmatic and Transparent

Orderly's technical stack prioritizes performance without sacrificing verifiability:

All contracts are audited and publicly verified. Governance uses multi signature wallets for security. It's a practical approach that acknowledges trade offs while maintaining transparency about them.

Why This Matters: The Invisible Revolution

Orderly represents a fundamental shift in how we think about DEX infrastructure. Instead of fragmenting liquidity across hundreds of competing exchanges, why not unite it in one place and let front ends compete on user experience?

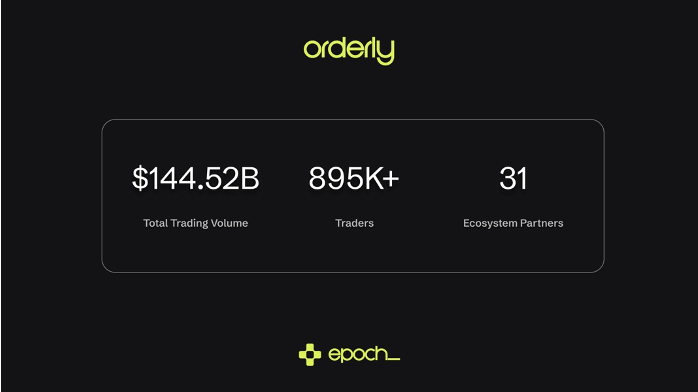

This unified approach is already delivering results. According to DefiLlama, Orderly Chain processes more perps volume than established chains like Arbitrum, Base, Ethereum, and even BSC.

If successful, Orderly becomes the invisible backbone of decentralized trading: the exchange inside every exchange. Users get CEX quality execution with DEX level security. Builders get instant liquidity without recruiting market makers. The entire ecosystem becomes more efficient.

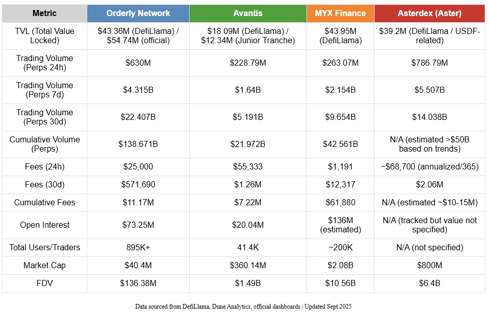

A recent comparison made by @Pedr0_DC of perpetuals infrastructure providers reveals a striking market inefficiency. When you line up Orderly against competitors like Avantis, MYX Finance, and Asterdex, the numbers tell a compelling story:

Orderly dominates virtually every metric that matters.

Orderly One: From Backend to Full Stack

While Orderly has mastered the backend infrastructure that powers perp DEXes, they're now expanding their vision with Orderly One. This new initiative recognizes that there are projects, teams, and individuals who already have established communities and want to offer perpetuals trading to their users without building everything from scratch.

Orderly One provides builders with ready-to-deploy frontend solutions alongside the existing backend infrastructure. Builders can now launch a complete perpetuals exchange, dramatically reducing time to market and development costs.

This evolution makes Orderly's infrastructure even more accessible. Whether you're a team that wants to build a custom frontend or one that prefers a turnkey solution, Orderly has you covered. It's the natural next step in their mission to democratize access to institutional-grade trading infrastructure.

The Bottom Line: Building the Boring Infrastructure That Changes Everything

Orderly isn't trying to win by being flashy. They're trying to win by being essential: the boring, reliable infrastructure that everyone depends on without thinking about it.

In a world where every wallet wants to offer trading, every game wants a marketplace, and every app wants to be "super," Orderly provides the engine that makes it all possible. They're not building another cathedral in the DEX landscape.

They're laying the plumbing.

And in the modular future of crypto, the plumbing might be the most valuable real estate of all.