Keeta: A Fintech L1 Backed by Ex-Google CEO

You might have heard some quiet whispers about Keeta. It stealth-launched during the peak of the bear market over the past two months. After doing some due diligence, I believe this project has serious potential to reach a multi-billion dollar market cap. This isn’t your typical CT play where VC cabals rotate the same coins. Most importantly, Keeta has cultivated a surprisingly cultish community—and I see that as one of its biggest strengths. Despite the negative sentiment around L1 launches this cycle, this project had a fair launch. That matters. It made on-chain traders feel like they were actually early for once—because they were. And the only way you build a cultish following is by giving a meaningful chunk of the project to early believers. Always has been.

We’re looking at one of the pioneers in the DAG architecture comeback. And most intriguingly: a potential SWIFT killer.

Keeta is a Layer 1 focused on fintech. Think of it like XRP’s original vision of helping banks—but broader. Keeta aims to support fintech apps with 10 million TPS and native KYC/AML functionality, native tokenization and atomic swaps built-in.

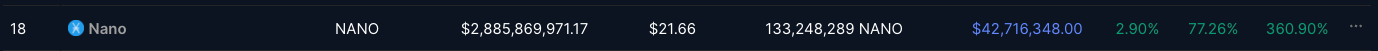

Most of the team members are OGs, going back to the Raiblocks/Nano days—massive projects back in 2017. DAG tech was revolutionary back then, leading to huge valuations in that niche (IOTA was another multibillion-dollar protocol).

What I haven’t seen many people talking about yet is the renewed momentum around DAG tech this cycle. Back in the day, people were skeptical of DAGs—they were seen as too centralized for the cyberpunk mindset. I still remember how people dragged Solana before its run-up, calling it "too centralized." Now that the Ethereum community has been humbled, and the idea of decentralizing everything including your mom has cooled off, devs are starting to re-evaluate DAGs. Why? Because the throughput is insane.

SUI, for example, incorporated DAG elements (see my early SUI thesis around the Mysticeti upgrade: link) to massively scale TPS and compete with Solana. Keeta takes a similar approach, using a DAG-based architecture with custom elements to scale horizontally and integrate with Web2 companies. If you're interested in the technical details of Keeta's DAG setup, check out this report: link.

What sets Keeta apart is its on-chain KYC/AML system—something specifically built for financial institutions. Combine that with its DAG infrastructure and fintech focus, and Keeta starts to look like a serious powerhouse. It has multiple USPs native KYC/AML native tokenization for RWAs and atomic swaps. Multiple innovations packaged in one token. Essentially, we’re talking about a protocol aiming to rival SWIFT—the global standard for interbank transfers.

Keeta is 153x faster than Solana. This matters a lot as Solana crashed during Trump/Melania launch. It's partially why I'm bullish on SUI on the long term but especially Keeta now. There are several players that will take some shares of the high TPS ecosystem and Keeta has good papers for that.

At first glance, it’s fair to be skeptical of such bold ambitions. But Eric Schmidt (ex-CEO of Google) clearly wasn't—he invested $17 million into Keeta, making it his first and biggest angel crypto investment ever. He’s also known for advising Chainlink (a multibillion-dollar token), so seeing him back a stealth-mode L1 project trading at $150 million market cap is no small thing. And he didn’t just invest—he lead the round.

The token has climbed from under $0.01 to $0.30, mostly driven by smart money. Still, it’s trading at $148 million market cap at time of writing, while XRP (fintech L1) sits at $250 billion and SUI (DAG-based L1) at $40 billion. Sure, those comparisons are a bit exaggerated—XRP is a legacy coin with mainstream exposure, and SUI benefited from branding/network effects from Facebook’s ex-Libra project. Also, most L1s this cycle have had shady token launches overloaded with VC allocations.

Keeta is different—it launched in stealth, with most private funding coming directly from Eric Schmidt. There were no massive insider allocations. If you want exposure, you’ve got to buy it on the open market—exactly what market participants want to see this cycle.

I grabbed a bag at $50 million market cap and I don’t plan to sell anytime soon. Some catalysts I’m keeping an eye on:

- Q3: Mainnet launch + 7 major partnerships to be announced

- DEX launch

- Major stablecoin partnership

- Q4: KeetaPay + debit card rollout