ICM: the next Solana Narrative

Internet Capital Markets

This new term is increasingly being associated with figures like Kyle Samani (Multicoin Capital) and the Believe app (Launchcoin). Initially, Launchcoin was the first token to capitalize on the ICM narrative: it went from below $1 million to nearly $400 million in market cap within just 1–2 weeks.

After the initial hype settled, it became clear that the ICM narrative was here to stay.

Kyle Samani has been bullposting about this new phenomenon relentlessly over the past few weeks. The Solana Foundation is doubling down on it as well. It seems the Solana cabal is tired of being overly associated with being the de facto memecoin chain: they’re now putting resources toward utility and financial innovation. The latter is especially important, as it's what previously drove Ethereum to new highs.

ICOs, DeFi, NFTs: these were all financial innovations people speculated on.

The ICO era, in particular, is highly relevant here. Ethereum essentially introduced a revolutionary, more democratized way of engaging with financial market concepts. ICOs allowed the average person to invest early in projects, whereas IPOs (the traditional equivalent in TradFi) were reserved for accredited investors and heavily gatekept.

Long story short: Ethereum used to be the hub for financial innovation, bringing traditional finance concepts on-chain and democratizing them.

Unfortunately, in this cycle, we haven’t seen any meaningful new financial innovation: especially on Ethereum. It seems the Solana cabal is aware of this and wants to claim that title. They are positioning Solana to become the leading chain for financial innovation. This is why they're doubling down on Internet Capital Markets.

Today, we're diving into ICM.RUN ($ICM)

Currently trading at a $14 million market cap at the time of writing, we’re covering what may be the strongest bet on the ICM narrative outside of Believe (Launchcoin).

What is Internet Capital Markets?

For those who’ve been in the space for a while, 2017 was a turning point. It was the first time everyday people had the opportunity to invest in seed rounds. The so-called ICO era was revolutionary because, before that, the average person couldn’t participate in early-stage funding rounds. Access was restricted by KYC-gated processes and high net worth requirements.

This shift led to a massive influx of capital. Projects conducting ICOs suddenly had access to global liquidity, and most of them aimed to raise as much money as possible. As with any gold rush, it created a bubble, just like the Dotcom bubble. Most ICOs failed, but a small number survived, gained traction, and are now worth billions. 99% didn’t make it.

Eventually, regulations caught up. ICOs became heavily scrutinized and largely non-permissible under traditional securities law frameworks.

Enter Internet Capital Markets (ICMs)

Internet Capital Markets aim to be ICO 2.0, but this time, done legally, transparently, and with the benefit of hindsight.

The democratization of capital remains one of the most important goals in finance. ICMs seek to replicate and improve traditional finance (TradFi) using blockchain technology, especially around fundraising and capital formation.

ICOs weren’t inherently bad; they just lacked legal structure, which led to regulatory backlash. ICMs aim to solve that.

Solana’s Bet on ICMs

Solana appears to be doubling down on bringing this concept back, this time with proper infrastructure and legal framing.

In January 2025, Kyle Samani (Multicoin Capital) published a thesis outlining how Solana could become the new hub for startups to fundraise, without the friction of traditional methods like IPOs. He paints a vision of a decentralized NASDAQ but built on Solana, not Ethereum.

ICOs → DeFi → NFTs → Internet Capital Markets.

And this time, the innovation isn’t happening on Ethereum: it’s happening on Solana.

Believe app

After the crypto market nuke in April, the ICM meta was born. Believe, an app made by Ben Pasternak, gained a lot of traction: it emerged as the dominant force of this meta, pumping the native platform token ($LAUNCHCOIN) to almost $400 million in market cap.

It was a new way of raising funds for your startup idea: a dev could tweet a ticker + name, and the token would be immediately created. By using social media, you could raise awareness for your plans, and people could buy into the idea. The execution usually follows later.

The Believe app ensured that liquidity was locked (no rugs), and a percentage of the fees in the pool would go to the creator (instead of allocating an X amount of tokens pre-TGE). At its peak, the app generated $6.4 million in fees, which were split between the app itself and the creators. It aligned the app, the creators, and the token with the ecosystem.

Despite the initial explosion of Believe, and Launchcoin in particular, the hype faded quickly. Most of the projects launched weren’t that revolutionary or lacked a proper team to execute the idea (marketing, etc.). Just like with ICOs, filtering the legit projects from the vapor is extremely difficult.

Enter ICM.RUN: the leading launchpad for ICM projects

Alliance DAO might be a name you're familiar with if you've been in the Solana trenches. They are one of the most successful accelerators for on-chain projects. Big names like Xverse (Bitcoin wallet), Caldera (L1), Stride (liquid staking), etc., are all under the same umbrella of Alliance DAO. A lot of the trenchers are buying into projects when they know they're backed by Alliance DAO for this reason. Polycule was another recent example: it went from $2 million to $60 million in market cap.

There is one other project that is incubating projects in ICM with a tradeable token:

ICM.RUN ($ICM)

$ICM is the only incubation platform focussed on incubating Internet Capital Market projects as a DAO

The difference between incubation and acceleration is:

- Accelerators help projects that already have a product or testnet ready, pushing them faster to market.

- Incubators focus on helping founders go from idea to real company. Mentorship is key here.

The reason incubation is so important for ICM is because we've already seen with Believe how hard projects can fall, from initial hype to practically zero, when there's no proper guidance on how to build a real company. 99% of projects failed, which mirrors what happened during the ICO era.

This is where ICM.RUN comes in:

- ICM.RUN has a team of mentors that will go through applications from ICM founders

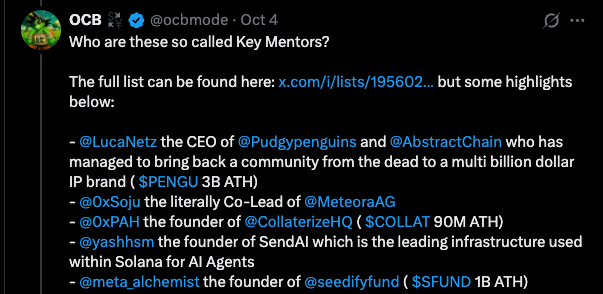

- The mentors in ICM.RUN involved are huge names like Luca Netz (Pudgy Penguins) , Meteora Team, Seedifyfund etc.

- Once accepted by the mentors, 1-5% of the supply goes to the ICM.RUN dao, the same way happens with Alliance DAO

- The mentors are key in the process: they will help guide the ICM founders towards making their project flourish

Looking at the names of the mentors, you can clearly see there are some huge names that managed to grow their own project to multi billions. Luca Netz is an advisor on top of that for ICM.RUN.

Based on the tweet above, more than 100 applications have applied to join ICM.RUN. A recent project that joined the program is 0gprotocol by Justin Waldron, founder of Zynga: the company behind Farmville and more (worth 12 billion+).

Tokenomics

DAO Launch

- Platform: Launched on DAOs.fund

- Raise Size: 420 stall raise

- Seats:

- 20 Mentor Seats (higher allocation)

- 100 Contributor Seats

- Mentors receive a higher share of allocation compared to contributors.

- Funds raised are divided as follows:

- Liquidity: A portion of the raise is placed into liquidity for the token launch.

- Treasury (AUM): The remainder is placed into the DAO treasury.

- Once the raise is complete, a liquid DAO token goes live on DEX.

- Publicly tradable asset with an initial FDV of ~$74,000 market cap.

Conclusion

By combining Solanas ecosystem, strong mentorship, and DAO-aligned incentives:

ICM.RUN is positioned as the leading launchpad for ICM projects.

A lot of projects on Solana reached multi billions in mcap because of the incentive of the Solana cabal. Projects like Believe, Pumpdotfun etc. all are ICM projects in some way or another. Alliance DAO had massive success as it earned a lot with getting a cut of the % of projects joining their program.

ICM.RUN could be the next play to capitalise on the ICM narrative.

Another interesting argument is that historically speaking, after a blackswan event like we witnessed 2 days ago, new narratives emerge. This process starts onchain. The Covid crash is a good example. In march 2020, the whole market nuked. DeFi was a concept that started before the covid crash but didn't attract much capital from retail. There were just a few project focussing on DeFi (Makerdao/Aave) but there wasn't a way to make money on the new paradigm itself. It was until after the covid crash, specifically 2/3 months after the crash, that DeFi summer started with a mania of retail flooding the food farm ponzis. If history repeats itself, a new paradigm could emerge of which onchain people will have a new narrative to bet on. Internet Capital Markets has one of the best papers to be that (if it happens).

There are not many ways to bet on it as it's too early. Launchcoin could revive again after a bottomed chart. ICM.RUN seems to be a safe bet as it's an index play on ICM projects. Token holders of $ICM receive a % of the projects incubated.

At 14m mcap at time of writing, we think it's worth covering $ICM at Epoch. If you are bullish on Internet Capital Markets, $ICM might be a worthy bet. Launchcoin found a bottom after an understable 70%+ correction. Both are considered ICM bets on Solana. Though $ICM has a higher ceiling because of the marketcap.

All in all: at Epoch, we don't believe ICMs are dead. It will come back and positioning yourselves before the crowd does is exactly why we made Epoch in the first place.

Goodluck.

Disclaimer: This article is for informational and research purposes only. It does not constitute financial, investment, or trading advice. Always do your own research (DYOR) and consult with a qualified financial advisor before making any investment decisions.