Ethena: The Next Circle Trade

Stablecoins are the backbone of the crypto landscape. They combine the efficiency and programmability of blockchain technology with the stability of fiat currencies. Amidst the volatility of crypto markets, they serve as a digital “safe haven,” and are used in the most traded pairs on both centralized and decentralized venues.

In other words, stablecoins matter a lot. The overall market cap has reached around $250 billion, and stablecoins now account for over 50% of Total Value Locked (TVL) within DeFi.

Ethena is the fastest growing stablecoin in crypto. There are several enormous (positive) catalysts that happened during this market drawdown that isn't necessarily priced in yet:

- The GENIUS Stablecoin Act, recently passed in the U.S. Senate, establishes clearer rules for stablecoin issuance

- Circle went public, offering a quick 8.7x (!) on public markets after IPO: indicating a strong institutional demand for stablecoin projects

- The rise of Equity Wrappers, initially started by Microstrategy

These catalysts are going to be the foundation for the bullish triangle on Ethena. We are going to dive into these catalysts one by one and highlight how each pillar is strengthening the Ethena thesis. We will start first with an overview of Ethena and it's statistics, followed by each catalyst being analysed. The final part will be a summary followed by hypothetical cases of where Ethena is heading to.

Ethena’s Differentiator: A Truly Crypto-Native Model

Ethena marks a major step forward in the evolution of algorithmic stablecoins. By combining synthetic dollar exposure with native, real-time yield, it’s quickly become the leading non-fiat stablecoin by both supply and adoption.

Ethena offers a crypto-native synthetic dollar, USDe, that maintains its peg using a delta-neutral strategy rather than fiat backing. It holds long stETH positions to earn staking yield, while simultaneously opening short perpetual futures to neutralize price movements. This approach enables capital-efficient dollar exposure with only 100% collateral, no TradFi reliance, and built-in yield.

The Rise of the Productive Stablecoin

At the center of Ethena’s ecosystem is USDe, and its staked version sUSDe, which captures the yield generated through the delta-neutral strategy. With real-time, native yield integrated into its design, Ethena is pioneering a new category: the productive stablecoin.

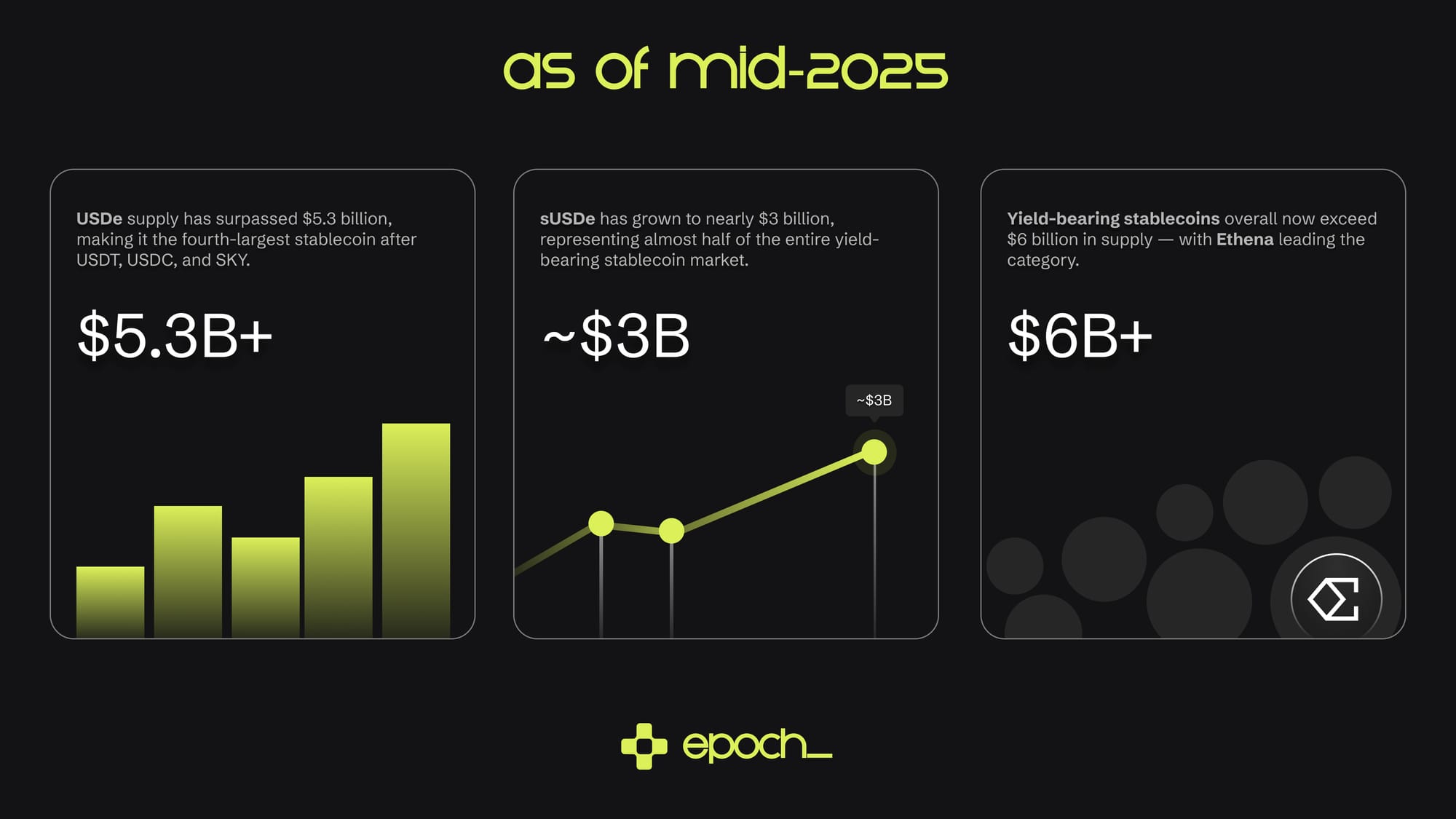

As of mid‑2025:

- USDe supply has surpassed $5.3 billion, making it the fourth-largest stablecoin after USDT, USDC, and SKY.

- sUSDe has grown to nearly $3 billion, representing almost half of the entire yield-bearing stablecoin market.

- Yield-bearing stablecoins overall now exceed $6 billion in supply — with Ethena leading the category.

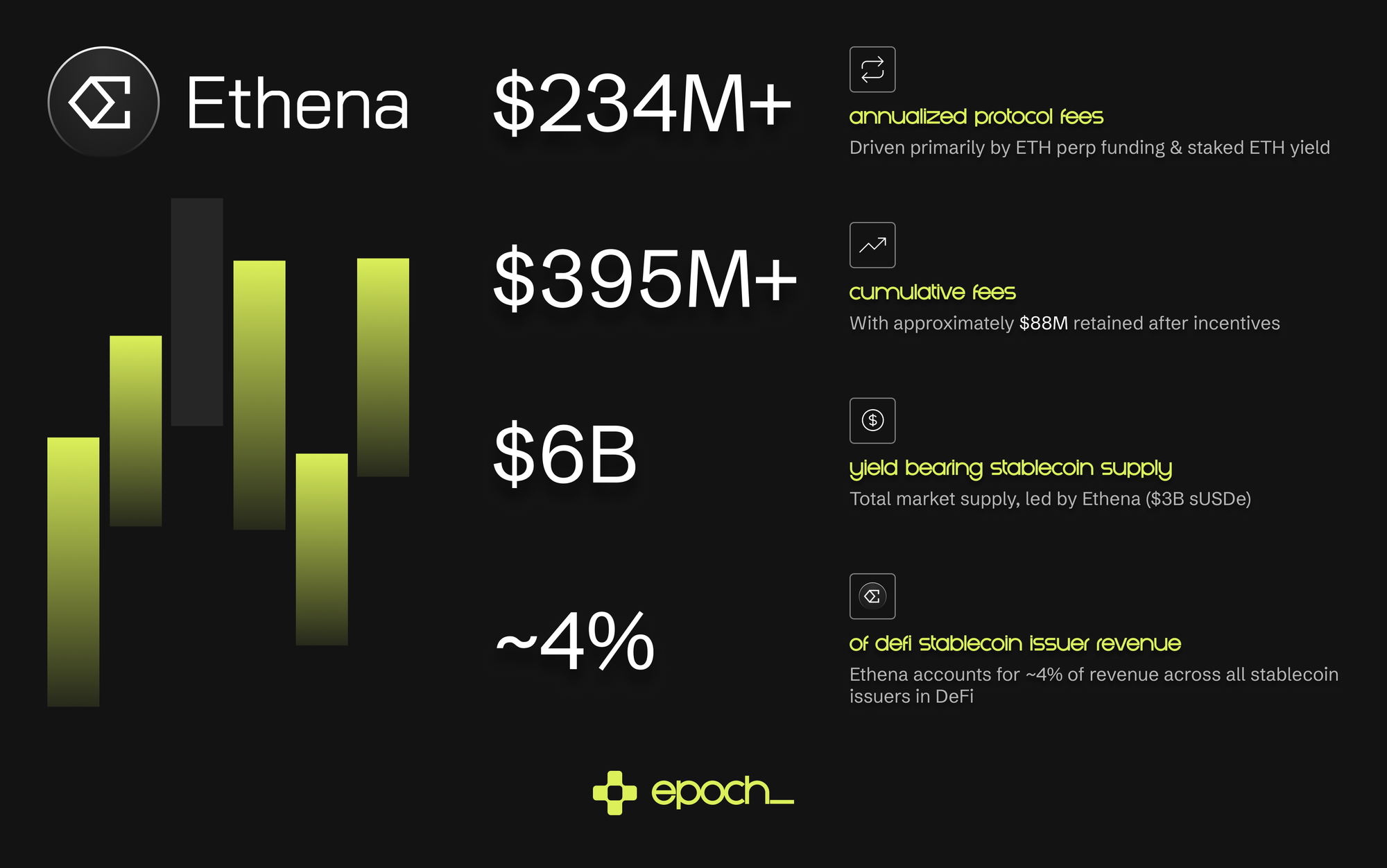

Protocol Fundamentals and Revenue Growth

Ethena’s yield engine balances crypto-native and traditional sources. When funding rates on ETH perpetuals are favorable, the protocol earns yield from those short positions. During low-volatility or bearish markets, it shifts toward U.S. Treasuries for more stable returns.

This approach has generated strong results:

- Annualized protocol fees exceed $234 million, mostly from perp funding and staking yield.

- Cumulative fees surpassed $395 million, with $88 million in net revenue after incentives.

- Ethena now generates around 4% of all stablecoin issuer revenue in DeFi.

Remarkably, this growth has occurred with minimal token incentives, highlighting a path toward sustainable protocol scaling.

ENA Token: Aligning Incentives with Usage

Ethena’s governance token, ENA, is tied directly to protocol performance. A portion of fees generated by the protocol is allocated to staked ENA holders, a mechanism that creates a positive feedback loop as adoption grows.

ENA is the first non-fiat stablecoin token to offer live fee-sharing based on actual revenue, setting it apart from purely algorithmic or collateralized stablecoins. Most ENA tokens are allocated to long-term users and contributors, aligning the community with the project’s long-term success.

Catalysts

Regulatory Positioning and the GENIUS Act

The GENIUS Stablecoin Act, recently passed in the U.S. Senate, establishes clearer rules for stablecoin issuance. While USDe is not fiat-backed, its hybrid model, especially through wrappers or integrations, positions it well to benefit from the regulatory environment.

In contrast to fiat-backed coins, where only issuers benefit from yield, Ethena’s design allows end users to access yield directly. This has drawn interest from DAOs, DeFi protocols, fintech teams, and yield-focused users seeking alternatives to custodial models.

It's also important to highlight that Ethena recently partnered with Anchorage, the only and first regulated crypto bank in the United States. A very strategic move from Ethena to expand their services to US citizens and directly competing with USDC.

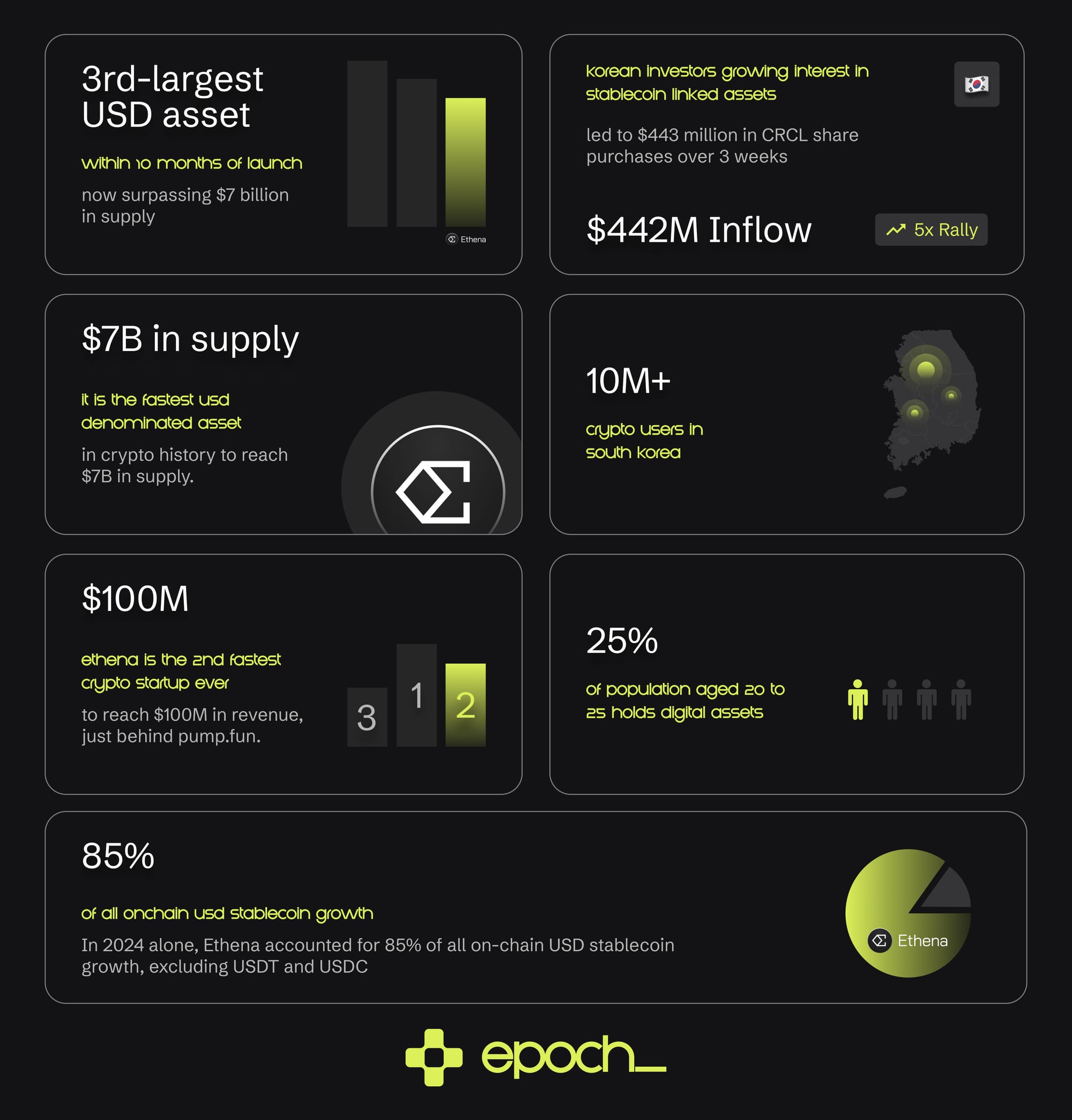

Ethena in Asia: Korean Expansion and CRCL Parallels

Ethena’s reach expanded significantly with ENA’s recent listing on Upbit, South Korea’s largest crypto exchange. The timing is significant: South Korea is seeing a wave of positive sentiment toward crypto, particularly stablecoins.

This momentum follows the IPO of CRCL, which quickly became one of the most popular stocks in Korea. In just three weeks, Korean investors bought $443 million worth of CRCL shares, driving a 5x rally, largely on the back of investor demand for stablecoin exposure.

- South Korea now has over 10 million crypto users

- 25% of the population aged 20–50 holds digital assets

Ethena is well-positioned as a "catch-up trade" to CRCL’s performance, with even stronger on-chain fundamentals:

- It became the third-largest USD asset within 10 months of launch, now surpassing $7 billion in supply.

- It is the fastest USD-denominated asset in crypto history to reach $7B in supply.

- It’s the second-fastest crypto startup ever to reach $100M in revenue — only pump.fun did it faster.

- In 2024 alone, Ethena accounted for 85% of all on-chain USD stablecoin growth, excluding USDT and USDC.

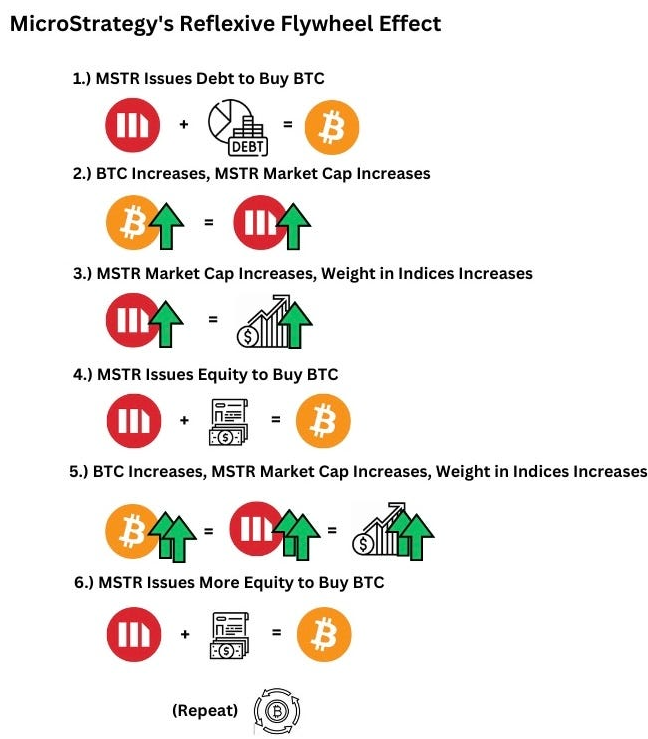

Equity wrappers: Microstrategy of Ethena is born

Ethena recently announced that StablecoinX inc., an investment vehicle for wrapping assets, will be raising 360 million usd.$260 million will be used in an acquisition program which represents approximately 7% of ENA’s circulating supply at the current market price of $0.50. When accounting for the locked allocation, StablecoinX will hold close to 10% of total supply, positioning it as a significant strategic holder.

As the price of $ENA appreciates, so too does the equity value of StablecoinX, creating the potential for new equity issuance. This capital can be recycled into further accumulation of ENA, establishing a reflexive dynamic where price appreciation enables additional treasury expansion—analogous to the MicroStrategy playbook, but deployed within a higher-growth, crypto-native environment. Below you can find how Microstrategy is using this loophole on Bitcoin and how StablecoinX could have a similar effect on the ENA token.

Over time, quarterly disclosures are expected to mark these holdings to market, elevating $ENA's visibility among traditional financial analysts and placing the asset squarely within the institutional investment research. The Microstrategy of Ethena is born.