Why Maple Finance should be a multibillion protocol in making

After getting burned on some new coin launches, I decided to put my focus towards coins with good PMF + low mcap + most of the supply (80%>) already in circulation. It’s clear that most new launches are having either high inflation or scammy MMs so it’s pointless to time those. Easier swing trades would be high circulating + pmf. This is actually hard to find as most coins are dead by the time they have all supply.

I came across Maple Finance (Ticker: SYRUP). This project has been on my radar before the cycle even started but I lost interest when the TVL went to zero. Yet, even after the fallback, they managed to pick themselves up again and they finally reached the important 1 billion TVL mark this week. In a cycle where there are many teams trying to extract the most money out of tokeninvestors/traders, it’s clear that these guy don’t care what the market is doing. I respect them a lot for that and they caught my curiosity just because of that.

Now let’s get into what Maple Finance does and why it has been slowly creeping up.

Maple Finance allows people to lend their stables towards institutional groups. Not only that, it creates a lot of products for these institutional groups. They are essentially pioneering onchain credit for institutions. This is obviously huge as a lot of institutions want to deploy their capital onchain but will need credit for that. Especially as we are in a Bitcoin dominated cycle (way more dominant than most alts in previous cycles), we can conclude that most of it is because of institutional demand. The next step would be institutional demand onchain which Maple helps with onchain products such as loans.

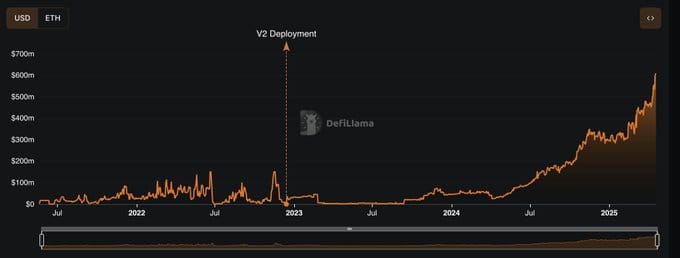

Maple Finance TVL almost crashed to zero in TVL after massive defaults due to undercollateralised loan models on the platform. This was in handsight bad but they learned from it, removed it, and now offer overcollateralised loans. This was the introduction of Maple v2.

Maple v2 was an important moment for the protocol. After a couple of months, the protocol suddenly started an uptrend in TVL as you can see. The amount of loans skyrocketed and the comeback arc started. This went quite unnoticed in the space. At first, the protocol generated 10k a month and now it’s 400k. This is obviously peanuts in the grand scheme of things but the percentual growth looks very promising and increasing.

Not only that, Grayscale has been adding Maple on their top 20 list of cryptos as the first institutional asset manager onchain. As you can see, the mcap is a joke compared to other projects on that list. Whether or not you like Grayscale or not, it shows that the big names are noticing their comeback and even considering a future blue chip.

We have updated the Grayscale Research Top 20. The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter. The new assets this quarter are Maple $SYRUP, Geodnet $GEOD, and Story Protocol $IP. All the… pic.twitter.com/GylvbfT277

— Grayscale (@Grayscale) March 26, 2025

Another thing important to mention is the bitcoin product they recently started offering. Most institutional bitcoin just sit idly doing nothing. This needs to change which is why Maple offers a yield bearing bitcoin asset powered by Core (alongside custodians like Bitgo). There is already more than 1000 btc being allocated for that which is currently increasing by the day. A bitcoin yielding product for institutional groups is attractive in itself as Bitcoin is obviously their biggest exposure. This bitcoin product became its fastest-growing product in history. Maple also announced a strategic partnership with Bitwise to expand access to institutional on-chain credit. As Bitcoin has a solid foundation of riding the digital gold narrative, it only makes sense that alts which are focussed on delivering proper bitcoin products will appreciate in price. They have proved there is an actual PMF on yield bearing bitcoins and it's only starting.

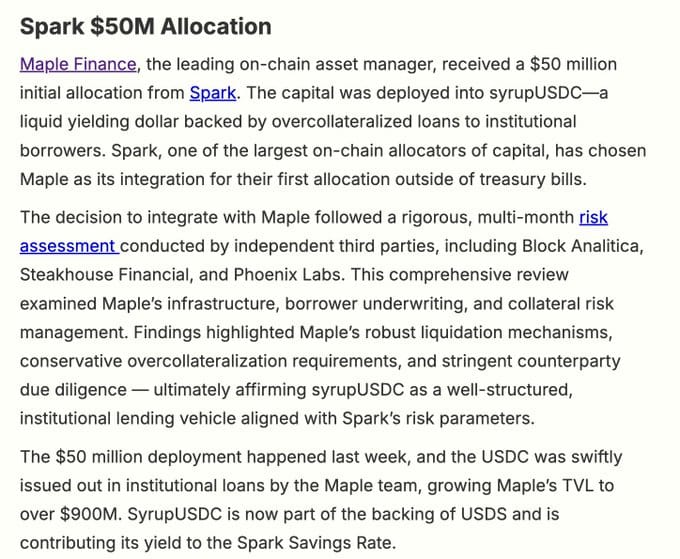

Maple has its own stablecoin called SyrupUSDC. With the recent stablecoin hype and mania (and truly, the biggest PMF of crypto ever), this is a good selling point. One of their partners (Spark) already started utilising syrupUSDC.

My view on Maple vs comps:

Maple Finance has more TVL than Ondo (biggest RWA token in mcap). Ondo (at the time of writing) has a mcap of 70 times higher than Maple Finance (!!!). This is an insane difference imo which needs a repricing. It doesn’t makes sense that Ondo with an fdv of 8 billion (+low circulating supply) should be a good investment. Their name has been tied too long towards being the leading RWA bet (+blackrock shenanigans). Now that we are in rough market, marketing schemes won’t work: only true PMF and bullish stats will reflect in token price. This is how SYRUP has an advantage. I won’t even start about OM, it’s a joke how this is trading still above SYRUP after going -90% in one day.

In my eyes, based on the info above, I truly believe that Maple has the best papers if you want to bet on RWA and institutional demand. Especially as they are also focussed on Bitcoin products for these clients. Bitcoin products that aren’t a wrapper, are still very much undervalued which is why I could see hype around it in the future. Earning yield on your digital gold in a ‘safe’ way should be a huge PMF in itself. I believe this product will dominate Defi as it’s in custody (no wrapper).

At a mcap of 130m (at the time of writing), Maple is severely undervalued. I bought a lot at around .13 and don’t plan to sell until 1b>. Downside is liquidity but it’s the price you pay for being early and taking the risk. The stats speak for themselves so it was a no-brainer to ape.

It also does help that they have a fresh new chart as the token migration from MPL to SYRUP is finished at end of the month. New charts (new coins) tend to pump historically speaking, kind of comparable when ethlend converted to Aave back in the days. Unit bias is a little bonus (buying at 2 double digits vs buying at 15 cents rn).

Time to eat some pancakes now.

UPDATE: This article is made and published on X on april 21 2025 when Syrup traded at sub 14 cents. Since then, price surged a lot.

This article serves as an example for future reports that will be posted on this website.