Fluid: The unspoken DeFi Renaissance coin

This is going be a relatively short one, wrote it today in the back of the taxi after doing DD last week. If you aren't familiar with Fluid: this most likely will be the easiest way to digest why smart money has been talking about it these last 2 months (and accumulating). Enjoy reading.

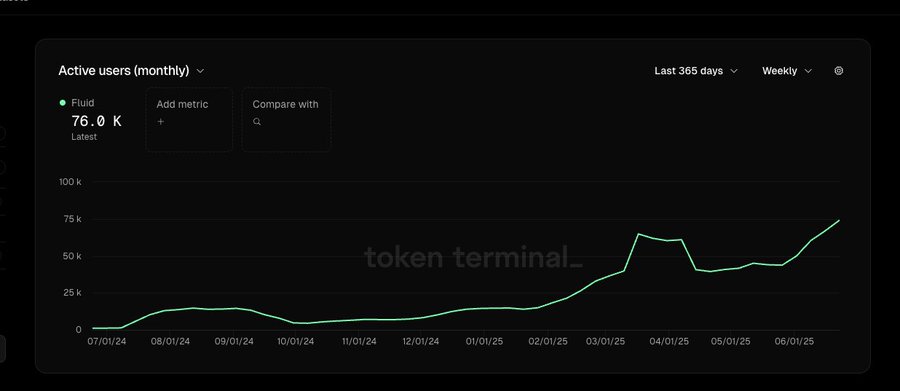

$FLUID is currently one of the most underrated protocols in the DeFi space. Uniquely positioned, it is aiming to capture market share from both Uniswap and Aave simultaneously. Since the beginning of 2025, Fluid has expanded its DEX market share from 3% to 20%, indicating a robust growth trajectory. Notably, it surpassed $40 billion in cumulative trading volume within just 199 days, marking the second-fastest growth in DeFi DEX history, trailing only the rapid rise of Sushiswap following its vampire attack.

Launched on Arbitrum approximately six months ago, Fluid has already secured the largest market share in stablecoin swaps on the network. Achieving such growth outside Ethereum demonstrates its strong potential to expand across multiple chains. Last month, Fluid announced its upcoming expansion to Solana in collaboration with Jupiter. Given Fluid’s rapid market share acquisition on Ethereum mainnet and its leading position on Arbitrum, it appears well-positioned for similarly explosive growth on Solana, currently the second-largest blockchain by activity in crypto.

Jupiter, a key player in the Solana DEX ecosystem, is working to become the leading DeFi superapp, expanding beyond simple token swaps. Through its integration with Fluid and by leveraging Fluid’s liquidity layer, Jupiter is strategically aligning to fulfill this vision.

A noteworthy trend is that Fluid has gained the most market share in “conservative” pools, specifically stablecoins and wrapped Bitcoin (wBTC). In fact, Fluid now handles 50% of all wrapped Bitcoin volume on Ethereum. Fundamentally, this DeFi cycle has been driven by demand for Bitcoin and stablecoins, especially from institutions. Fluid has been a central beneficiary of this trend, according to volume and user data.

How It Works

Lending and borrowing protocols have seen a significant resurgence, especially those offering innovative solutions. Fluid introduces novel mechanisms called Smart Collateral and Smart Debt. Like other platforms, borrowers must provide collateral to take out stablecoin loans and pay interest on those positions. However, Fluid allows users to deploy their collateral into LP (liquidity provider) positions that earn trading fees. These trading fees are then used to reduce the borrower’s interest payments, making borrowing on Fluid more cost-effective than on most competing protocols. This innovation is a key driver of the protocol’s recent surge in adoption.

Tokenomics

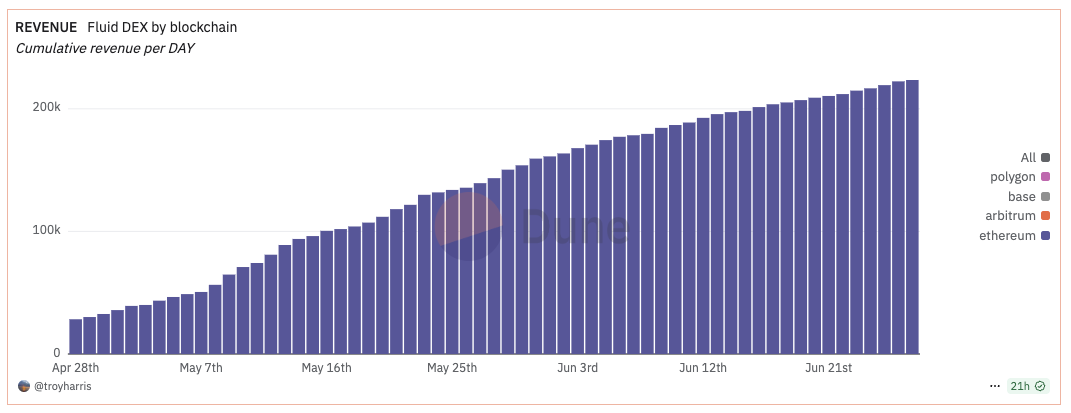

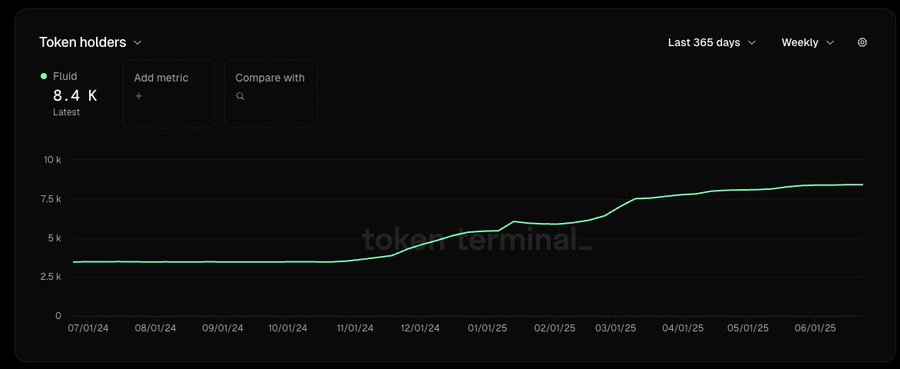

Fluid plans to initiate a token buyback program once protocol revenue reaches $10 million. As of now, revenue stands at $7.7 million. If current growth continues, especially with the upcoming Solana launch and Jupiter collaboration, the revenue target is likely to be met soon. Additionally, 99% of the token supply is already unlocked, with the remaining tokens set to unlock by the end of June (i.e., now).

Own views

With a current marketcap of sub $100 million (and a fully diluted valuation of $368 million), and with no further token inflation from early investors, the team, or advisors since 2021, Fluid presents a compelling investment opportunity. It belongs in the same category as protocols like Pendle, Syrup, LQTY, and Euler, yet it remains under the radar. They have been working on this project since 2018 and have shown to be innovative and here to stay. Yet, because it's considered an 'old' coin, it's heavily underlooked. The rebranding started in end of december 2024 (instadapp -> Fluid) which was kind of similar to what Maple Finance had undergone.

I’ve started accumulating a position at current prices, awaiting a breakout. The fundamentals are strong, and the chart appears to be bottomed—offering an attractive risk/reward setup in my view.

My major catalyst to look out for is the expansion of towards Solana (Jupiter collab) + Fluid DEX v2, both next month (july). Both should be extremely good for the metrics which already has seen explosive growth.