Omnipair: a new DeFi primitive

Prediction markets

If you have read our first report in regards to Flipr, you already know that prediction markets are one of the most popular PMFs in crypto in general. These last few weeks, we have seen increased mindshare on prediction markets like Polymarket and Kalshi. It resulted into a big pump of all prediction market coins. Futarchy is a form of financial prediction markets in terms of decision making (governance). We will explain this part, making a bridge to MetaDao and then making the last bridge to Omnipair.

Futarchy

Futarchy is a governance approach that fits the rising popularity of prediction markets. It pairs voting on goals with markets that forecast which policies are most likely to achieve those goals. Economist Robin Hanson introduced this idea because policy debates often mix up values, which are about what we want, with factual expectations about what will work. Even when people agree on the goal, they can disagree about the path to reach it, and voters may not directly or immediately feel the consequences of poor predictions. Futarchy addresses this by first setting goals and indicators through a democratic process, then using a real money market to pool information from many people about which policy is expected to perform best.

In futarchy, a proposal is not put to a yes or no vote; it is traded. The proposal is listed in two prediction markets: one for the world with the policy and one for the world without it. Traders buy and sell small contracts that later pay out based on an independent measurement of the agreed indicator. Each contract’s price, often shown as a percentage or implied probability, reflects the crowd’s expectation. Over a predefined window and with sufficient volume, if the with policy price remains below the without policy price, the system infers a worse expected outcome and the proposal is rejected. If the with policy price is clearly and consistently higher, the proposal is adopted.

As forecasting tools, prediction markets perform well. In U.S. presidential elections, for example, the Iowa Electronic Markets have often produced predictions that track the final results more closely than leading polls, especially as election day approaches. Inside companies, internal markets at Google and HP have also produced more accurate forecasts than standard methods on product demand and project timelines. As a clear example, in the 2004 U.S. presidential race the IEM closing prices closely matched the actual vote shares and outperformed most national polls published in the last week. These results do not guarantee accuracy in every context. Markets can be thin, subject to temporary imbalances or incentives to manipulate, and they can struggle with rare or highly controversial events. Taken together, the evidence suggests that when outcomes are clearly defined, data is trustworthy, and participants can trade with sufficient liquidity, prediction markets provide signals that are useful for decisions, which are the conditions futarchy aims to create.

Participants earn money when their expectations are correct. If you believe the policy improves the indicator, you buy the with policy contract when it is cheap and either sell later at a higher price or hold to settlement to receive the payout.

Futarchy has largely remained theoretical; MetaDAO brings it into practice in crypto.

MetaDAO

MetaDAO writes in their whitepaper that voting does not work: low participation, insufficiently informed voters, and outsized influence from whales and insiders. They argue that people buy with their head but vote with their heart. By applying futarchy they try to reverse this. Decisions are not voted on; they are traded. This gives participants skin in the game: accurate expectations are rewarded, poor ones lose money. It motivates more considered choices and attracts experts who “vote” on what they understand.

Manipulation is usually hard to sustain because a mispriced market immediately creates opportunities for counterparties. If an expert sees that the price in the with policy market or the without policy market is off, they take the other side. If a market is too low, people buy and the price moves up toward a more realistic expectation; if a market is too high, people sell. Because the decision rule looks at the price difference between the two markets, traders can sell the expensive world and buy the cheap one, pulling the spread back into line. With an average price over a fixed window, short pushes carry little weight, and traders who keep making poor decisions are competed out over time.

A DAO on Solana registers a proposal with Autocrat. Autocrat creates two conditional vaults: one with the DAO token META as the underlying and one with USDC. Depositors receive two SPL tokens in return: PASS and FAIL, which have value only in the world with policy or the world without policy, respectively. Autocrat then opens two markets with a simple AMM and a TWAP oracle: PASS-META vs PASS-USDC and FAIL-META vs FAIL-USDC. Traders price both worlds during a decision window. Afterward Autocrat compares the TWAPs. If PASS is at least a configured threshold above FAIL, the proposal is executed, PASS vaults are finalized, and FAIL vaults are reverted; otherwise the reverse happens. The unchosen branch is economically unwound so that positions there return to the starting point. Profit for speculators comes from the difference between their trade price and the eventual value in the world that actually settles.

One of the uses cases of MetaDAO is Omnipair.

Omnipair

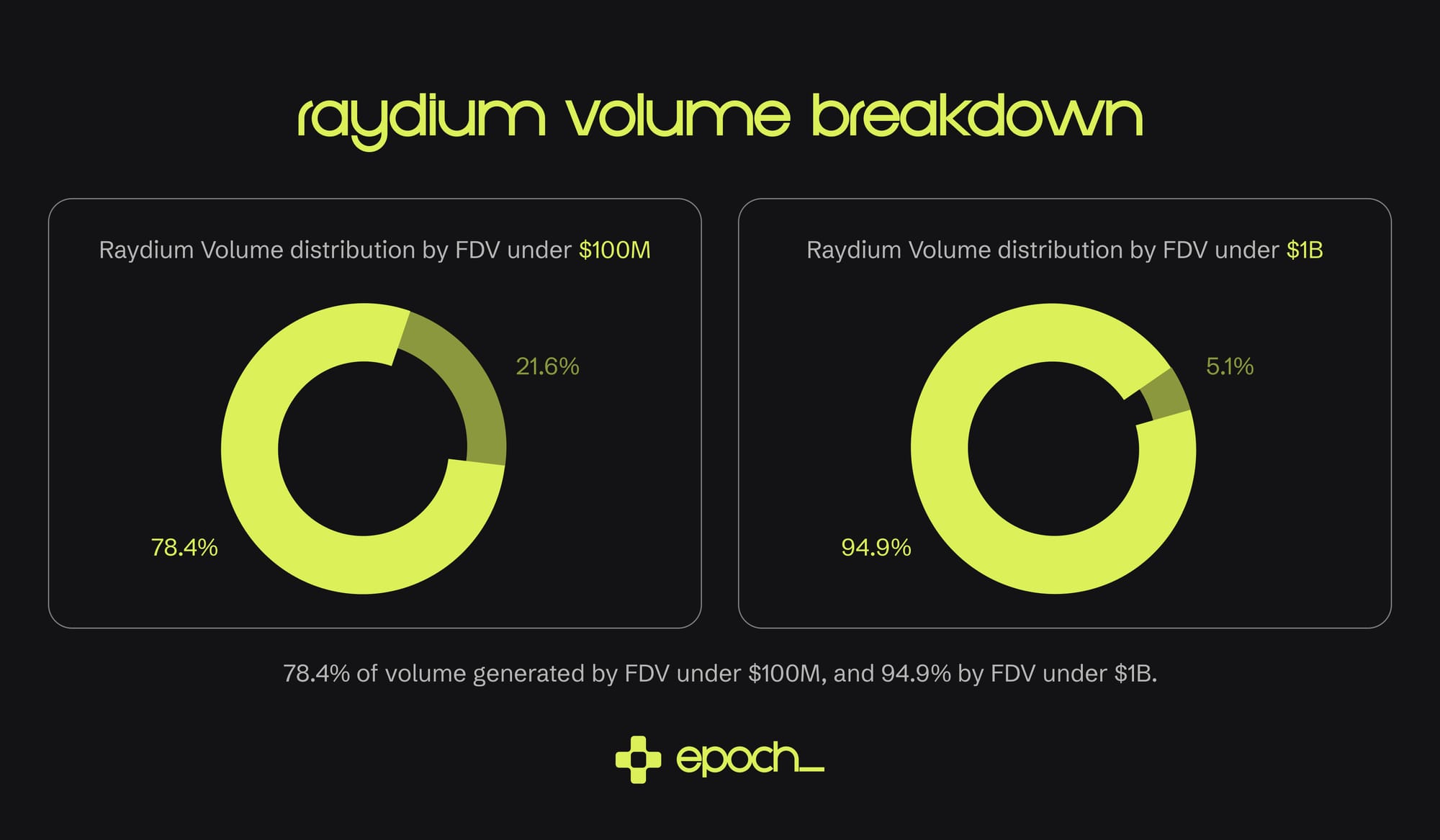

In today’s DeFi landscape, there are clear structural limitations. Even though there's strong demand for long-tail assets, lending and borrowing protocols are still mostly permissioned, making it more difficult for protocols to adopt these assets.

Lending and borrowing protocols also operate separately from AMMs, where tokens are traded on spot markets. Whenever a new token is added to a lending and borrowing protocol, critical risk parameters, such as the loan-to-value (LTV) ratio, must be configured manually. This process is essential: if it is skipped or misconfigured, the protocol risks becoming insolvent.

Another major limitation is their reliance on oracles to determine token prices. Many long-tail or newly launched assets lack reliable oracle integrations. And even when oracles are available, their dependency introduces additional risks, including price manipulation, latency and failure.

Because of these risks, protocols often fall back on governance processes to decide which tokens qualify for the whitelist. Only after this approval can they be borrowed or lent within the system.

Omnipair solves these issues with a Generalized Automated Market Maker (GAMM), a new DeFi primitive that combines a traditional AMM with a lending pool. This makes it possible to use a single pool for both spot trading and lending/borrowing, all without relying on external oracles. In the following sections, we’ll explore how this works in detail.

Generalized Automated Market Maker (GAMM)

Omnipair is a decentralized hyperstructure that runs on a Generalized Automated Market Maker (GAMM), a new DeFi primitive that combines a traditional AMM with a lending pool. This makes it possible to use a single pool for both spot trading and lending/borrowing, all without relying on external oracles.

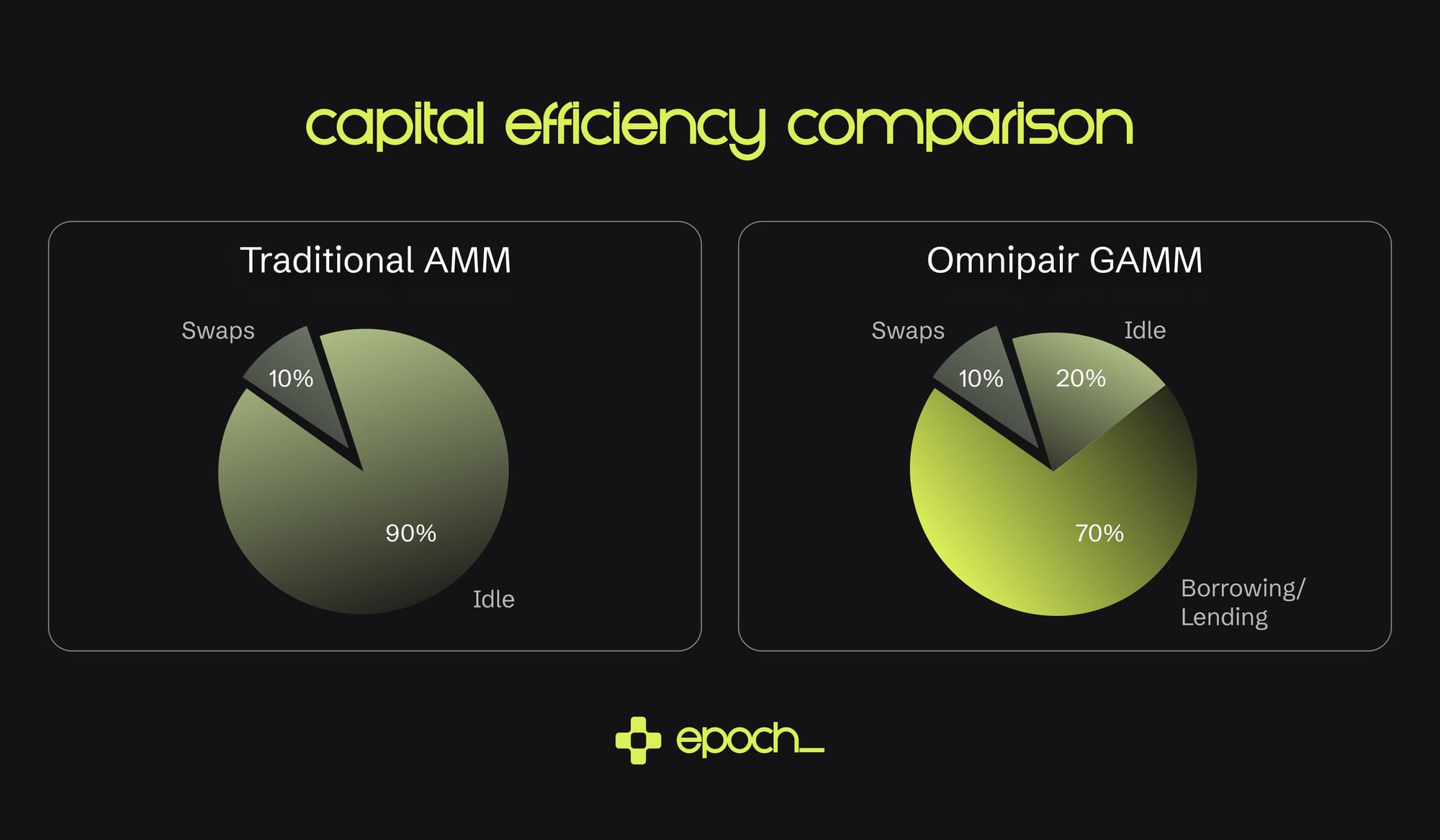

In traditional AMMs, a large share of the liquidity often remains unused whenever trading activity is low. In Omnipair, that same liquidity does not sit still: even if swaps are limited, it can still be applied to borrowing and lending. By combining both functions in a single pool, Omnipair makes liquidity continuously productive, giving LPs more consistent returns on their capital.

Each pool consists of two types of reserves: the virtual reserves and the actual reserves. The spot price is based on the virtual reserve, where the borrowed tokens are excluded in order to prevent the price from moving unfairly when someone takes a loan. The actual reserve represents the number of tokens physically remaining in the pool after loans have been issued.

An alternative price is also calculated based on a time-weighted Exponential Moving Average (EMA). This price is used to determine borrowing power and liquidation thresholds, allowing the system to function oracle-less. This part is important because it concerns a pool where both swaps and the lending/borrowing of long-tail assets take place. By using EMA, volatility is slightly reduced and market manipulation related to liquidations can be prevented.

Slippage-aware Collateral Factor

In traditional lending protocols, a fixed Collateral Factor is applied. This determines how much collateral is required for a loan, creating a built-in safety margin. If the value of the collateral falls below the required threshold (CF), the collateral is liquidated. This percentage remains fixed until governance decides to adjust it, a process that can take days or even weeks before changes take effect. For trading long-tail assets, this system is unsuitable: these products are highly volatile. In addition, the system can be exploited, for example by bypassing slippage through borrowing or by taking advantage of EMA lag.

Omnipair uses a slippage-aware dynamic CF, where borrowing limits are dynamically adjusted based on loan size, pool liquidity, and market conditions. This minimizes risks such as insolvency and market manipulation.

In addition, a pessimistic CF is applied to protect against EMA lag. The downside of using an EMA is that its price lags behind the spot price. While this is useful for highly volatile assets, if the market moves too quickly the collateral may already be undercollateralized before the EMA has updated. This can lead to bad debt.

The pessimistic CF minimizes this risk by lowering borrowing limits whenever there is a gap between the EMA price and the actual spot price. In practice, this means borrowers can only take on debt that would still be safe at the real-time spot price, not just at the slower-moving EMA price. Even during a sharp decline, this ensures that loans remain backed by actual market conditions rather than outdated EMA values.

Debt write-off

Omnipair’s approach to liquidation is different from the standard process when a loan falls below the required collateral level. In traditional markets, positions are liquidated instantly through external liquidators. Such sudden liquidations heavily impact the market, create slippage, and can trigger cascading liquidations; a snowball effect where liquidations feed into further price declines caused by earlier liquidations. In addition, these protocols rely on third parties and external oracles. This is particularly risky in the volatile market of long-tail assets, especially when combined with leverage trading.

Omnipair, however, is not dependent on external oracles but manages liquidations internally. When a loan falls below its liquidation threshold, the debt is immediately written off in the debt accounting pool. Instead of dumping the collateral on the market in one go, it is released back into the pool step by step.

If bad debt does occur, it is fairly distributed among all LPs in the pool, in proportion to their contribution. This prevents bank runs. An LP can exit immediately, but they will already have been assigned their share of the debt, meaning that leaving early provides no advantage. In fact, an LP has the chance of recovery: since the collateral is gradually streamed back into the pool, its value may increase before it has fully returned. Omnipair refers to this mechanism as Socialized Losses.

Liquidity provision

For liquidity providers, Omnipair offers a clear advantage: their capital works on two fronts at the same time. In traditional DeFi you usually have to choose between an AMM, where you earn swap fees, or a money market, where you collect interest from lending. In Omnipair, both functions are combined in a single pool. Whether trading volume is high or borrowing demand is stronger, the liquidity you provide is always put to work.

When an LP decides to withdraw, they receive their share of the pool back in both tokens. At that point, the system checks whether the pool remains healthy. If a large portion of the tokens is currently borrowed, it may happen that not all liquidity can be released immediately. In that case, part of the position remains temporarily tied up until borrowers repay their loans.

Use cases

It is possible for users to build a leveraged position through recursive borrowing. On traditional exchanges this is not possible, and while some DeFi protocols like Aave or Compound support recursive borrowing, they rely on external AMMs for swaps and on oracles for pricing. Omnipair combines trading and lending within the same pool and allows users to build leverage in a permissionless and oracle-less way, even on long-tail assets.

To do this, the user goes through a series of steps. First, token0 is deposited as collateral, after which token1 is borrowed. That token1 can then be swapped back into token0 within the same pool, allowing the cycle to start again from the beginning. By repeating this process multiple times, the user creates recursive (capped) leverage.

For liquidity providers, Omnipair offers a clear advantage: their capital works on two fronts at the same time. In traditional DeFi you usually have to choose between an AMM, where you earn swap fees, or a money market, where you collect interest from lending. In Omnipair, both functions are combined in a single pool. Whether trading volume is high or borrowing demand is stronger, the liquidity you provide is always put to work. When an LP decides to withdraw, they receive their share of the pool back in both tokens. At that point, the system checks whether the pool remains healthy. If a large portion of the tokens is currently borrowed, it may happen that not all liquidity can be released immediately. In that case, part of the position remains temporarily tied up until borrowers repay their loans.

Benefits

Omnipair offers LPs clear advantages compared to traditional AMMs and lending protocols. Because swaps and borrowing/lending take place within a single pool, capital is always used efficiently. Even when swap volume is temporarily low, liquidity remains productive through the loans that are issued.

Another benefit is that LPs earn two streams of income in one place. On the one hand they receive swap fees, and on the other they collect interest on outstanding loans.

LPs are also better protected during liquidations. Thanks to the debt write-off mechanism, positions are not sold off at once but instead flow back gradually into the pool. This reduces sudden market movements and lowers the risk of cascade liquidations. If bad debt does occur, it is absorbed through socialized losses, where each LP contributes pro-rata. Since this process takes place step by step, there is also the chance that collateral regains value before it is fully returned to the pool, which can help limit losses.

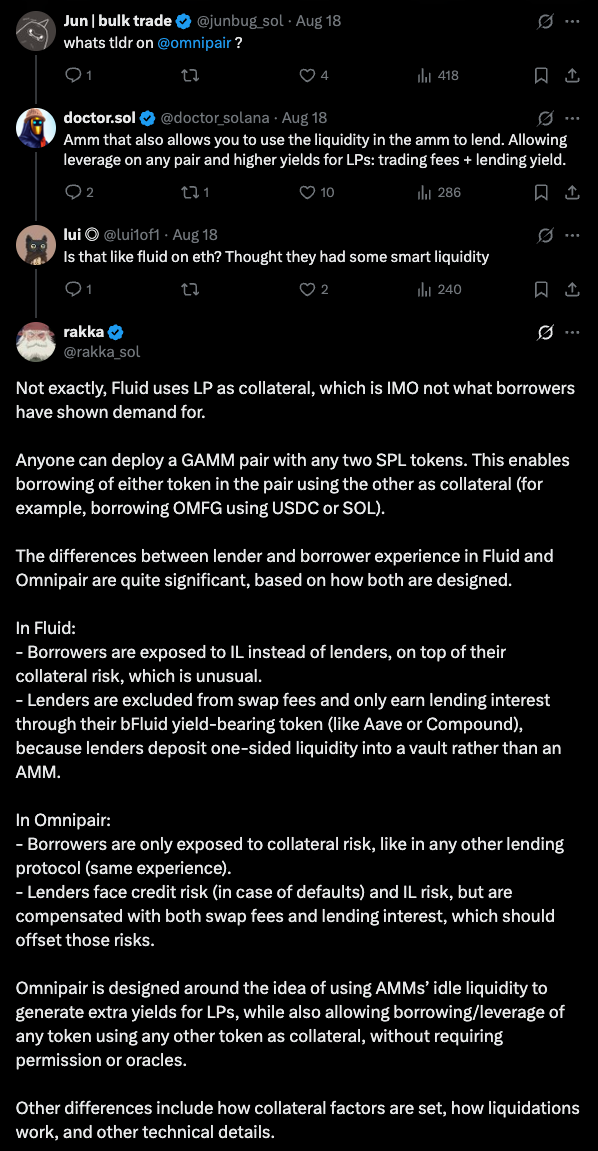

Omnipair vs Competition (Fluid)

As both Omnipair and Fluid leverage lending with AMM, it makes sense to compare both projects on a technical level but also on the marketcap. There has been confussion on the two projects and Rakka, the founder of Omnipair, covered that part on X.

All in all, we believe that $OMFG (not the best ticker?) has the potential to be a big new DeFi primitive. Sitting below 10m mcap, it's one of the dark horses we had to cover on Epoch.

Enjoy your weekend.