Epoch #1: Reppo

At Epoch, we have always liked efficiency over noise and especially as a crypto trader or investor: you will need a place that curates it for you. This is why we started with a new series called:

Epoch: gem of the week

Every week we will highlight the gem(s) of the week. We will dive into the fundamentals and why we think the gem(s) are going to be interesting picks as onchain runners. Obviously, choosing these coins in these environments is tricky but it will pay off big if the thesis is correct. We haven't seen onchain altcoin reports and we will be the first to do it from now on.

Let's dive into it.

Gem of the week

Reppo: the new KTA?

The first pick of the week will be $REPPO. If you have followed my main account (x.com/zoomeroracle) you have seen that I've already posted about it at around 1.5m mcap. It surged a lot since then but it seems to have no real pulldowns. This is because Reppo seems to be much bigger than it initially looks like.

Just the same way how Keeta launched at sub 2-3m mcap in March/April (when the markets were shitting itself), we are right now in a similar environment. This offers the possibility for the ones that didnt give up yet to make an insane amount of wealth. The people that bought Keeta saw a peak of 1.6b FDV couple months later.

(If you are not familiar with keeta: At Epoch, we covered Keeta in the early days, you can read it here https://www.epoch.biz/keeta-a-fintech-l1-backed-by-ex-google-ceo/)

Similar folks on CT are speaking about a Keeta'esque project on Reppo. I personally don't think it will reach the same valuations as Keeta (Keeta had the L1 premium combined with ex-google CEO leading the raise) but it could definitely run way higher to 100m> in FDV. It's hard to find proper alpha about Reppo so this is why we curated the most important pieces of our research.

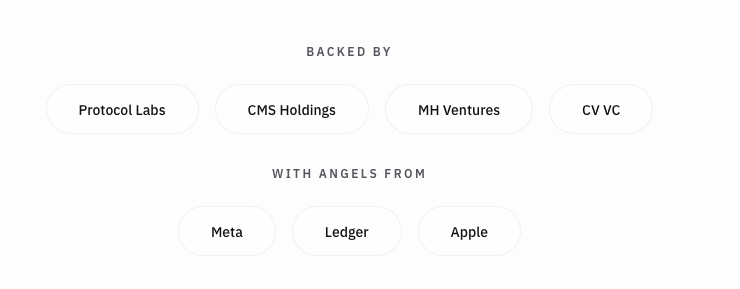

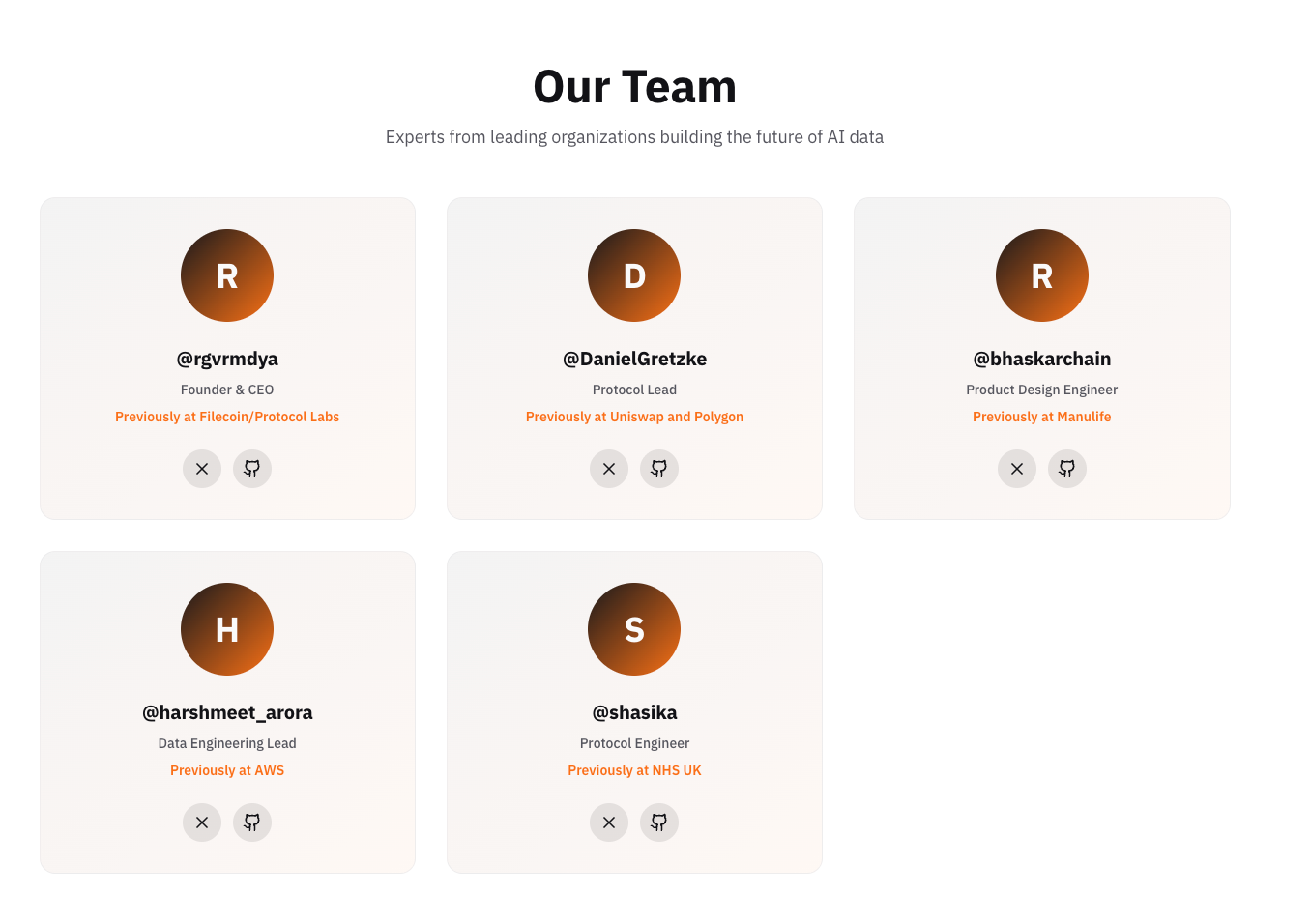

Backers

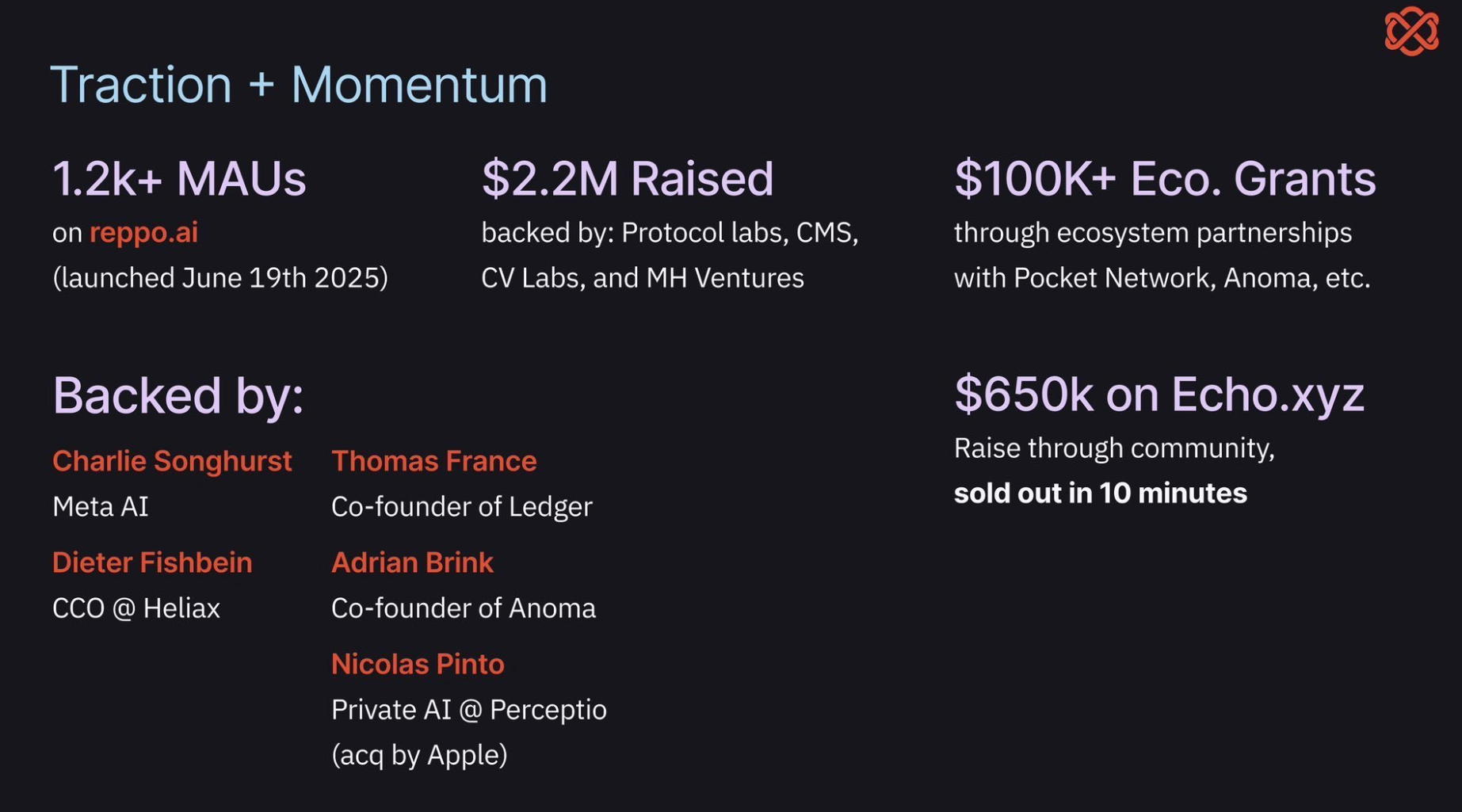

Looking at the backing, you can clearly see that there are some big names and work background involved. Angels from Meta/Ledger invested, a raise of 2.2m at 30m FDV has been done and an echo of 650k usd got sold out in 10 mins.

The fact is that it launched at an fdv of sub 10m which meant that seed round investors were down quite a lot (30m vs 10m). This gap vs the potential that it had, made smart onchain traders ape into it while the markets were bad (and still is). This is similar to how Keeta launched, as the seed round investors were down vs the onchain launch.

This playbook is quite genius as it allows the little players to get into a valuations way lower than seed and it creates an interesting situation: because they bought at a lower valuation, they become more comfortable holding the bags of VCs. Ironically: retail holds their bag quicker than VCs does. It's what happened with Keeta and is now happening with Reppo.

Barely nobody is talking about this phenomenon and it's something to consider when you are investing in this current environment onchain.

Now that we covered why people compare it with Keeta, let's dive into what they actually do.

Fundamentals

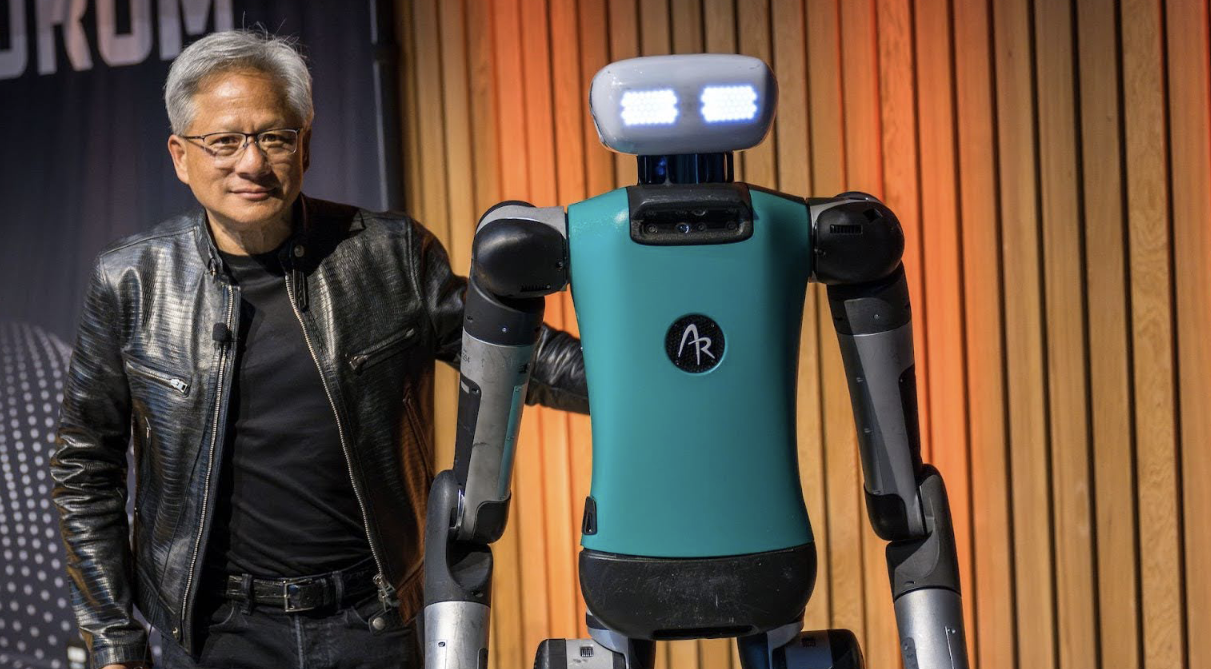

AI/Robotics have three major problems:

- Computing power

- Data

- Hardware (building robots)

The Issue

All of the AI robots right now need a lot of data in order to train themselves. The big robotic companies are keeping this data for themselves. Data is the most extreme scarce asset in the AI problem. The independent researchers or individuals cannot access enough data to build good AI systems because data is scarce.

The solution (Reppo comes in)

A marketplace where people can get rewarded for sharing robotic training data. Let's say somebody captures a video of a robot doing a certain task with a label: they can earn rewards through a prediction market system.

- More people contribute data --> bigger dataset shared

- bigger dataset --> better AI models

- Better models --> faster progress within robotics space

You can see it as a decentralised place to get all the robotics learning data you need. Hence why Reppo could be a good beta as robotic play. It isn't trying to provide computing power or build robots: it's solving the robotic data problem.

- Computing power = Nvidia

- Robots hardware = Tesla/Figure

- Datasets = Reppo

Pumpamentals

- No marketmakers involved till 50m FDV

Reppo isn't planning to hire marketmakers until the asset is mature enough. Outsourcing MM isn't their vision as they plan to fix structural improvements like buybacks, better liquidity or even v3 style AMM. It's similar to how Keeta operated where no CEX listings happened until the last stages of the parabolic move. Most of the upside was done onchain.

- Robotics narrative

It's hard to find proper utility projects related to robotics. Virtuals can be seen as a high cap play with size for robotics. Reppo launched on Virtuals and is therefore a max bet on robotics outside of their fundamentals (product).

- Low marketcap vs other big competitors

Despite the recent pump, the ceiling could be way higher. A lot of people are still sidelined despite the interest increasing. From our perspective and research, we think Reppo is a Cognitive DePin play which is a category on it's own. A unique narrative. This alone could catapult it as it has a monopoly.

- Reppo vs TAO

- Tao subnets collapses when emissions drop vs not possible on Reppo. It produces revenue vs Tao producing incentives (mining). Paid usage vs printed tokens.

- Reppo will integrate FHE (Fully Homomorphic Encryption). It's a way to run computations on encrypted data without ever decrypting it. This will make it more private. Tao lacks privacy.

- Tao rewards computing power while Reppo rewards correctness of data.

Conclusion

It wouldn't do justice to dedicate this article alone to summarise Reppo. There is a lot more information out here which we will disclose in a 2nd article. This article is mainly produced to introduce people to a potential onchain runner. In this environment, it's easy to give up and not believe anymore (just like the markets during Keeta launch) but it offers massive opportunities for the ones who stay sharp.

Like we explained earlier: we are seeing a phenomenon of people being comfortable holding bags from lower than seed rounds and not selling their bags because of that. These coins tends to be the strongest onchain. Keeta ironically created a new launch method accidently that onchain holders love. Reppo is having the same playbook with strong pumpamentals.

Disclosure: none of this is financial advice. This is merely our opinions and we have bags in it.

Give us a follow on https://x.com/epochbiz if you liked the article