Lighter: Fast Orderbooks with Cryptographic Receipts

A perpetual futures DEX where fairness isn't claimed but proven

Currently in beta on Ethereum testnet

Trade on any perp DEX today and you're making a leap of faith. Did your order match at the right price? Was your liquidation actually necessary? You'll never really know. The matching happens in a black box, and all you get back is a result.

Lighter breaks this model entirely. Every single action generates a cryptographic proof. Not a log entry. Not a promise. A zero-knowledge proof that the exchange followed its own rules, verifiable by anyone. This isn't just another DEX with better marketing. It's a fundamental reimagining of how orderbooks should work.

How Mathematical Certainty Replaces Trust

The magic happens through zero knowledge proofs, but the concept is simpler than it sounds. Lighter runs as a specialized rollup built for one purpose: perpetual futures trading with provable fairness.

When you place an order, it flows through a sequencer into a matching engine that operates on strict price time priority. So far, nothing revolutionary. But here's where everything changes: a prover component generates mathematical proof that every single trade followed the rules exactly. This proof gets verified on Ethereum before any balance updates become final.

Think about what this means. If the matching engine tried to skip someone in line, favor a particular trader, or execute at the wrong price, the proof generation would fail. The entire block would be rejected. The system literally cannot cheat because cheating would break the mathematics. It's not about trusting good behavior anymore. It's about making bad behavior impossible.

The Mark Price Problem and Its Solution

Most liquidation horror stories start the same way. A synthetic wick appears out of nowhere, positions get liquidated in milliseconds, then price returns to normal as if nothing happened. Traders lose everything while someone, somewhere, profits from their pain.

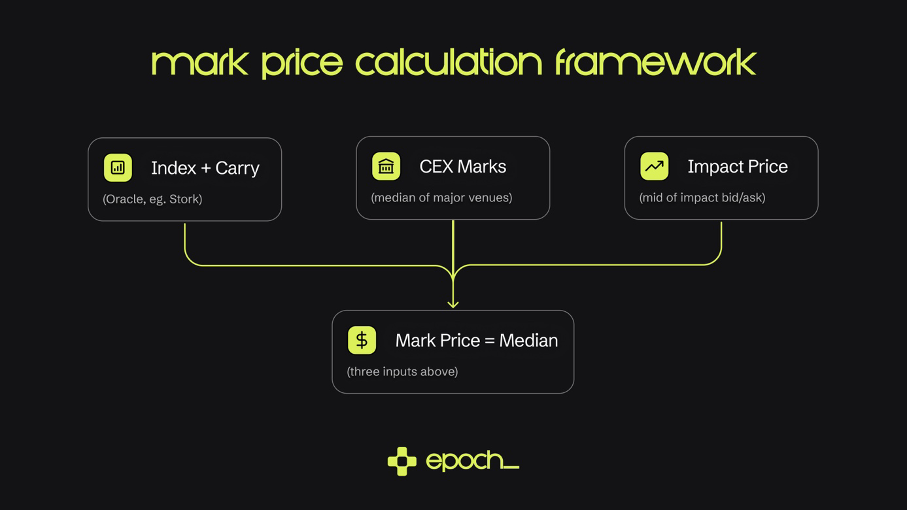

Lighter makes this manipulation mathematically impossible through redundancy. The mark price, that critical number that determines whether you keep trading or get liquidated, comes from three completely independent sources:

First, there's the oracle index price multiplied by one plus the last funding rate times the remaining funding period ratio. This gives a baseline tied to real spot markets.

Second, the system takes the median of mark prices from major centralized exchanges like Binance and OKX. This ensures alignment with where most volume actually trades.

Third, it calculates an impact price from Lighter's own orderbook, specifically what you'd pay to trade 500 USDC divided by the initial margin fraction. For a 10% margin market, that's $5,000 of actual orderbook depth.

The final mark price is the median of these three values. To manipulate it, you'd need to compromise at least two independent data sources simultaneously. Stork provides the oracle infrastructure, adding another layer of professional grade reliability. Single source manipulation becomes pointless, and traders finally get a mark price they can trust.

Funding That Actually Makes Sense

Perpetual futures need a mechanism to stay anchored to spot prices. Without it, perps would drift away from the underlying asset like untethered balloons. Lighter handles this through transparent funding payments that flow directly between traders.

The system works elegantly. Each minute, at a random moment, it snapshots the premium between perp and index prices using the actual impact bid and ask from the orderbook. After sixty samples across the hour, it computes the time weighted average. This average gets an interest rate component added, then divided by eight to match the standard eight hour funding periods traders expect. The final rate is clamped between negative 0.5% and positive 0.5% per hour to prevent extreme moves.

When funding is positive, longs pay shorts. When negative, shorts pay longs. The protocol takes nothing. Every satoshi flows peer to peer, creating natural balance between buyers and sellers.

Liquidations That Protect Rather Than Punish

Traditional liquidation engines are predatory by design. They wait for the moment of maximum pain, then execute at the worst possible prices. Lighter flips this model completely.

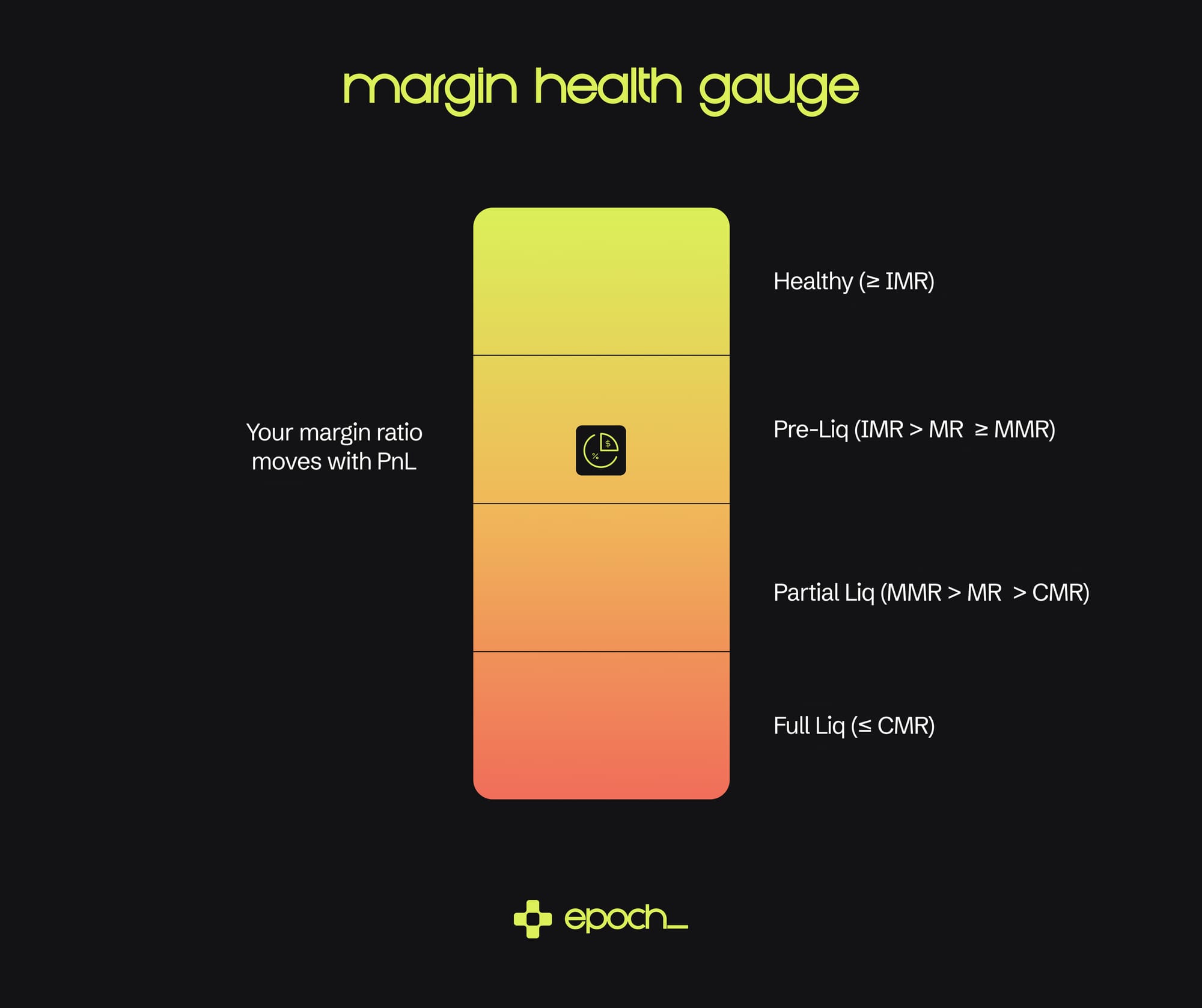

The system follows a waterfall approach designed to minimize damage while maintaining solvency. When your account is healthy and above initial margin requirements, you trade normally with full access to every feature. As margin decreases, the response escalates gradually.

First comes the pre liquidation zone between initial and maintenance margin. Here you can only reduce positions, preventing you from digging a deeper hole while giving you time to add collateral or close trades at your own prices.

Drop below maintenance margin and partial liquidation begins. The system cancels all open orders, then sends immediate or cancel orders at a carefully calculated "zero price" for the full position amount. This zero price is mathematically derived to ensure that any execution can only improve your health ratio, never worsen it. If you get filled at better prices than the zero price, up to 1% flows to the LLP Insurance Fund to protect the system.

Only when an account falls below the close out margin does full liquidation occur. The LLP Insurance Fund takes over the position entirely. Even in extreme scenarios where auto deleveraging must occur, counterparties get reduced at their own zero prices, preventing cascade failures that plague other platforms.

Account Architecture Built for Real Trading

Professional traders need professional tools. Each wallet can spawn multiple sub accounts for strategy isolation. Each sub account supports up to 256 API keys, enough for serious algorithmic trading operations that need different permission levels and rate limits.

For social traders who prefer to follow proven strategies, Public Pools enable copy trading with enforced operator stakes. Pool managers must maintain minimum ownership percentages, ensuring their interests align with their followers. No more traders going all in with other people's money while keeping their own capital safe.

Safety mechanisms run continuously in the background. Fat finger protection rejects obviously erroneous prices before they can cause damage. Self trade prevention cancels your resting orders if you would cross yourself, preventing wash trading. Currently, maker and taker fees are both zero, an unusual but real incentive while the platform builds liquidity.

The Nuclear Option That Keeps Everyone Honest

What happens if the sequencer goes rogue? What if it starts censoring transactions or breaking its own rules? Lighter has an answer: the Exit Hatch.

This mechanism works like a dead man's switch for the entire protocol. If the sequencer fails to include priority transactions or violates pre commitments it has made, users can trigger Exit Hatch mode. The rollup immediately freezes. No more blocks, no more trades, no more risk. Users can then withdraw directly through smart contracts using Merkle proofs of their positions and balances.

The Exit Hatch should never activate. Its mere existence keeps the sequencer honest, knowing that misbehavior means instant death for the protocol. It's mutually assured destruction that ensures mutual good behavior.

This connects to how Lighter achieves instant finality. The sequencer signs and publishes transaction data to a public feed before committing blocks on chain. If any discrepancy appears between what was promised and what was delivered, users have cryptographic proof of the violation. One trigger, and everything stops. This creates true accountability for every single transaction.

Security Through Radical Transparency

zkSecurity has reviewed Lighter's custom circuits for verifiable matching and their audit is fully public. Every formula from funding rates to liquidation prices is documented in the whitepaper. The protocol doesn't just claim to be fair while hiding behind proprietary algorithms. It proves fairness with every block through open-source code and public mathematics.

The platform remains in beta testing on Ethereum's testnet with security audits published progressively as development continues.

Why This Changes Everything

Orderbook exchanges have always forced an impossible choice. Centralized venues offer speed and liquidity but require absolute trust in their operators. On chain alternatives provide transparency but suffer from frontrunning and crushing latency that makes real trading impossible.

Lighter demonstrates a third path that seemed impossible until now. It maintains traditional exchange performance with sub five millisecond execution while generating cryptographic proofs of fairness for every action. Deep liquidity without custodial risk. Professional features without black box operations. The speed traders need with the transparency they deserve.

If this model proves stable under real volume, and early testing suggests it will, derivatives trading changes fundamentally. Fair and transparent stops being marketing copy and becomes mathematically provable fact. Trust transforms from a requirement into an obsolete concept. The exchange cannot cheat because the math won't let it.