Orderly ONE

Every 16 minutes, somewhere in the world, someone is creating a new perpetual DEX on Orderly ONE.

This isn't hyperbole. It's mathematics. 1,250 DEXs launched in 14 days. The infrastructure has become self-replicating, teaching communities they can own their own exchange for the price of a laptop. What started as an experiment in democratizing financial infrastructure has become something unprecedented: the fastest proliferation of exchanges in DeFi history.

The Two-Week Revolution

On September 23, 2025, Orderly Network launched Orderly One. A no-code platform that lets anyone create a perpetual DEX in seconds. Two weeks later, the numbers tell a story that challenges everything we thought we knew about platform adoption.

Timeline: September 23 - October 7, 2025 (14 days)

· Total DEXs Launched: 1,250+

· Graduated DEXs (Monetized): 60+

· Graduation Rate: 4.8%

· Total Fees Generated: $606,858

· Distributed to DEX Creators: $335,575

· Orderly Net Fees: $271,283

· To Stakers (60%): $162,770

· ORDER Burned: $50,000+

· Daily Launch Rate: 89 DEXs/day

[Source: Orderly Network Internal Data, October 7, 2025]

Eighty-nine exchanges launching daily means a new DEX every 16 minutes, 24/7, without pause. For context, there were fewer than 500 perp DEXs total across all of DeFi before Orderly One launched.

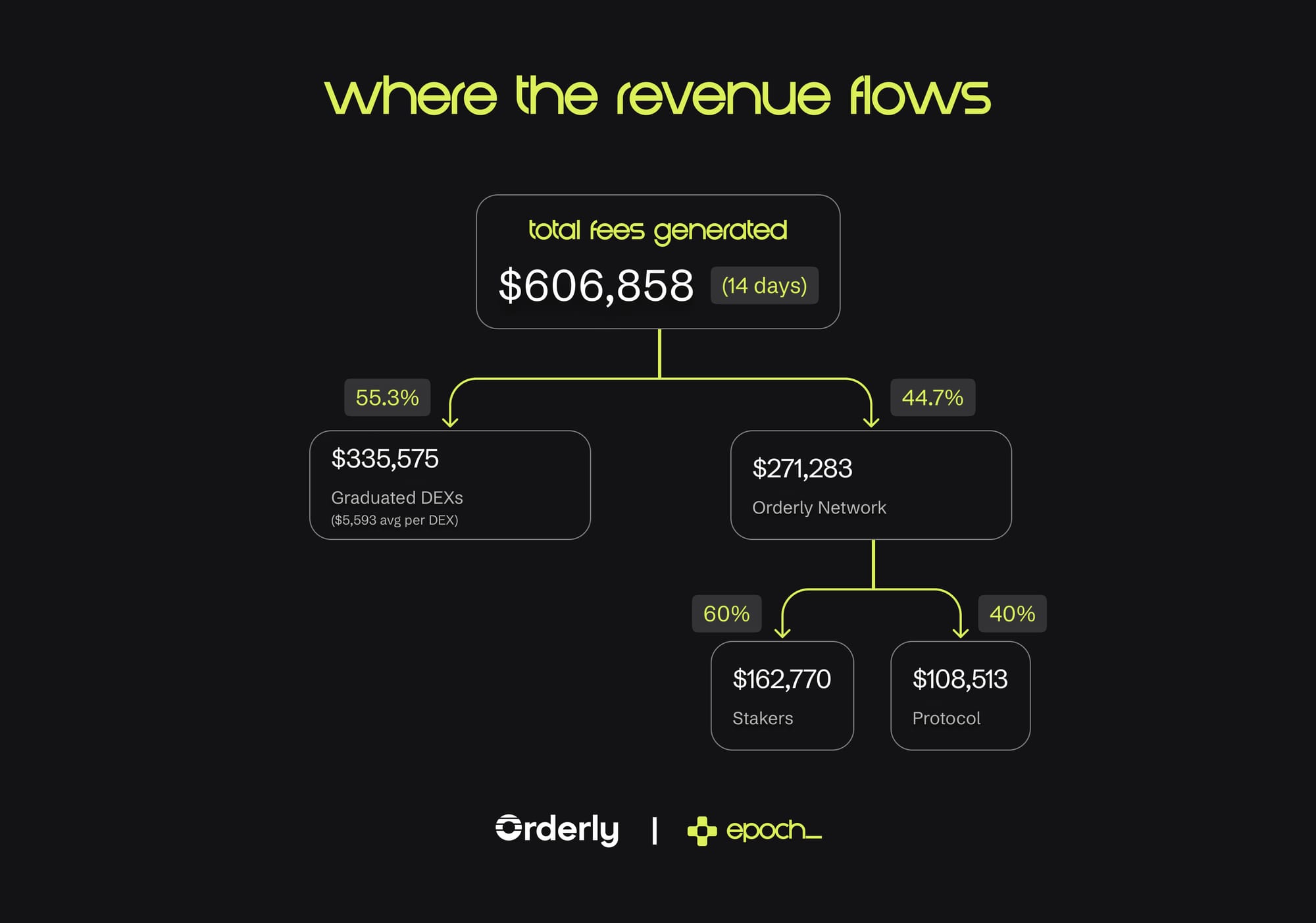

Follow the Money: $606,858 in Two Weeks

The revenue generated in just 14 days reveals how quickly this model creates real value:

The 60 graduated DEXs are averaging $400 in daily revenue, though this varies wildly. Top performers like ADEN generate $10,000+ daily, while smaller DEXs might earn $50-100. For the high-volume DEXs, the $1,000 broker code investment pays back in hours. For others, it's a longer game.

The Korean Factor

ADEN, launched by Korean trading influencer Inbum, processes over $500 million in daily volume. This single DEX generates more volume than most traditional exchanges.

Korea's trading culture found its perfect expression in Orderly One. Inbum's community alone generates $50 billion in monthly volume on centralized exchanges, now that firepower is moving to infrastructure they own.

The 4.8% That Matters

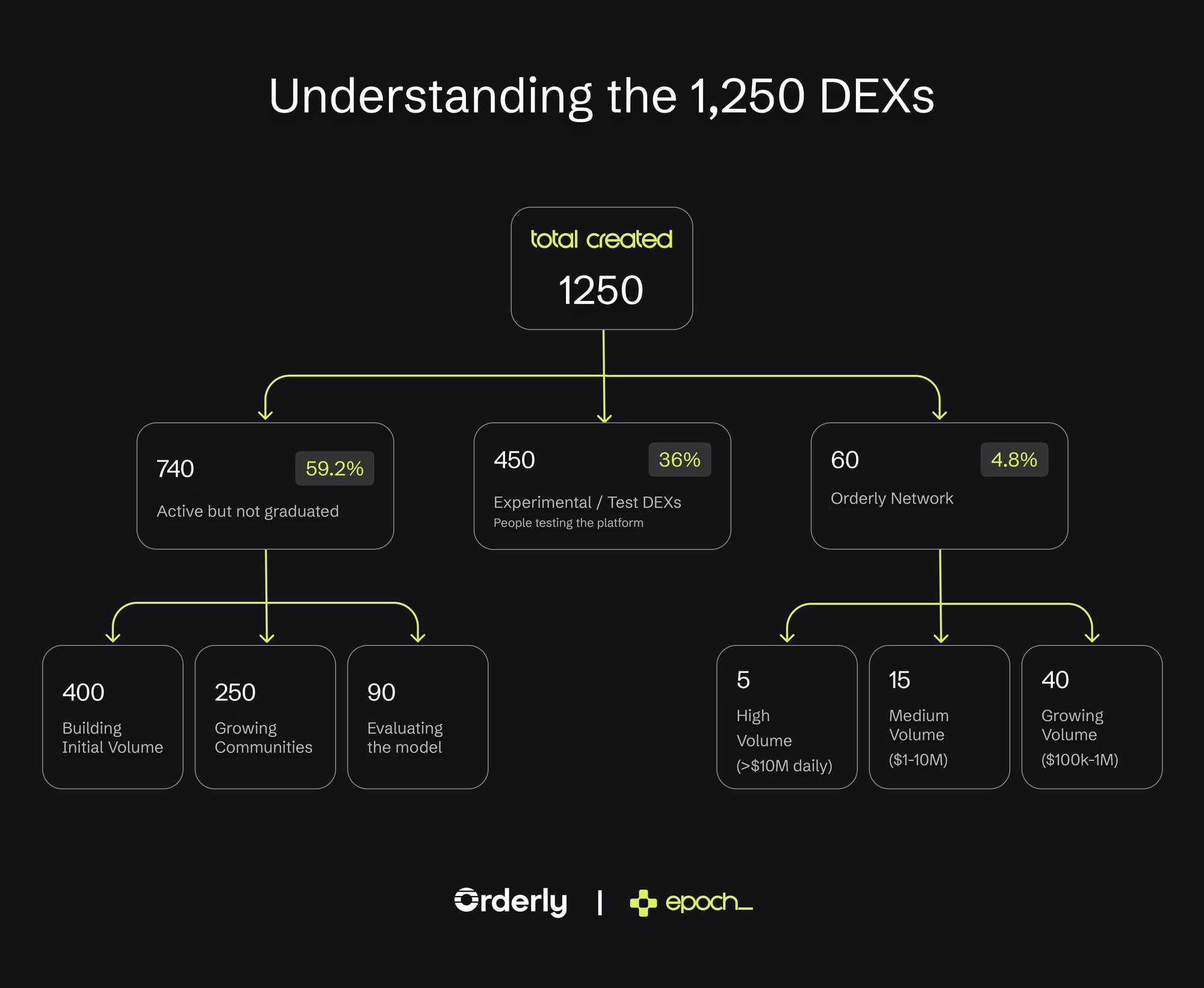

Only 60 of 1,250 DEXs have graduated by paying the $1,000 broker code fee. This low percentage is actually healthy, it filters for serious operators:

Understanding the 1,250 DEXs

The low graduation rate combined with high revenue per graduate creates natural selection. Only DEXs with real communities and volume survive.

The Staking Reward Reality

ORDER stakers received $162,770 in real yield from real fees in just two weeks. This comes from 60% of Orderly's net protocol fees of $271,283 being distributed directly to stakers.

The math is compelling: if 10 million ORDER tokens are staked, that's $0.0163 per ORDER earned in just two weeks, or $0.424 per ORDER annually. A 42.4% APY from fees alone.

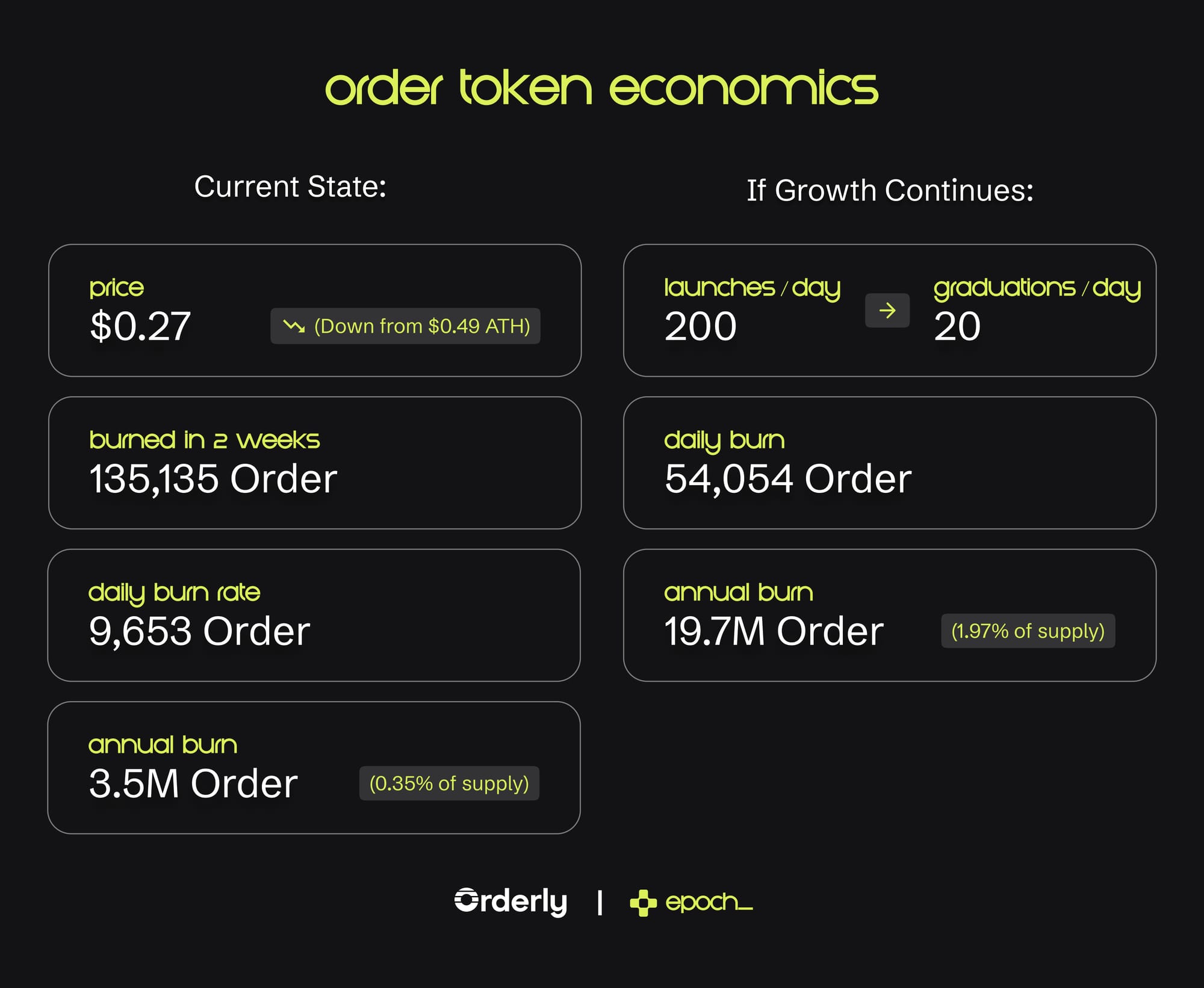

The Deflationary Mechanics

Every graduation burns ORDER tokens, creating constant deflationary pressure:

Currently the $0.27 ORDER price represents a 45% discount from its ATH of $0.49, despite 1,250 DEXs launching and $606k in fees generated and partially due to the crash of last weekend.

What Happens Next

The Ultimate Crypto Championship (UCC) is coming. A gladiatorial trading competition where major influencers will battle against each other on their own Orderly One DEXs. This isn't just entertainment; it's a mass adoption catalyst disguised as content.

50 of crypto's biggest KOLs, each with audiences ranging from 50,000 to 500,000 followers, streaming their trading battles live. Each influencer launches their own DEX, customizes it with their branding, and trades against others while their communities watch and participate. The combined theoretical reach is over 5 million crypto-native users; though realistically, perhaps 500,000 will actually tune in across various streams.

The genius is in the demonstration effect. When a popular trader shows on stream that they're earning $5,000 to $10,000 daily from their DEX fees, not from trading profits, but from owning the infrastructure, their audience does the mental math. Even if just a handful of viewers from each stream decide to launch their own DEX, and only the most active KOLs consistently stream, we're still looking at hundreds of new exchanges sparked by the championship.

The current baseline of 89 DEXs launching daily could realistically spike to 200-300 during peak championship moments, potentially establishing a new normal of 150+ daily launches post-event. Every major DeFi competition from the Curve Wars to the recent Hyperliquid trading competitions has triggered lasting step-changes in adoption. The difference here is that participants aren't just trading; they're becoming exchange owners. The narrative shift from trader to exchange operator is profound and permanent.

The Reality Check

Let's be clear about what's happening:

In 14 days:

- 1,250 communities decided they wanted their own exchange

- $606,858 in fees was generated from essentially nothing

- $335,575 went directly to community operators

- 60 projects committed real money to graduate

- 89 new DEXs launched every single day

Every Discord server is potentially sitting on $5,000-10,000 monthly revenue. Every influencer with 10,000 followers could be running their own Binance. Every meme coin community could offer derivatives on their own token.

The $0.27 $ORDER token price (down 45% from ATH) suggests the market hasn't fully grasped what 1,250 DEXs in 14 days represents. When communities realize they can monetize their user base directly, when the friction to launch drops to zero, when every trading group becomes its own exchange.

We're watching the democratization of financial infrastructure happen in real-time. Not through rhetoric or promises, but through 89 new exchanges launching every single day.

One dex launching every 16 minutes.