Flipr: The Social Layer for Prediction Markets

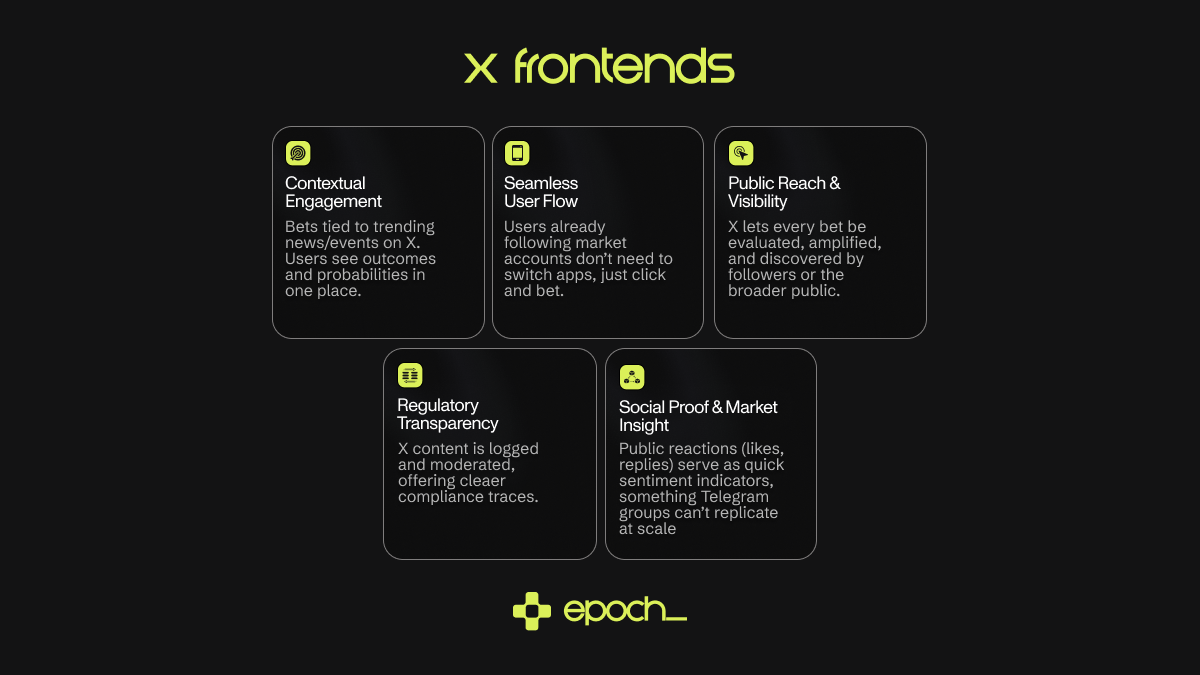

Prediction markets are gaining attention, but most platforms remain difficult to access and removed from everyday internet use. Flipr takes a different approach. It lets users place trades directly on X, turning each bet into content that’s easy to share, engage with, and counter.

By making trades public by default, Flipr turns market participation into a social experience. Visibility becomes a key feature. Users don’t just make predictions, they show them, and others join in.

This design creates a strong feedback loop. A user places a bet. That bet appears on the timeline. Others copy it, counter it, or quote it. This brings in more users and more trades, which drives more fees and rewards. The product grows by being used in public.

How It Works

Flipr connects to Polymarket and, soon, Kalshi. But rather than building its own interface, Flipr uses X as the front-end. A trade is made by tagging @fliprbot in a tweet and stating the direction and size. For example: @fliprbot bet $100 yes

The simplicity of this setup removes friction for new users. There’s no need to visit a website, connect a wallet, or learn a new interface. Users can deposit funds, place trades, and track results all through X.

This approach also supports a more expressive form of trading. Users can react to each other in real time, build reputations, and share conviction in a public format. As more of the feed becomes tradeable, the product becomes easier to discover and use.

Mindshare Mining Campaign

On the 5th of July 2025, Flipr launched Mindshare Mining, a six-week campaign that rewards users for both trading and posting about Flipr on X. A total of 10 million FLIPR tokens will be distributed over the course of the campaign, with rewards paid weekly based on a scoring system.

Unlike typical reward programs that focus only on volume, Mindshare Mining tracks five components:

- Trade size: larger trades earn more points

- Post timing: earlier posts each week are more valuable

- Posting streak: rewards grow for posting consistently

- Spam control: excess posting is penalised

- Engagement: more interaction leads to higher scores

This design encourages meaningful activity. A few well-timed, high-quality trades and posts can outperform volume alone. The system is designed to reward quality posting over engagement farming, or spamming. Flipr also bought 1% of the supply on the open market and gave it back to the community by offering it in the Mindshare Mining Campaign.

Sector Growth

To understand Flipr’s potential, it helps to look at the broader industry benchmarks:

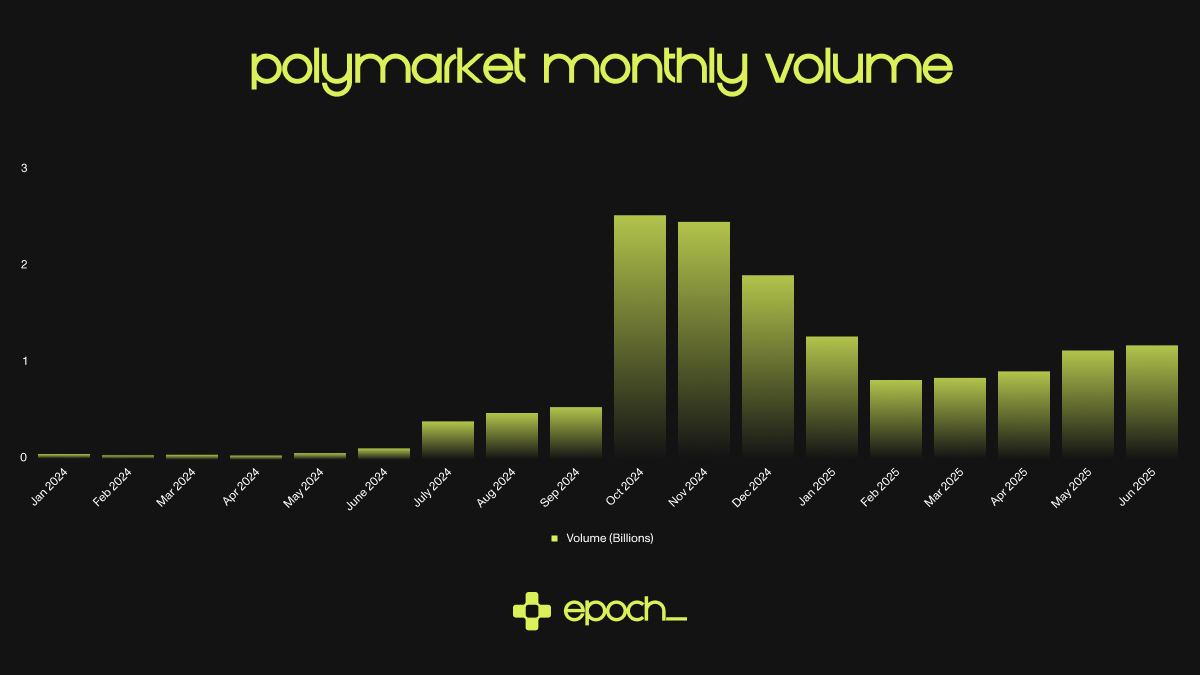

Polymarket

- Handled over $9 billion in trading volume in 2024, including a $2.63 billion peak around the U.S. election

- Hosted approximately 314,500 active traders in December 2024

- Continues to dominate with over 70% market share among crypto-native prediction platforms

- In May 2025 alone, volume reached over $1.1 billion, signaling steady activity

- Raised $74 million total, valuing the company at $1 billion

Kalshi

- Grew trading volume to roughly $1.97 billion in 2024, a nearly 10x increase from 2023

- Generated estimated $24 million in revenue in 2024, a 1,200% year-over-year rise

- Raised $185 million in mid-2025, valuing the company at $2 billion

- Operates under CFTC approval, making Kalshi fully legal in the U.S. retail market

Together, these platforms have processed over $10 billion in predictions, showcasing a high-growth vertical that’s still early in its mainstream cycle.

The importance of Kalshi

Prediction markets are experiencing significant growth. Polymarket has demonstrated this trend, and Kalshi has raised funding at twice Polymarket's valuation. Many new projects are emerging to compete with them. Instead of competing, Flipr aims to be complementary—a strategy that offers a smarter, beta-style exposure to both Polymarket and Kalshi. The integration with Kalshi suggests a potential future collaboration.

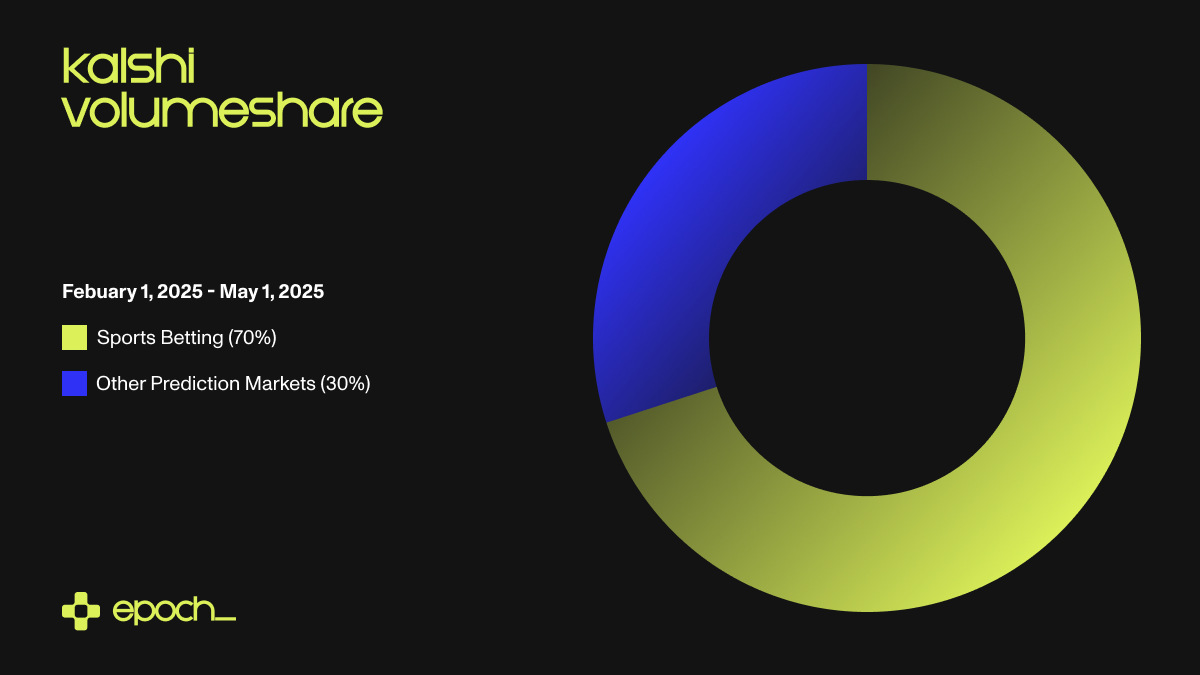

Regulations remain a major challenge for prediction market users in the U.S. Polymarket currently leads in user numbers as a borderless platform, but U.S. users are restricted from participating. In contrast, Kalshi is accessible to U.S. users. Notably, sports betting now accounts for up to 75% of total volume, with $513 million in March and $453 million in April.

Traditional sportsbooks like DraftKings and FanDuel are at a disadvantage: they remain unavailable in 11 states due to state-by-state gaming approvals and typically operate with a 4–5% house edge per bet. Kalshi, as a federally regulated derivatives exchange, bypasses state restrictions and is available in all 50 states, charging just a 1% fee per bet.

Kalshi Integration

Flipr is also integrating with Kalshi, one of the only CFTC-regulated prediction markets in the US. Kalshi recently raised 185 million dollars at a 2 billion dollar valuation, and its platform is legal for retail users across most states. The challenge is accessibility. Its user experience is still geared toward professional or sophisticated traders.

Flipr offers a more open entry point. By building a lightweight interface on X, it gives Kalshi markets visibility in the same feed where users already spend their time. This lowers the barrier for new users and gives Kalshi and Polymarket a broader distribution channel.

Public interactions between the Flipr and Kalshi teams suggest active collaboration. If fully integrated, Flipr could serve as a social front-end for a regulated US platform, with the potential to drive usage through creator campaigns, public trades, and influencer engagement.

Outlook (Flipr vs Pcule)

Flipr isn’t trying to rebuild prediction markets from the ground up. Instead, it's building a layer on top—one that makes them more accessible, more visible, and more social.

While Polymarket and Kalshi focus on infrastructure, Flipr focuses on reach. Its product is designed accordingly: trades become content, engagement drives distribution, and users participate in both the market and the conversation.

This strategy positions Flipr as the social layer for prediction markets. It brings in new users, rewards public conviction, and connects existing platforms in a simple, user-friendly way.

Despite growing momentum in the space, most prediction market platforms still feel isolated or hard to access. Flipr changes that by meeting users where they already are—on X—and by making participation seamless and visible.

While PCULE is focused more on backend infrastructure and tooling, Flipr is focused on the frontend experience (social). This distinction is key: X has proven to be an ideal platform for real-time betting activity. Flipr leverages X’s ~150 million daily active users, who are already engaged with live news and events, reducing friction and improving discovery.

Conclusion

With the Kalshi integration on top of Polymarket, Flipr is positioning itself as the go-to bot for placing bets on prediction markets. Since neither Polymarket nor Kalshi has a token, and Flipr currently sits at a $4 million market cap (at the time of writing), it stands out as a potential gem under a $10 million valuation.

The main risk lies in adoption: will X users widely adopt Flipr to place bets?

If you believe the answer is yes, then the upside is significant—especially considering the trading volume outlined in this research.

Given that a large portion of X’s user base is based in the United States, the opportunity becomes even more compelling. Interactions between the Flipr and Kalshi teams on X also suggest a close relationship, possibly hinting at exciting developments or a future push from Kalshi.